EUR/USD Forecast: Euro could stretch lower in case 1.0680 support fails

- EUR/USD has started the new week on a bearish note.

- US Dollar preserves its strength following the upbeat May jobs report.

- A four-hour close below 1.0680 could bring in additional sellers.

EUR/USD has continued to stretch lower and dropped below 1.0700 after having declined sharply late Friday. The pair's technical outlook suggests that the pair could extend its slide in case 1.0680 support fails.

The US Bureau of Labor Statistics reported ahead of the weekend that Nonfarm Payrolls (NFP) in the US rose 339,000 in May. This print came in much higher than the market expectation of 190,000 and helped the US Dollar (USD) outperform its rivals during the American trading hours on Friday. Although the CME Group FedWatch Tool shows that markets are still pricing in a nearly 70% probability of the US Federal Reserve (Fed) leaving its policy rate unchanged in June, the USD holds its ground at the beginning of the week.

Later in the day, the ISM will release the Services PMI report for May. After the ISM Manufacturing PMI showed an unexpected drop in the inflation component, the Price Paid Index, the US Dollar struggled to find demand. Hence, a similar reaction could be witnessed in case the Prices Paid Index of the ISM Services PMI survey, which is forecast to edge lower to 57.8 from 59.6 in April, declines toward 50. The headline PMI is expected to retreat to 51.5. A reading below 50 could also weigh on the USD while an increase should have the opposite impact on the currency's valuation.

Meanwhile, US stock index futures trade mixed and the Euro Stoxx 50 Index stays flat in the European session. A noticeable negative shift in risk sentiment could provide an additional boost to the USD and cause EUR/USD to push lower and vice versa.

It's also worth noting that European Central Bank (ECB) President Christine Lagarde will speak at the Hearing before the Committee on Economic and Monetary Affairs (ECON) of the European Parliament in Brussels. Lagarde reiterated last week that they need to continue to raise rate until they are confident that inflation will return to target. A similarly hawkish tone could help the Euro show some resiliency against its peers.

EUR/USD Technical Analysis

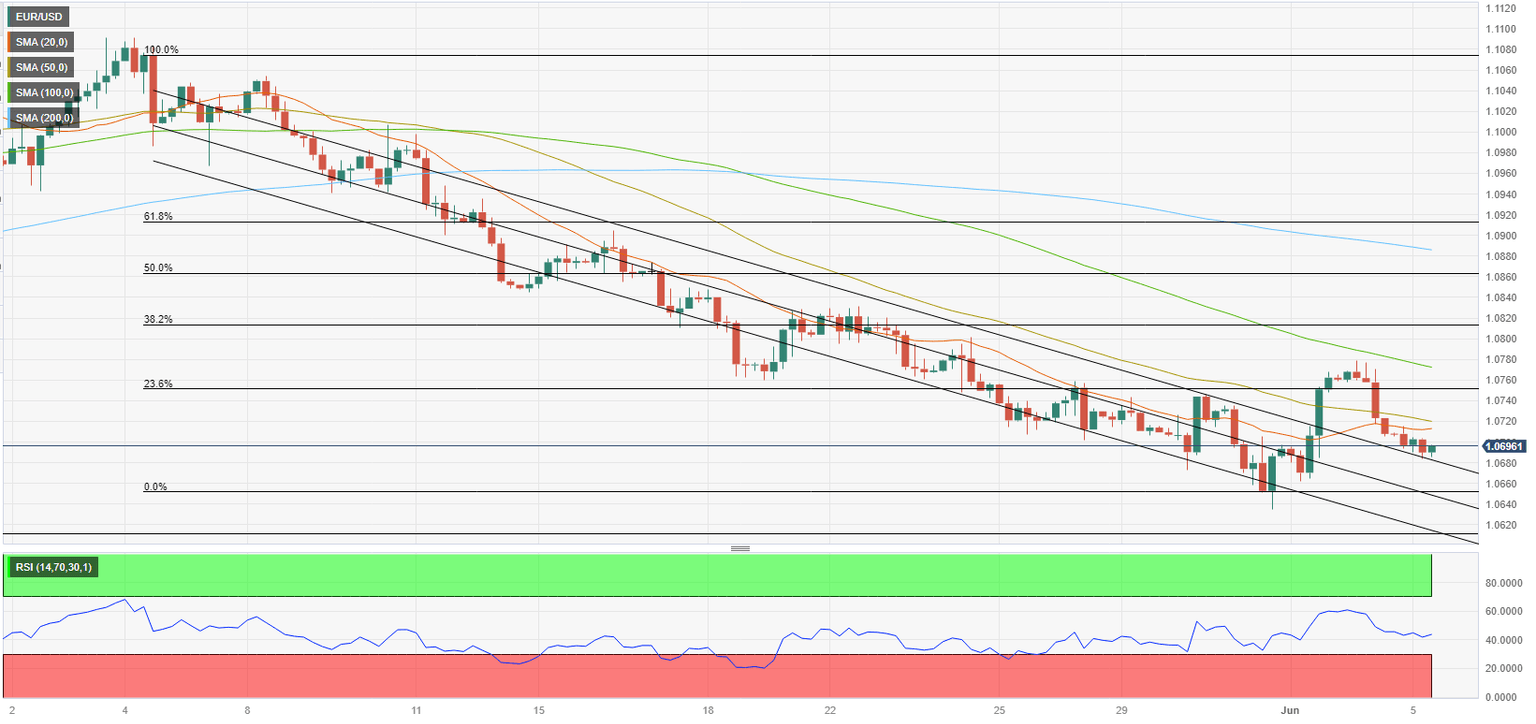

EUR/USD broke below the 20 and the 50-period Simple Moving Averages (SMA) on the four-hour chart and the Relative Strength Index (RSI) indicator on the same chart dropped below 50, reflecting the bearish bias in the short term.

The upper-limit of the descending regression channel aligns as immediate support at 1.0680. In case EUR/USD returns within that channel by confirming that level as resistance, 1.0650 (mid-point of the channel, end-point of the latest downtrend) aligns as strong support before bears could target 1.0600 (psychological level, lower-limit of the descending channel).

On the upside, a four-hour close above 1.0720 (50-period SMA) could discourage sellers. In that scenario, 1.0750 (Fibonacci 23.6% retracement level of the latest downtrend) and 1.0780 (100-period SMA) align as next hurdles.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.