EUR/USD Forecast: Euro looks fragile following modest recovery

- EUR/USD retreats below 1.0500 following a modest rebound.

- The risk-averse market atmosphere helps the US Dollar stay strong against its rivals.

- US economic calendar will feature Retail Sales data for November.

After posting marginal gains for two consecutive trading days, EUR/USD finds it difficult to hold its ground and trades below 1.0500 in the European session on Tuesday. The pair's near-term technical outlook highlights a lack of buyer interest.

Euro PRICE Last 7 days

The table below shows the percentage change of Euro (EUR) against listed major currencies last 7 days. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.64% | 0.53% | 1.74% | 0.78% | 1.51% | 1.84% | 2.08% | |

| EUR | -0.64% | -0.10% | 1.08% | 0.13% | 0.85% | 1.20% | 1.43% | |

| GBP | -0.53% | 0.10% | 1.17% | 0.24% | 0.97% | 1.30% | 1.54% | |

| JPY | -1.74% | -1.08% | -1.17% | -0.94% | -0.21% | 0.10% | 0.36% | |

| CAD | -0.78% | -0.13% | -0.24% | 0.94% | 0.73% | 1.07% | 1.31% | |

| AUD | -1.51% | -0.85% | -0.97% | 0.21% | -0.73% | 0.33% | 0.57% | |

| NZD | -1.84% | -1.20% | -1.30% | -0.10% | -1.07% | -0.33% | 0.24% | |

| CHF | -2.08% | -1.43% | -1.54% | -0.36% | -1.31% | -0.57% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The negative shift seen in risk sentiment supports the US Dollar (USD) and causes EUR/USD to edge lower. Reflecting the sour mood, US stock index futures lose between 0.2% and 0.3%.

In the early American session, the US Census Bureau will release Retail Sales data for November. Investors expect an increase of 0.5%. A stronger-than-forecast reading could put additional weight on EUR/USD's shoulders. Nevertheless, investors are unlikely to take large positions based on this data alone, while gearing up for the Federal Reserve's (Fed) monetary policy announcements on Wednesday.

If safe-haven flows continue to dominate the action in financial markets, however, the USD could preserve its strength.

In the meantime, the data from the Euro area painted a mixed picture, not allowing the Euro to stay resilient against its peers. ZEW Survey - Economic Sentiment Index in the Eurozone improved to 17 in December from 11.6 in November, while the ZEW Survey - Current Situation Index in Germany worsened to -93.1 from -91.4 in the same period.

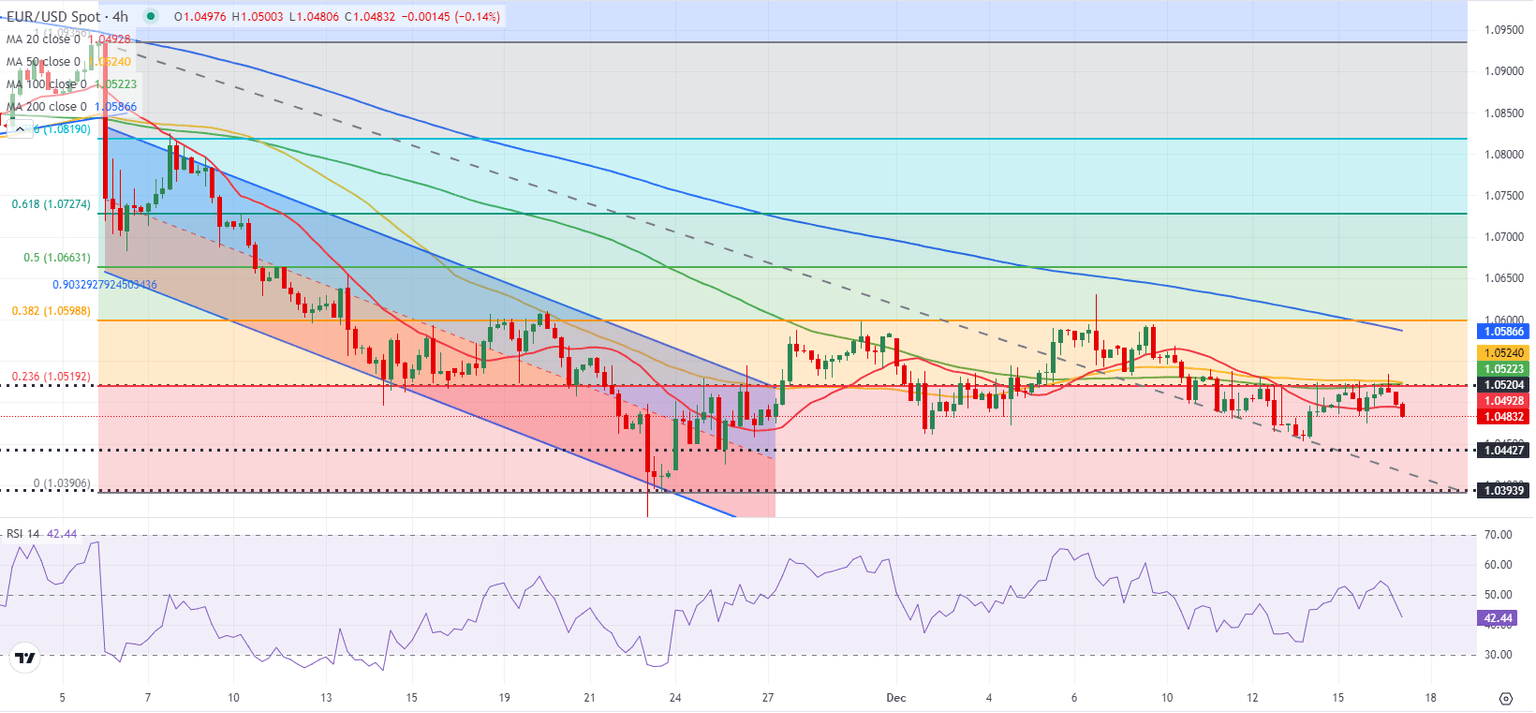

EUR/USD Technical Analysis

EUR/USD lost its traction after testing 1.0520, where the 100-period Simple Moving Average (SMA) on the 4-hour chart, the 50-period SMA and the Fibonacci 23.6% retracement of the latest downtrend align. Additionally, the Relative Strength Index (RSI) indicator dropped below 50, highlighting the lack of buyer interest.

On the downside, 1.0440 (static level) aligns as next support before 1.0400 (end-point of the latest downtrend) and 1.0330 (November 22 low). In case EUR/USD stabilizes above 1.0520, 1.0600 (Fibonacci 38.2% retracement) could be seen as next resistance.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day, according to data from the Bank of International Settlements. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.