EUR/USD Forecast: Euro is yet to stage a correction

- EUR/USD trades comfortably above 1.1200 to start the week.

- A negative shift in risk sentiment could cause the pair to correct lower.

- The US economic docket will not feature any high-impact data releases.

EUR/USD rose more than 200 pips last week and posted its largest one-week gain of 2023. Although the pair remains technically overbought in the near term, a noticeable negative shift in risk mood could be required for buyers to step away.

The broad-based selling pressure surrounding the US Dollar (USD) fuelled the pair's rally last week as markets scaled back bets on two more 25 basis points Federal Reserve (Fed) rate hikes this year. The US Dollar Index, which gauges the USD's valuation against a basket of six major currencies, lost over 2% last week to its weakest level since April 2022.

The NY Fed's Empire State Manufacturing Survey will be the only data featured in the US economic docket on Monday, which is likely to be ignored by investors.

Following the mixed macroeconomic data from China, markets seem to have turned cautious at the beginning of the week. The Euro Stoxx 50 Index is down more than 0.5% in the European session and US stock index futures trade modestly lower on the day.

In case safe-haven flows dominate the financial markets in the second half of the day, the USD could hold its ground and limit EUR/USD's upside.

Nevertheless, investors are likely to refrain from betting on a steady pullback in EUR/USD with the European Central Bank (ECB) seemingly looking to further tighten its policy. The accounts of the ECB's June policy meeting showed last Thursday that policymakers agreed that it was seen as essential to communicate that monetary policy had still more ground to cover.

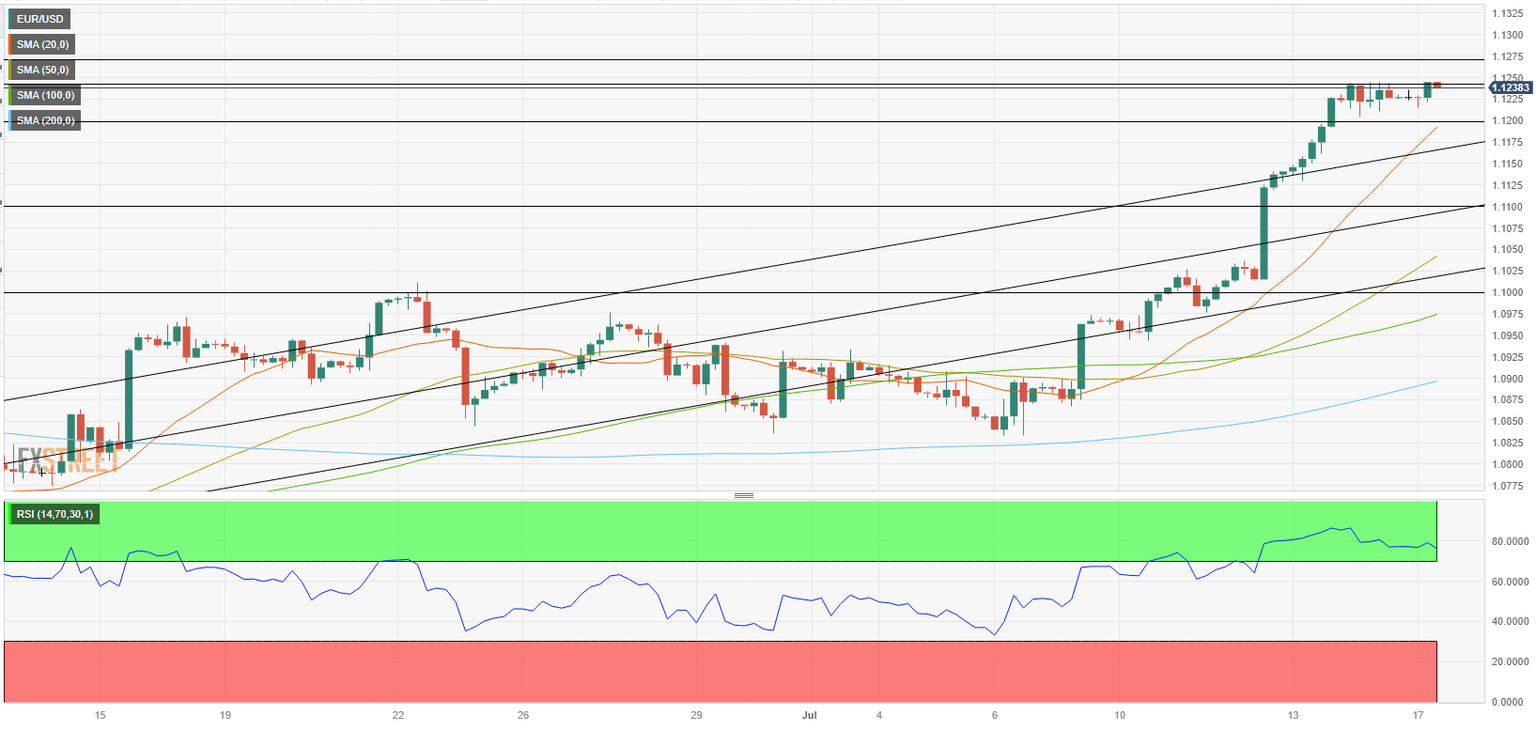

EUR/USD Technical Analysis

Static resistance seems to have formed at 1.1240 for EUR/USD. Once the pair rises above that level and starts using it as support, 1.1270 (static level from March 2022) and 1.1300 (psychological level) could be seen as next bullish targets.

On the downside, 1.1200 (20-period Simple Moving Average (SMA), psychological level) aligns as first support ahead of 1.1170 (upper-limit of the ascending regression channel). A 4-hour close below the latter could open the door for an extended slide toward 1.1100 (psychological level, mid-point of the ascending channel).

The Relative Strength Index (RSI) indicator on the four-hour chart stays in the overbought territory above 70 for the third straight trading day on Monday, suggesting that the pair could struggle to gather bullish momentum.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.