EUR/USD Forecast: Euro manages to hold above key support for now

- EUR/USD has staged a rebound after having declined below 1.0800.

- Hawkish Fed bets on renewed inflation concerns could limit the pair's upside.

- ISM will release the Manufacturing PMI for March later in the day.

EUR/USD has regained its traction and recovered above 1.0800 after having spent the Asian session under bearish pressure on Monday. The pair's technical outlook doesn't yet point to a buildup of bearish momentum but buyers could remain hesitant in case safe haven flows dominate the action later in the day.

Over the weekend, OPEC+ producers, led by Saudi Arabia, announced that they will voluntarily reduce the crude oil output by more than 1 million barrels per day from May to until the end of the year. Crude oil prices surged higher on this development and revived concerns over higher energy prices feeding into inflation.

According to the CME Group FedWatch Tool, markets are currently pricing in a more than 60% probability of the US Federal Reserve (Fed) raising its policy rate by 25 basis points at the upcoming policy meeting, compared to 48% on Friday.

Markets also seem to have turned cautious with US stock index futures trading in negative territory in the early European session. Additionally, Euro Stoxx 50 has already turned flat following a positive opening.

In the second half of the day, the ISM will release the Manufacturing PMI for March. The headline PMI is forecast to edge lower to 47.5 from 47.7. The Price Paid Index, the inflation component of the survey, is expected to rise to 53.8 from 51.3. In case the headline stays below 50 and there is a bigger-than-anticipated increase in the inflation print, the US Dollar could gather strength and cause EUR/USD to lose its traction. On the other hand, the USD is likely to have a hard time finding demand if the Price Paid Index drops below 50 unexpectedly.

Investors will also pay close attention to US stocks. If there is a deep downward correction in Wall Street's main indexes after the opening bell, EUR/USD could hold its ground and vice versa.

EUR/USD Technical Analysis

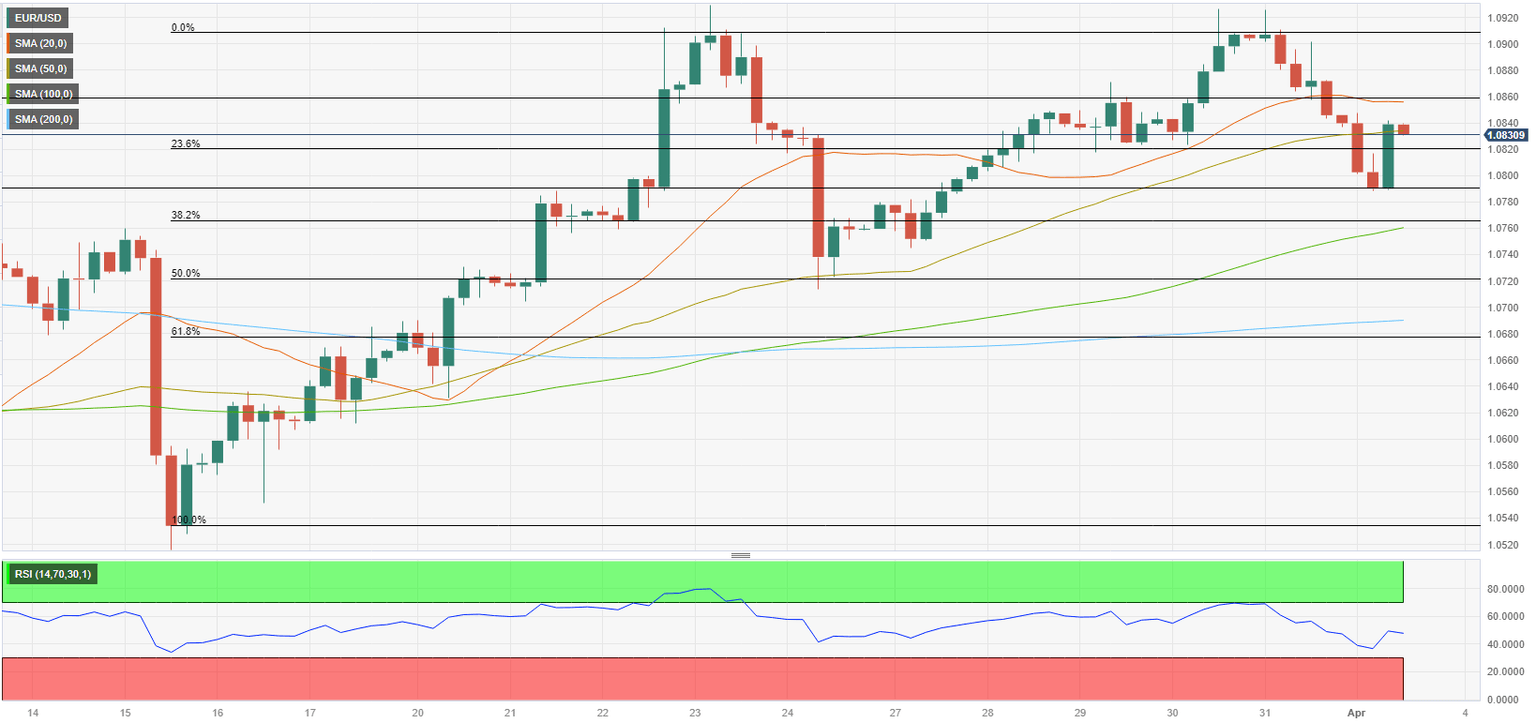

With the latest rebound, the Relative Strength Index (RSI) indicator on the four-hour chart rose to 50, suggesting that sellers are struggling to stay in control. On the downside, 1.0820 (Fibonacci 23.6% retracement of the latest uptrend) aligns as key support level. If the pair falls below that level and starts using it as resistance, it is likely to meet interim support at 1.0790 (static level) before testing 1.0760 (100-period Simple Moving Average (SMA), Fibonacci 38.2% retracement).

On the other hand, 1.0860 (static level, 20-period SMA) is the first resistance ahead of 1.0900 (psychological level) and 1.0930 (static level, March 23 high).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.