EUR/USD Forecast: Euro needs to clear 1.0800 to extend recovery

- EUR/USD recovered above 1.0750 in the early European session on Tuesday.

- The pair's bearish bias remains intact despite the rebound.

- Buyers could show interest in case Euro stabilizes above 1.0800.

EUR/USD staged a technical correction and rose above 1.0750 early Tuesday after touching its weakest level since mid-November near 1.0720 on Monday. The pair's near-term technical outlook is yet to point to a bullish tilt.

The US Dollar (USD) continued to gather strength against its rivals on Monday as the benchmark 10-year US Treasury bond yield stretched higher on growing expectations about the Federal Reserve (Fed) delaying the policy pivot following the upbeat labor market data.

The modest improvement seen in risk sentiment makes it difficult for the USD to outperform its rivals and helps EUR/USD edge higher. Meanwhile, the data from Germany showed that Factory Orders rose 8.9% (seasonally adjusted) on a monthly basis in December and further supported the euro.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.13% | -0.18% | -0.24% | -0.48% | -0.07% | -0.34% | -0.12% | |

| EUR | 0.14% | -0.04% | -0.11% | -0.34% | 0.06% | -0.20% | 0.02% | |

| GBP | 0.18% | 0.04% | -0.06% | -0.31% | 0.09% | -0.17% | 0.05% | |

| CAD | 0.22% | 0.10% | 0.07% | -0.25% | 0.16% | -0.10% | 0.11% | |

| AUD | 0.48% | 0.35% | 0.31% | 0.24% | 0.41% | 0.14% | 0.36% | |

| JPY | 0.07% | -0.05% | -0.10% | -0.17% | -0.42% | -0.27% | -0.06% | |

| NZD | 0.32% | 0.20% | 0.17% | 0.10% | -0.15% | 0.26% | 0.21% | |

| CHF | 0.12% | 0.00% | -0.05% | -0.12% | -0.36% | 0.05% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Later in the day, Eurostat will release Retail Sales data for December. Since this figure is not adjusted for price changes, it is unlikely to trigger a noticeable reaction in EUR/USD.

In the second half of the day, the US economic docket will not offer any high-tier data releases. Hence, market participants will pay close attention to comments from central bank officials. According to CME FedWatch Tool, markets price in a 16.5% probability of a Fed rate cut in March. Unless Fed policymakers leave the door open to a policy pivot at the next meeting, investors are unlikely to bet on a steady USD weakness in the near term.

EUR/USD Technical Analysis

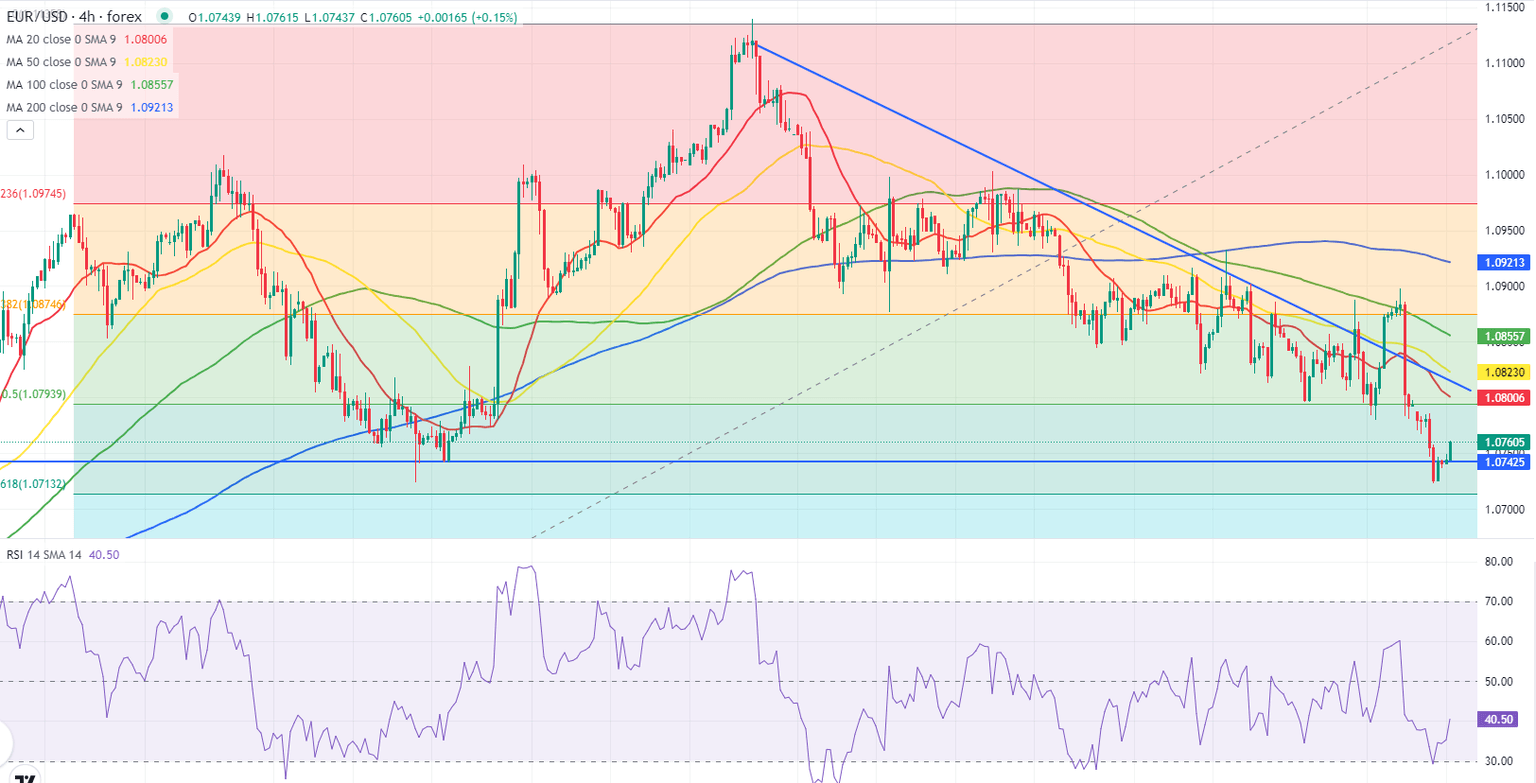

The Relative Strength Index (RSI) indicator on the 4-hour chart recovered to 40 after falling to 30 on Monday, suggesting that EUR/USD is in a corrective phase and yet to turn bullish.

On the upside, 1.0800 (Fibonacci 50% retracement of the latest uptrend) aligns as strong resistance. A 4-hour close above that level could discourage sellers and open the door for an extended recovery toward 1.0825 and 1.0855, where the 50-period and the 100-period Simple Moving Averages are located.

Supports could be seen at 1.0740 (static level), 1.0700 (psychological level, Fibonacci 61.8% retracement) and 1.0660 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.