EUR/USD Forecast: Euro could try to rebound in case risk mood improves

- EUR/USD stays below 1.0400 to begin the new year.

- US economic calendar will feature weekly Jobless Claims data.

- A positive shift in risk sentiment can help the pair hold its ground.

After ending the year on the back foot, EUR/USD struggles to gain traction on the first trading day of 2025. The pair's near-term technical outlook suggests that the bearish bias stays intact but an improving risk mood could help the pair limit its losses.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.55% | 0.36% | -0.66% | -0.24% | 0.05% | 0.26% | 0.32% | |

| EUR | -0.55% | -0.19% | -1.23% | -0.83% | -0.57% | -0.33% | -0.29% | |

| GBP | -0.36% | 0.19% | -1.04% | -0.65% | -0.38% | -0.14% | -0.09% | |

| JPY | 0.66% | 1.23% | 1.04% | 0.42% | 0.77% | 1.09% | 1.05% | |

| CAD | 0.24% | 0.83% | 0.65% | -0.42% | 0.28% | 0.57% | 0.55% | |

| AUD | -0.05% | 0.57% | 0.38% | -0.77% | -0.28% | 0.24% | 0.29% | |

| NZD | -0.26% | 0.33% | 0.14% | -1.09% | -0.57% | -0.24% | 0.05% | |

| CHF | -0.32% | 0.29% | 0.09% | -1.05% | -0.55% | -0.29% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The US Dollar (USD) benefited from the risk-averse market atmosphere and weighed on EUR/USD heading into the New Year break. Early Thursday, US stock index futures rise between 0.4% and 0.8%. In case risk flows dominate the action after Wall Street's opening bell, the USD could have a hard time preserving its strength.

The US economic calendar will feature weekly Initial Jobless Claims data. Markets expect the number of first-time applications for unemployment benefits to rise to 224,000 from 219,000 in the previous week. A bigger-than-forecast increase in this data could hurt the USD in the second half of the day.

Meanwhile, European Central Bank (ECB) President Christine Lagarde reiterated that they have made significant progress in 2024 in bringing down inflation. "Hopefully, 2025 is the year when we are on target as expected and as planned in our strategy,” Lagarde added. These comments, however, failed to trigger a market reaction.

EUR/USD Technical Analysis

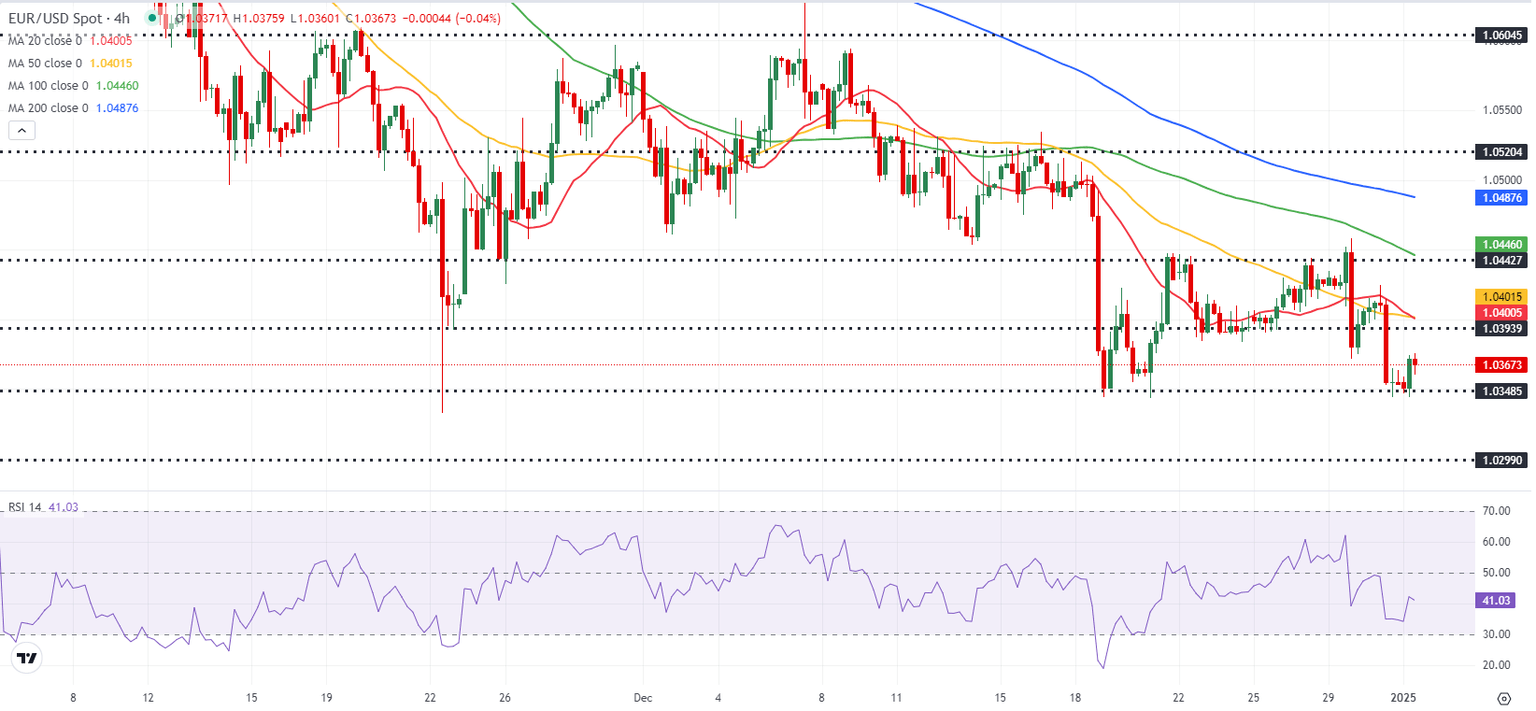

The Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and EUR/USD continues to trade below the 20-period and the 50-period Simple Moving Averages (SMA), reflecting the bearish bias.

On the upside, 1.0400 (20-period SMA, 50-period SMA, static level) aligns as first resistance level before 1.0440-1.0450 (static level, 100-period SMA) and 1.0490 (200-period SMA). Looking south, supports could be spotted at 1.0350 (static level), 1.0300 (static level, round level) and 1.0250 (static level).

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.