EUR/USD Forecast: Euro loses bullish momentum ahead of Powell testimony

- EUR/USD continues to move sideways slightly above 1.0800 on Tuesday.

- The technical outlook points to a loss of bullish momentum.

- Fed Chairman Powell will present the Semi-Annual Monetary Policy Report.

EUR/USD failed to make a decisive move in either direction on Monday and closed the day virtually unchanged. The pair holds steady slightly above 1.0800 early Tuesday as investors stay on the sidelines while waiting for Federal Reserve (Fed) Chairman Jerome Powell's testimony before the Senate Banking Committee.

Euro PRICE Last 7 days

The table below shows the percentage change of Euro (EUR) against listed major currencies last 7 days. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.75% | -1.24% | -0.27% | -0.70% | -1.15% | -0.65% | -0.54% | |

| EUR | 0.75% | -0.49% | 0.51% | 0.07% | -0.40% | 0.09% | 0.21% | |

| GBP | 1.24% | 0.49% | 1.01% | 0.56% | 0.07% | 0.59% | 0.70% | |

| JPY | 0.27% | -0.51% | -1.01% | -0.44% | -0.88% | -0.41% | -0.29% | |

| CAD | 0.70% | -0.07% | -0.56% | 0.44% | -0.46% | 0.05% | 0.15% | |

| AUD | 1.15% | 0.40% | -0.07% | 0.88% | 0.46% | 0.50% | 0.62% | |

| NZD | 0.65% | -0.09% | -0.59% | 0.41% | -0.05% | -0.50% | 0.11% | |

| CHF | 0.54% | -0.21% | -0.70% | 0.29% | -0.15% | -0.62% | -0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

In its Semi-Annual Monetary Policy Report published on Friday, the Fed noted that there was further progress on inflation this year but added that they still need greater confidence before moving to rate cuts. Fed Chairman Powell will present this report and respond to questions later in the day.

According to the CME FedWatch Tool, markets currently price in a nearly 23% probability of the Fed leaving the policy rate unchanged in September. In case Powell acknowledges loosening conditions in the labor market, as reflected by the June jobs report, and sticks to an optimistic tone on the inflation outlook, investors could see that as a sign of a confirmation of a September rate cut. In this scenario, the US Dollar (USD) could lose interest and help EUR/USD regain its traction.

On the other hand, the USD could gather strength if Powell refrains from hinting at a September rate reduction by reiterating the data-dependent approach to policy.

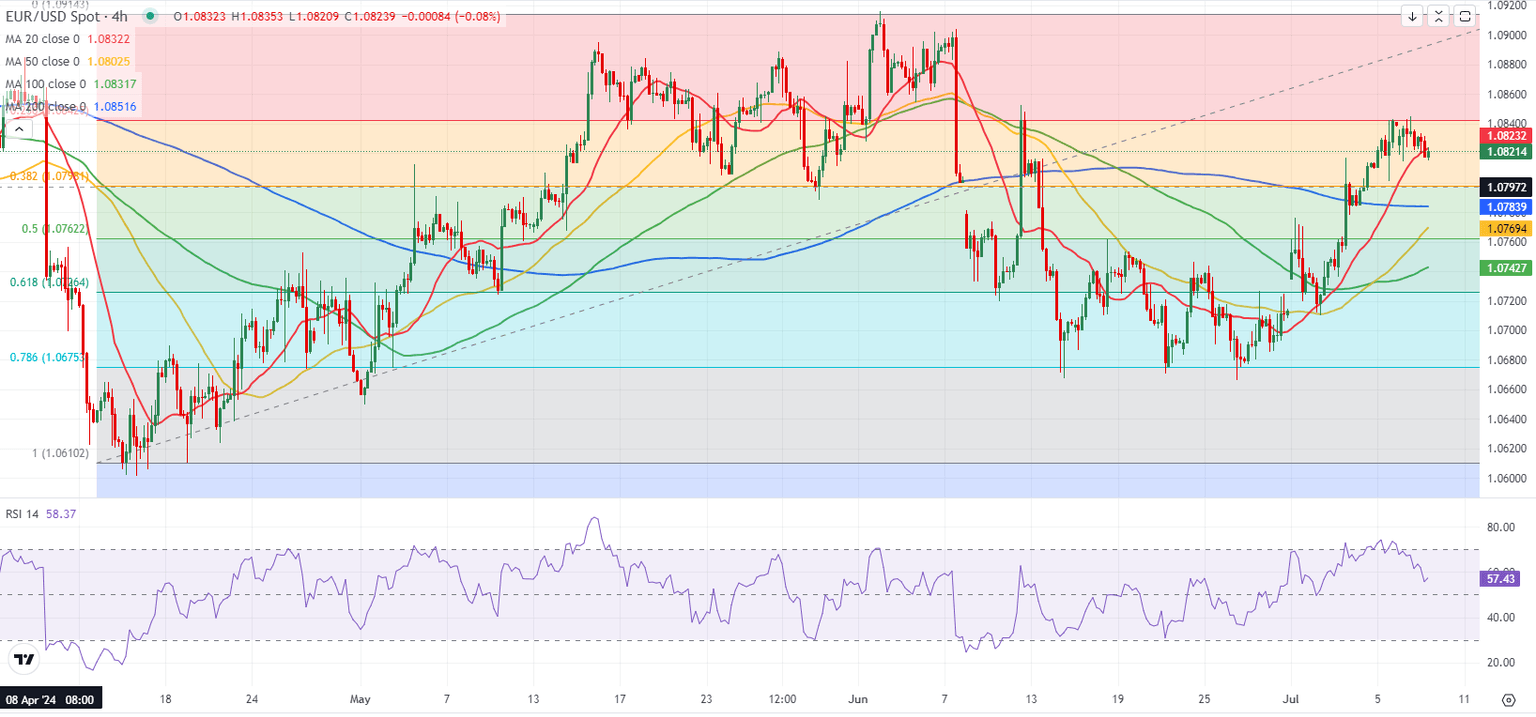

EUR/USD Technical Analysis

Monday's action confirmed 1.0840 (Fibonacci 23.6% retracement of the latest uptrend) as immediate resistance for EUR/USD. If the pair manages to clear that level and starts using it as support, 1.0900 (psychological level, static level) could be seen as the next bullish target.

On the downside, the 100-day and the 200-day Simple Moving Averages form strong support at 1.0800. A daily close below this level could discourage the buyers and open the door for an extended correction toward 1.0760 (Fibonacci 50% retracement).

Economic Indicator

Fed's Chair Powell testifies

Federal Reserve Chair Jerome Powell testifies before Congress, providing a broad overview of the economy and monetary policy. Powell's prepared remarks are published ahead of the appearance on Capitol Hill.

Read more.Last release: Thu Mar 07, 2024 15:00

Frequency: Irregular

Actual: -

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.