EUR/USD Forecast: Euro needs to clear 1.0760 to extend recovery

- EUR/USD holds above 1.0700 after closing in positive territory on Wednesday.

- ECB President Lagarde reiterated that they will continue to follow a data-dependent approach.

- US economic docket will feature Retail Sales and weekly Initial Jobless Claims data.

Following Tuesday's sharp decline, EUR/USD staged a technical correction and closed in positive territory on Wednesday. The pair struggles to gather recovery momentum on Thursday and continues to fluctuate below 1.0750 as markets await US data releases.

The improving risk mood and retreating US Treasury bond yields made it difficult for the US Dollar (USD) to build on Tuesday's rally that was fuelled by the stronger-than-expected Consumer Price Index (CPI) data.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.01% | 0.18% | 0.03% | 0.05% | -0.24% | 0.03% | -0.16% | |

| EUR | 0.01% | 0.20% | 0.05% | 0.05% | -0.23% | 0.04% | -0.14% | |

| GBP | -0.20% | -0.22% | -0.18% | -0.16% | -0.45% | -0.17% | -0.36% | |

| CAD | -0.03% | -0.04% | 0.17% | 0.01% | -0.27% | 0.00% | -0.18% | |

| AUD | -0.03% | -0.06% | 0.16% | 0.00% | -0.29% | -0.01% | -0.19% | |

| JPY | 0.25% | 0.25% | 0.43% | 0.28% | 0.29% | 0.29% | 0.11% | |

| NZD | -0.04% | -0.05% | 0.17% | -0.01% | 0.01% | -0.27% | -0.19% | |

| CHF | 0.16% | 0.14% | 0.34% | 0.18% | 0.21% | -0.09% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Early Thursday, the 10-year US yield continues to stretch lower toward 4.2% and US stock index futures trade modestly higher on the day, not allowing the USD to gather strength and helping EUR/USD hold its ground.

While testifying before the Committee on Economic and Monetary Affairs (ECON) of the European Parliament on Thursday, European Central Bank (ECB) President Christine Lagarde reiterated that they will continue to follow a data-dependent approach to policy. Lagarde further added that the ECB's forward-looking wage tracker points to strong wage pressures. These comments, however, failed to provide a boost to the Euro.

Later in the day, January Retail Sales and the weekly Initial Jobless Claims data from the US will be looked upon for fresh impetus.

Retail Sales are forecast to decline by 0.1% and the number of first-time applications for unemployment benefits is expected to come in at 220,000. A significant decline in Retail Sales, a reading close to -0.5%, combined with a stronger-than-anticipated increase in Jobless Claims could weigh on the USD with the immediate reaction. On the other hand, the USD could stay resilient against its rivals in case Jobless Claims arrive near 200,000 and Retail Sales rise.

If the data come in mixed, investors are likely to wait for Wall Street's opening bell before taking any positions. A bullish opening in major equity indexes could hurt the USD and support EUR/USD in the American session.

EUR/USD Technical Analysis

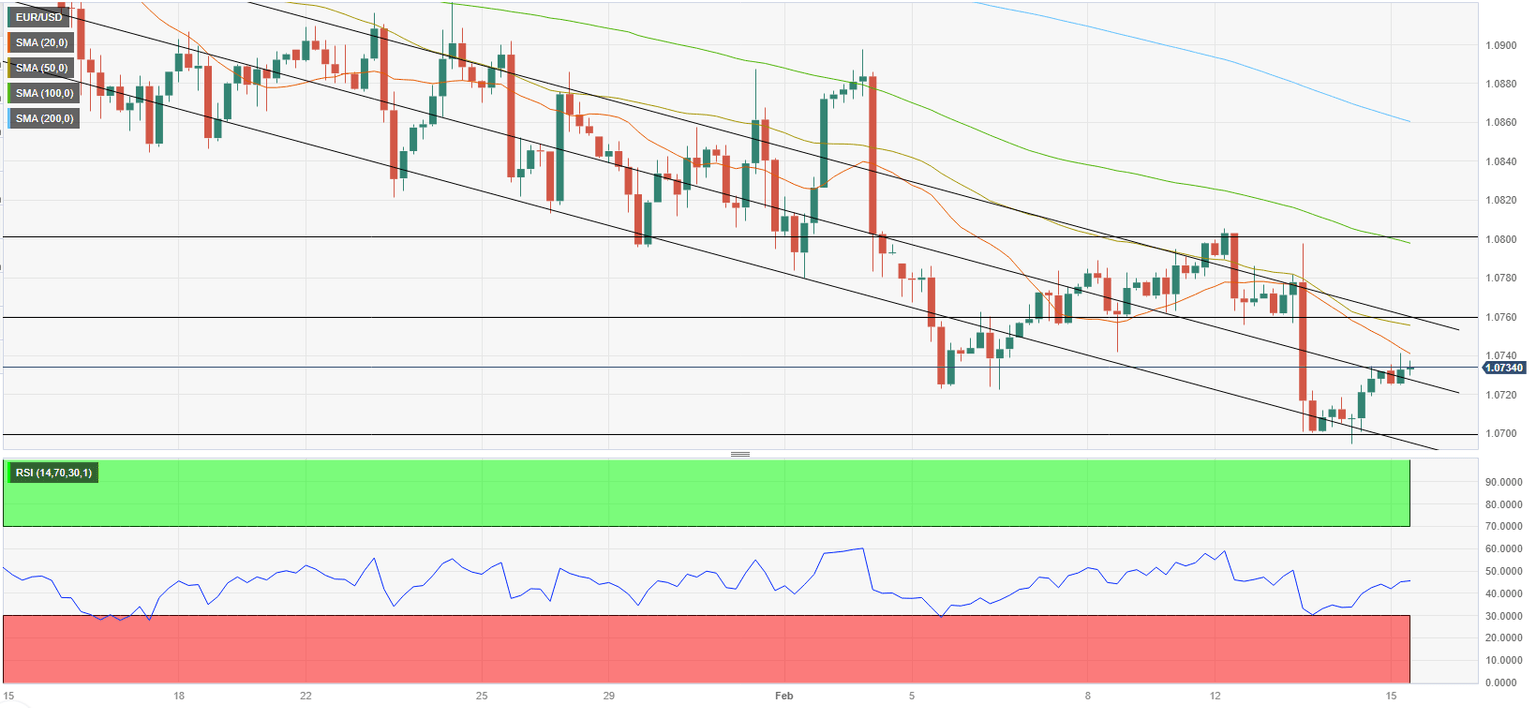

EUR/USD was last seen trading near the mid-point of the descending regression channel and the Relative Strength Index (RSI) indicator was moving sideways slightly below 50, reflecting a lack of recovery momentum.

On the upside, 1.0760 (upper limit of the descending channel) aligns as next resistance. A 4-hour close above that level could attract buyers and open the door for a leg higher toward 1.0800, where the 100-period Simple Moving Average (SMA) is located.

If EUR/USD fails to hold above 1.0730 (mid-point of the descending channel), it could push lower toward 1.0700 (psychological level, static level, lower limit of the descending channel) and 1.0660 (static level from November).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.