EUR/USD Forecast: Euro looks vulnerable as focus shifts to US jobs report

- EUR/USD edged lower early Friday after posting small gains on Thursday.

- An upbeat December jobs report from the US could weigh on the pair ahead of the weekend.

- 1.0920 aligns as key near-term technical support for the pair.

EUR/USD gained traction during the European trading hours on Thursday but struggled to extend its rebound in the second half of the day as rising US Treasury bond yields supported the US Dollar (USD). The pair stays on the back foot and trades in negative territory below 1.0950 as the market focus shifts to December jobs report from the US.

Euro price this week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.12% | 0.40% | 0.80% | 1.53% | 2.78% | 1.36% | 1.19% | |

| EUR | -0.97% | -0.55% | -0.17% | 0.57% | 1.69% | 0.40% | 0.17% | |

| GBP | -0.41% | 0.55% | 0.41% | 1.12% | 2.47% | 0.94% | 0.71% | |

| CAD | -0.81% | 0.14% | -0.23% | 0.71% | 1.98% | 0.54% | 0.34% | |

| AUD | -1.56% | -0.58% | -1.14% | -0.76% | 1.08% | -0.19% | -0.40% | |

| JPY | -2.85% | -1.71% | -2.39% | -1.83% | -1.11% | -1.32% | -1.72% | |

| NZD | -1.37% | -0.39% | -0.94% | -0.55% | 0.20% | 1.28% | -0.21% | |

| CHF | -1.14% | -0.16% | -0.72% | -0.31% | 0.42% | 1.65% | 0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The positive shift witnessed in risk mood made it difficult for the USD to find demand early Thursday. After the ADP Employment Change for December came in at 164,000 to beat the market expectation of 115,000, however, the benchmark 10-year US Treasury bond yield climbed above 4% and helped the USD limit its losses.

Eurostat will release the Harmonized Index of Consumer Prices, the European Central Bank's (ECB) preferred gauge of inflation, for December in the European session. Investors forecast HICP inflation to climb to 3% on a yearly basis from 2.4% in November. An upside surprise could help the Euro hold its ground but EUR/USD's action is likely to be dominated by the US data later in the day.

Nonfarm Payrolls (NFP) in the US is seen rising 170,000 in December, following the stronger-than-expected increase of 199,000 recorded in November. The CME Group FedWatch Tool shows that markets are pricing in a 65% probability that the Federal Reserve (Fed) will lower the policy rate by 25 basis points in March, down from 85% seen earlier in the week.

A NFP reading at or above 200,000 could cause investors to reassess the probability of a policy pivot in March and provide a boost to the USD. On the other hand, a disappointing print below 150,000 could attract dovish Fed bets and allow EUR/USD to stretch higher ahead of the weekend.

EUR/USD Technical Analysis

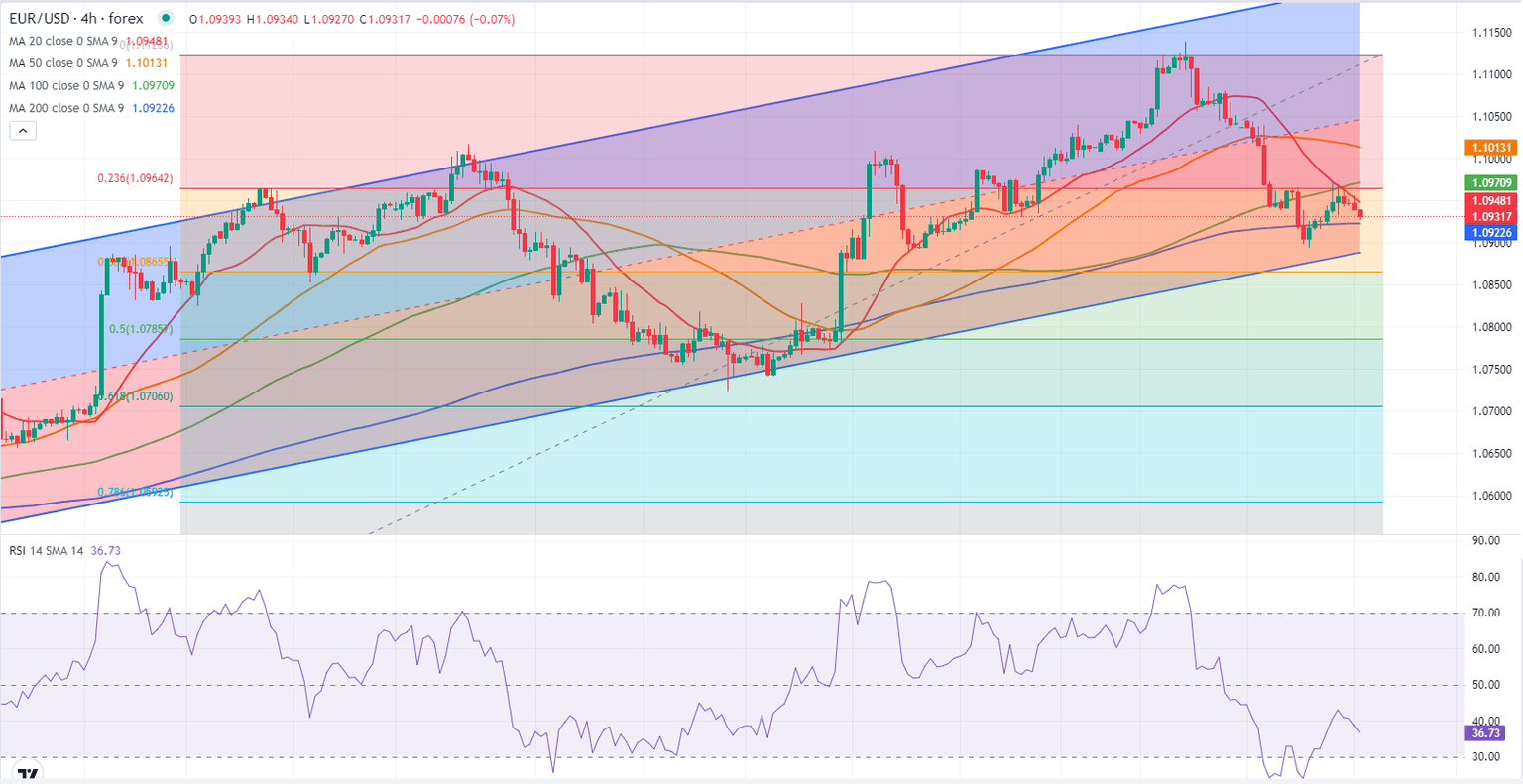

The 20-period Simple Moving Average (SMA) on the 4-hour chart stays above EUR/USD after completing a bearish cross with the 100-period SMA. Additionally, the Relative Strength Index (RSI) indicator turned south and declined below 40, highlighting the bearish bias.

1.0920 (200-period SMA) aligns as immediate support before 1.0880 (lower limit of the ascending regression trend channel) and 1.0850 Fibonacci 38.2% retracement of the latest uptrend).

On the upside, EUR/USD could face resistance at 1.0970 (100-period SMA), 1.1000 (psychological level, static level) and 1.1050 (mid-point of the ascending channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.