EUR/USD Forecast: Euro faces stiff resistance at 1.0370

- EUR/USD has reclaimed 1.0300 following a downward correction.

- Buyers could remain interested in case the pair clears 1.0370.

- Eyes on weekly Jobless Claims and July PPI data from the US.

EUR/USD has capitalized on the broad-based dollar weakness on Wednesday and climbed to its highest level in a month near 1.0370. Following a consolidation phase during the Asian trading hours, the pair has regained its traction and advanced beyond 1.0300. In order to extend its rally, however, EUR/USD needs to clear the stiff resistance that seems to have formed at 1.0370.

After the data published by the US Bureau of Labor Statistics revealed that annual inflation, as measured by the Consumer Price Index (CPI), declined to 8.5% in July from 9.1% in June, the greenback came under heavy selling pressure. More importantly, Core CPI, which strips volatile food and energy prices, remained steady at 5.9%, compared to the market expectation of 6.1%.

Although the initial reaction to soft US inflation data caused the probability of a 50 basis points (bps) Fed rate hike to jump to 70% from 35%, Fed policymakers did their best not to allow markets to get carried away.

Minneapolis Fed President Neel Kashkari and San Francisco Fed President Mary Daly both noted that they were still far away from declaring victory on inflation. Moreover, Chicago Fed President Charles Evans said that they were not finished with rate hikes and added that he was expecting the fed funds rate to top out at 4%. Following these comments, the odds of a 50 bps September rate increase declined below 60%. Nevertheless, the risk-positive market environment doesn't allow the greenback to stay resilient against its rivals and EUR/USD's bullish bias stays intact in the second half of the week.

Later in the day, the US economic docket will feature the weekly Initial Jobless Claims and July Producer Price Index (PPI) data. Markets expect the annual PPI for final demand to retreat to 10.4% from 11.3% in June. Unless the PPI continues to rise unexpectedly, the dollar could have a hard time staging a recovery. Additionally, US stock index futures are up between 0.4% and 0.6% in the European morning, suggesting that risk flows are likely to dominate the financial markets during the American session.

EUR/USD Technical Analysis

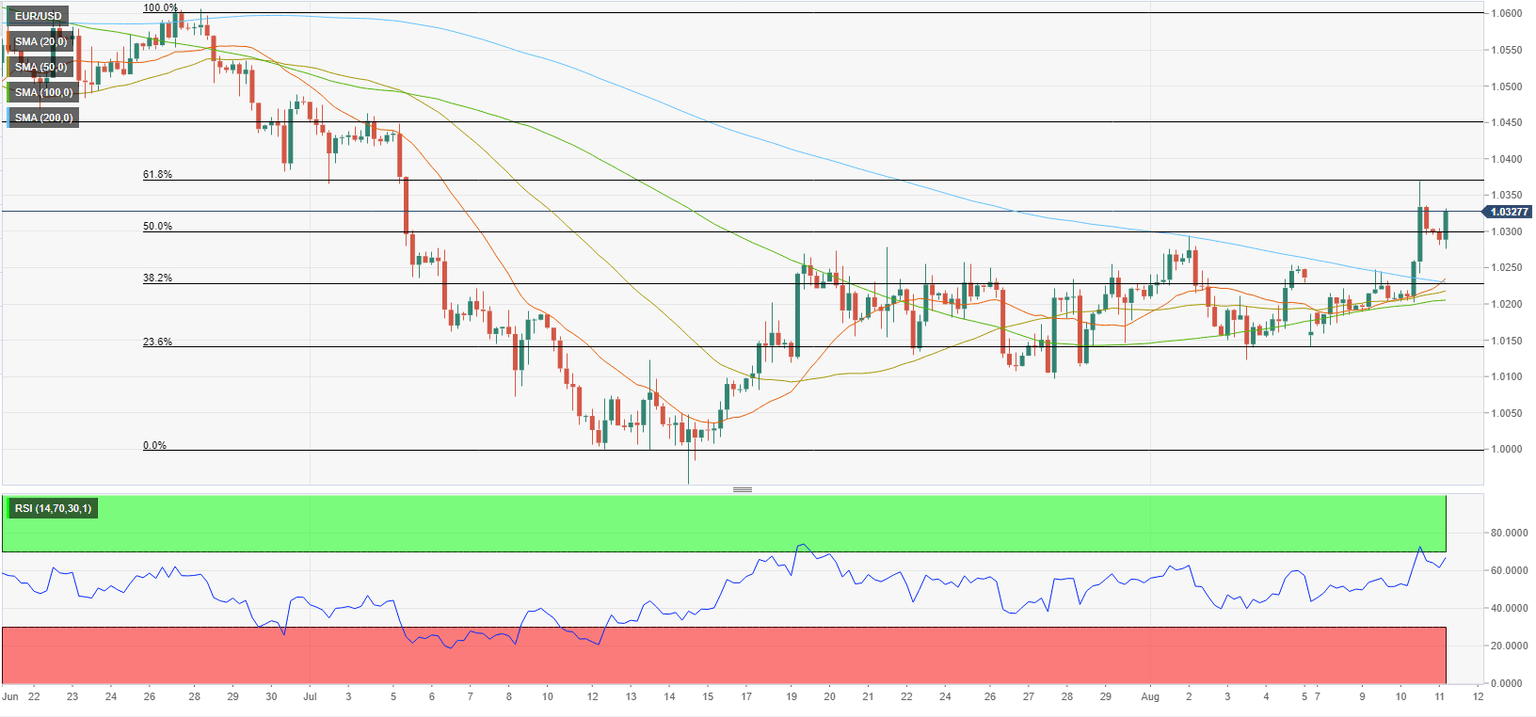

The Relative Strength Index (RSI) indicator on the four-hour chart climbed into the overbought territory above 70 during the American session on Wednesday. With EUR/USD edging lower early Thursday, the RSI declined to 60 before turning north once again. This action confirms that the pair remains bullish following the technical downward correction.

1.0370 (Fibonacci 61.8% retracement of the latest downtrend, Aug. 10 high) aligns as key resistance. In case this level turns into support, EUR/USD could target 1.0400 (psychological level) and 1.0450 (static level).

On the downside, 1.0300 (psychological level, Fibonacci 50% retracement) aligns as interim support ahead of 1.0230 (Fibonacci 38.2% retracement, 200-period SMA on the four-hour chart) and 1.0200 (psychological level, 100-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.