EUR/USD Forecast: Euro looks again at 1.1000

- The US dollar weakened amid a decline in US Treasury yields.

- Euro outperformed on Wednesday, with EUR/GBP rising toward 0.8600.

- The EUR/USD surged after a three-day correction to test 1.1000.

The EUR/USD surged on Wednesday, rising from 1.0915 to 1.0989, the highest level in a month. The Euro outperformed while the US Dollar weakened amid lower Treasury yields. Federal Reserve (Fed) Chair Powell's comments offered no surprises.

On Wednesday, the German IFO Institute warned that the German recession will be sharper than expected. European Central Bank (ECB) Kazimir said he is still determining if the central bank will continue raising rates in September. ECB Schnabel and Nagel sounded hawkish, mentioning that there is still work to do. Markets continue to see more hikes from the ECB, hence supporting the euro. The common currency outperformed, with EUR/GBP rising toward 0.8600, despite UK inflation numbers.

Fed Chair Powell reiterated last week's FOMC message that followed the monetary policy meeting while delivering his testimony to the House Financial Services Committee. He reiterated that most FOMC members expect more rate hikes this year if the economic performance is as expected. Powell will speak to a Senate committee on Thursday, but no surprises are expected.

Fed's Goolsbee mentioned that last week's decisions were a close call for him. He is trying to "figure out" if they had done enough regarding tightening. US yields turned negative during the American session and weighed on the US dollar, which weakened across the board, helping the EUR/USD move toward 1.1000.

No data from the European Union is due on Thursday from the Eurozone. In the US, Jobless Claims and Existing Home Sales are due. The Bank of England will announce its decision which could impact the markets.

EUR/USD short-term technical outlook

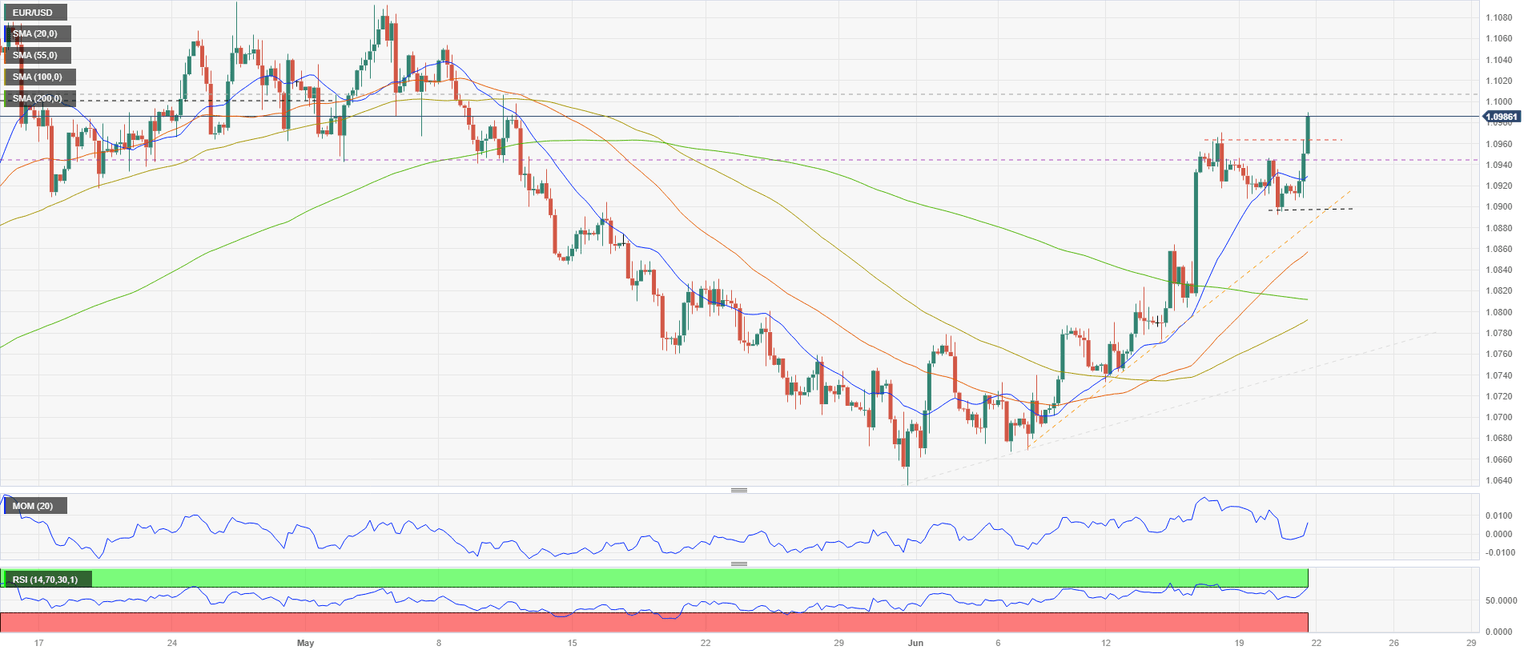

The EUR/USD pair resumed the upside, following three days of a bearish correction. It rose after finding support at the 55-day Simple Moving Average (SMA) and hit fresh monthly highs. The next area of relevance is 1.1000.

On the 4-hour chart, the Relative Strength Index is approaching 70, suggesting some exhaustion to the upside. Also, the approach to the key 1.1000 area points to consolidation ahead of the Asian session. The short-term trend will continue to be up while above 1.0890. A slide below 1.0960 would weaken the Euro, exposing 1.0945. Below that, the focus turns to the 20-SMA and 1.0925.

View Live Chart for the EUR/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.