EUR/USD Forecast: Euro looks fragile ahead of key ECB event

- EUR/USD is finding it difficult to stage a rebound on Monday.

- German data points to a gloomy economic outlook.

- ECB President Lagarde will deliver welcome remarks at ECB Forum on Central Banking.

EUR/USD trades in a narrow channel at around 1.0900 on Monday, following the sharp decline seen late last week. In the absence of high-tier macroeconomic data releases, the cautious market stance is likely to continue to weigh on the pair.

On Friday, PMI surveys from the Eurozone and Germany revealed a significant loss of growth momentum in private sector's business growth in early June. Early Monday, German IFO survey showed that the Business Climate Index dropped to 88.5 in June from 91.5 in May. Commenting on the survey's findings, "industry export expectations are noticeably down, global rate hikes dampen demand," said IFO Economist Klaus Wohlrabe. He further noted that the likelihood of Germany economy shrinking again in the second quarter has increased.

The worsening economic outlook in the Euro should continue to limit the Euro's potential gains on growing expectations of the European Central Bank (ECB) reassessing the need for additional rate hikes after July.

In the second half of the day, ECB President Christine Lagarde will present welcome remarks at the annual ECB Forum on Central Banking, themed “Macroeconomic stabilisation in a volatile inflation environment.” Early Tuesday, Lagarde will deliver her introductory speech and several ECB policymakers will speak on a variety of topics.

Ahead of the second day of the ECB event, risk mood could influence EUR/USD's action. US stock index futures are down around 0.2% in the European session and the Euro Stoxx 50 Index is losing 0.3%. In case the market environment remains risk-averse during the American trading hours, EUR/USD could stretch lower and vice versa.

EUR/USD Technical Analysis

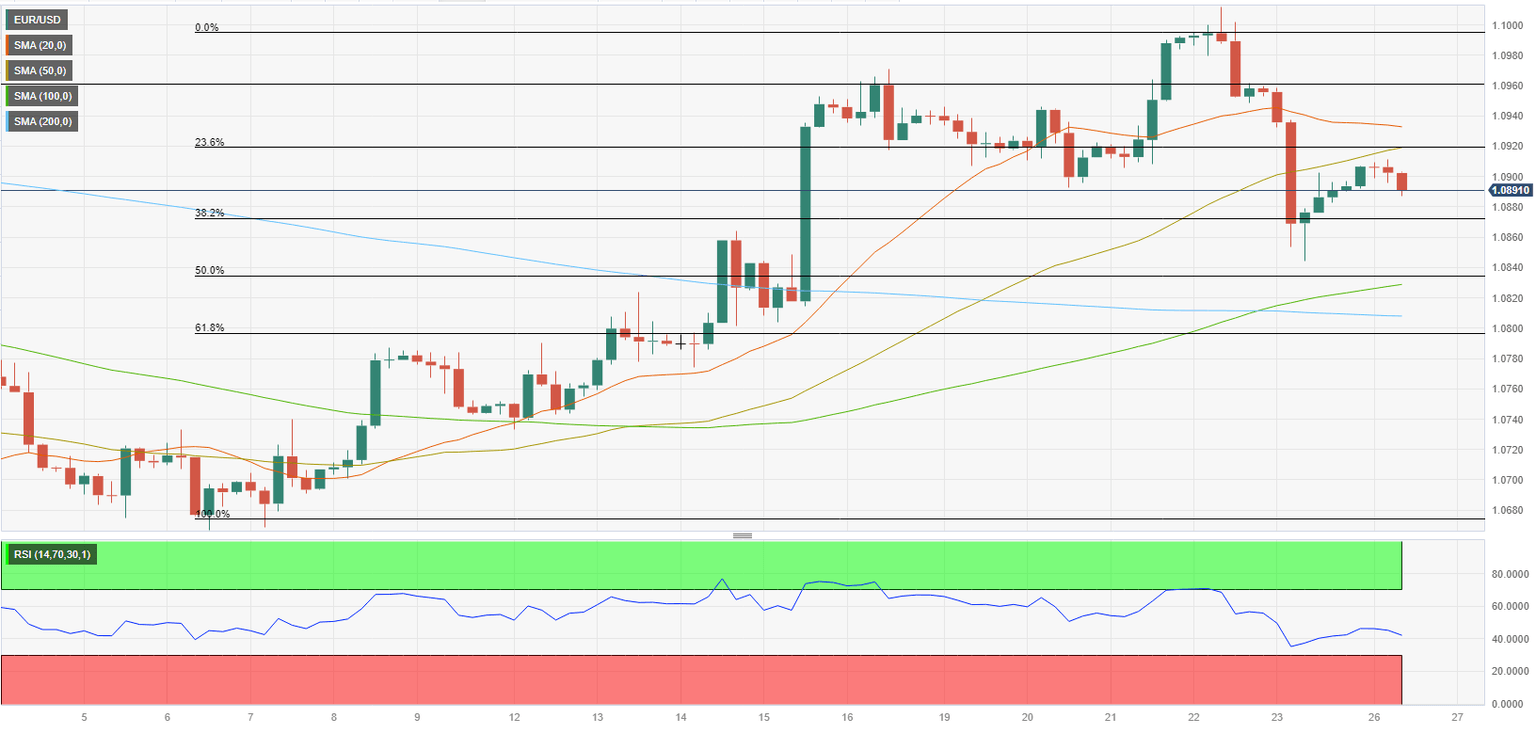

EUR/USD edged higher in the Asian session but lost its traction. The Relative Strength Index (RSI) indicator on the four-hour chart stays below 50 and the pair continues to trade below the 50-period Simple Moving Average (SMA), reflecting the bearish bias.

On the downside, 1.0870 (Fibonacci 38.2% retracement of the latest uptrend) aligns as interim support ahead of 1.0820/30 (100-period Simple Moving Average (SMA)Fibonacci 50% retracement) and 1.0800 (200-period SMA, Fibonacci 61.8% retracement).

In case EUR/USD rises above 1.0920 (50-period SMA; Fibonacci 23.6% retracement) and starts using that level as support, it could extend its recovery toward 1.0960 (static level) and 1.1000 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.