EUR/USD Forecast: Euro could face stiff resistance at 1.0800

- EUR/USD stabilized above 1.0750 after posting gains for two consecutive days.

- Strong resistance seems to have formed at 1.0800.

- Producer inflation and consumer sentiment data will be featured in the US economic docket.

EUR/USD stays in a consolidation phase above 1.0750 on Friday after closing the previous two days in positive territory. Although the pair's near-term technical outlook points to a buildup of bullish momentum, buyers could remain on the sidelines unless 1.0800 is flipped into support.

Mixed macroeconomic data releases from the US and the positive shift seen in risk mood made it difficult for the US Dollar (USD) to hold its ground on Thursday and allowed EUR/USD to extend its recovery. Retail Sales in the US declined 0.8% on a monthly basis in January, while the weekly Initial Jobless Claims declined to 212,000 from 220,000.

Later in the day, the US Bureau of Labor Statistics will release the Producer Price Index (PPI) data for January. The PPI is forecast to rise 0.1% on a monthly basis following December's 0.1% decline. A negative monthly PPI print could weigh on the USD with the immediate reaction. On the other hand, an unexpected increase of 0.3% or bigger could provide a boost to the currency and force EUR/USD to stay on the back foot.

According to the CME FedWatch Tool, markets are currently pricing in a near 70% probability of the Federal Reserve (Fed) leaving the policy rate unchanged at the next two policy meetings. The market positioning suggests that the USD could weaken sharply in case investors start leaning toward a policy pivot in May.

EUR/USD Technical Analysis

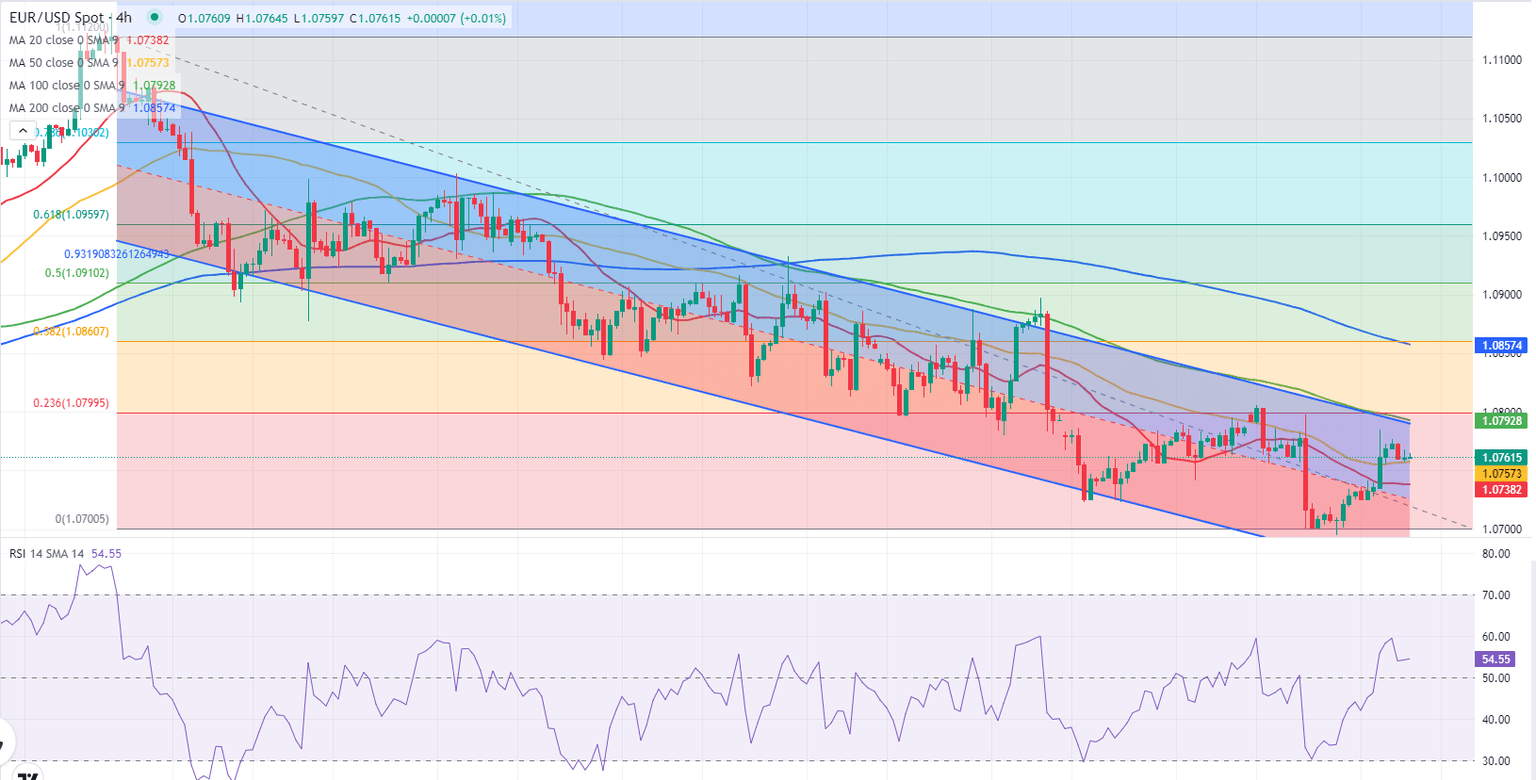

The Relative Strength Index (RSI) indicator on the 4-hour chart rose above 50 and EUR/USD closed the last 5 4-hour candles above the 20-period and 50-period Simple Moving Averages (SMA), highlighting a bullish tilt in the short-term technical outlook.

1.0800 (Fibonacci 23.6% retracement of the latest downtrend, 100-day SMA, upper limit of the descending regression trend channel) aligns as critical resistance for EUR/USD. In case the pair rises above that level and confirms it as support, it could target 1.0830 (50-day SMA) and 1.0860 (200-period SMA) next.

On the downside, immediate support is located at 1.0760 (50-period SMA) before 1.0730-40 (20-period SMA, mid-point of the descending channel) and 1.0700 (end-point of the downtrend, psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.