EUR/USD Forecast: Euro could struggle to find demand on a soft German inflation data

- EUR/USD retreated to the 1.0850 area following Tuesday's indecisive action.

- May inflation data from Germany will be watched closely by market participants.

- A bearish opening in Wall Street could support the USD later in the day.

EUR/USD rose toward 1.0900 in the first half of the day on Tuesday but lost its traction during the American trading hours. Early Wednesday, the pair fluctuates at around 1.0850 as investors await inflation data from Germany.

The upbeat consumer sentiment data from the US helped the US Dollar (USD) find demand on Tuesday. The Conference Board's Consumer Confidence Index rose to 102.00 from 97.5 in April. Commenting on the survey's findings, "views of current labor market conditions improved in May, as fewer respondents said jobs were hard to get, which outweighed a slight decline in the number who said jobs were plentiful," said Dana M. Peterson, Chief Economist at the Conference Board.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | -0.17% | 0.08% | -0.06% | -0.39% | -0.38% | -0.19% | |

| EUR | -0.09% | -0.29% | 0.00% | -0.15% | -0.55% | -0.57% | -0.26% | |

| GBP | 0.17% | 0.29% | 0.24% | 0.11% | -0.25% | -0.21% | 0.00% | |

| JPY | -0.08% | 0.00% | -0.24% | -0.18% | -0.49% | -0.39% | -0.30% | |

| CAD | 0.06% | 0.15% | -0.11% | 0.18% | -0.35% | -0.32% | -0.19% | |

| AUD | 0.39% | 0.55% | 0.25% | 0.49% | 0.35% | 0.07% | 0.26% | |

| NZD | 0.38% | 0.57% | 0.21% | 0.39% | 0.32% | -0.07% | 0.18% | |

| CHF | 0.19% | 0.26% | -0.01% | 0.30% | 0.19% | -0.26% | -0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Germany's Destatis will release the preliminary Consumer Price Index (CPI) data for May later in the session. Markets expect the CPI to rise 0.2% on a monthly basis following the 0.4% increase recorded in April. A stronger-than-forecast monthly CPI print could support the Euro with the immediate reaction. European Central Bank (ECB) Governing Council Member Dr. Joachim Nagel said last week that the ECB could cut rates in June but would probably have to wait until September for the next policy action. On the other hand, the Euro could struggle to find demand in case the monthly CPI comes in at or below the market forecast.

In the meantime, US stock index futures were last seen losing between 0.4% and 0.5%. If Wall Street's main indexes open in negative territory and continue to stretch lower, the USD could benefit from safe-haven flows and make it difficult for EUR/USD to gain traction.

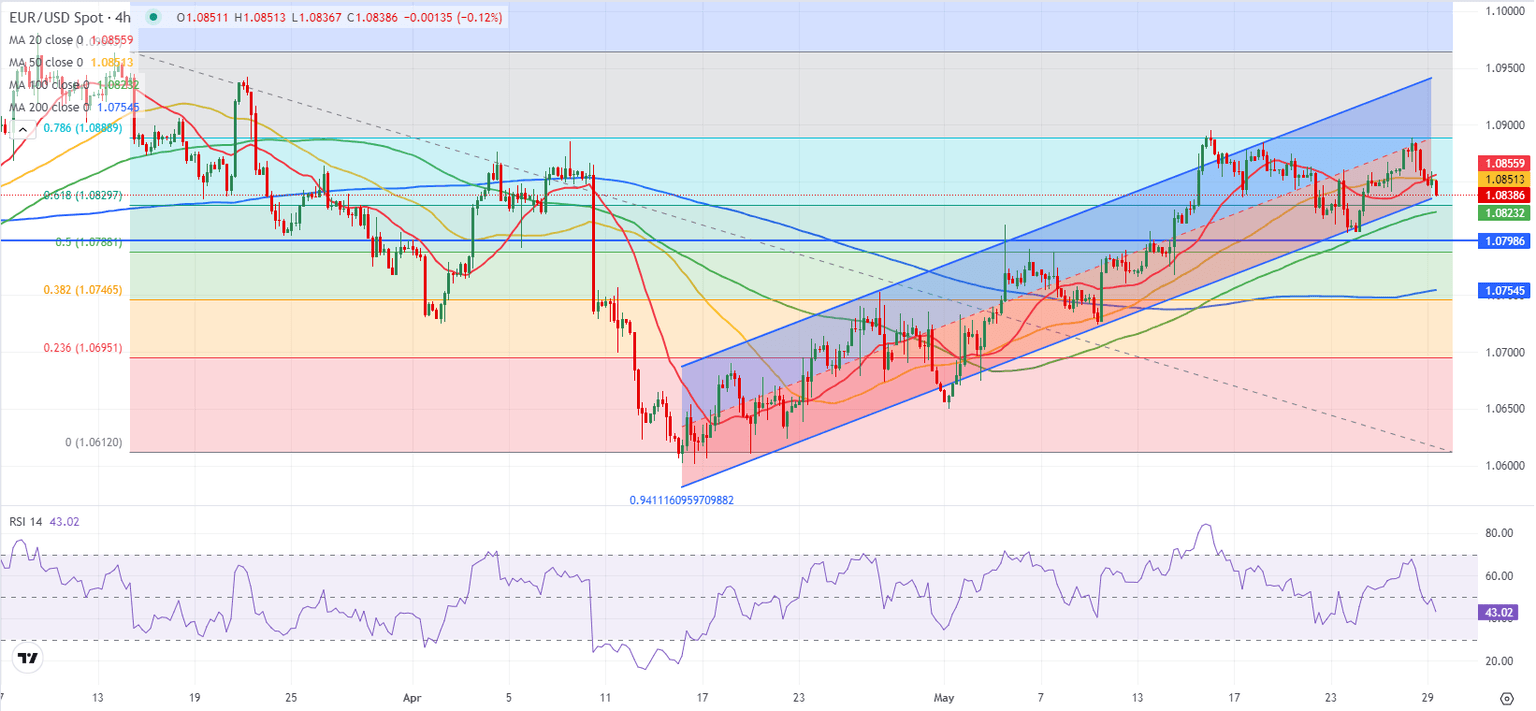

EUR/USD Technical Analysis

EUR/USD closes in on the lower limit of the ascending regression channel, which aligns as immediate support at 1.0830. If the pair drops below that level, the 100-day Simple Moving Average (SMA) could act as strong support at 1.0800 before 1.0780 (200-day SMA).

On the upside, first resistance is located at 1.0850 (50-period SMA on the 4-hour chart) ahead of 1.0890-1.0900 (mid-point of the ascending channel, Fibonacci 78.6% retracement of the latest downtrend).

Economic Indicator

Consumer Price Index (MoM)

The Consumer Price Index (CPI), released by the German statistics office Destatis on a monthly basis, measures the average price change for all goods and services purchased by households for consumption purposes. The CPI is the main indicator to measure inflation and changes in purchasing trends. The MoM figure compares the prices of goods in the reference month to the previous month. A high reading is bullish for the Euro (EUR), while a low reading is bearish.

Read more.Last release: Tue May 14, 2024 06:00

Frequency: Monthly

Actual: 0.5%

Consensus: 0.5%

Previous: 0.5%

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.