EUR/USD Forecast: Euro could extend uptrend once it stabilizes above 1.0850

- EUR/USD went into a consolidation phase near 1.0850 following Wednesday's correction.

- US data releases and comments from Fed speakers could impact the USD's valuation.

- The near-term technical outlook suggests that the bullish bias stays intact.

Following Tuesday's impressive upsurge, EUR/USD staged a correction and registered small losses on Wednesday. Although the pair continued to edge lower during the Asian trading hours on Thursday, it managed to erase its losses and stabilize near 1.0850.

The data from the US showed that Retail Sales declined at a softer pace than forecast in October and helped the US Dollar (USD) hold its ground after suffering heavy losses against its major rivals on Tuesday. Later in the day, the US economic docket will feature the weekly Initial Jobless Claims data and the Federal Reserve Bank of Philadelphia's Manufacturing Survey for November.

The number of first-time applications for unemployment benefits is forecast to rise to 220,000 from 217,000. A reading above 230,000 could make it difficult for the USD to find demand in the American session, while a negative surprise below 200,000 could provide a boost to the currency and weigh on EUR/USD.

Market participants will also pay close attention to comments from Federal Reserve officials. In case policymakers push back against the market expectation for a policy shift in 2024, the USD's losses could remain limited.

EUR/USD Technical Analysis

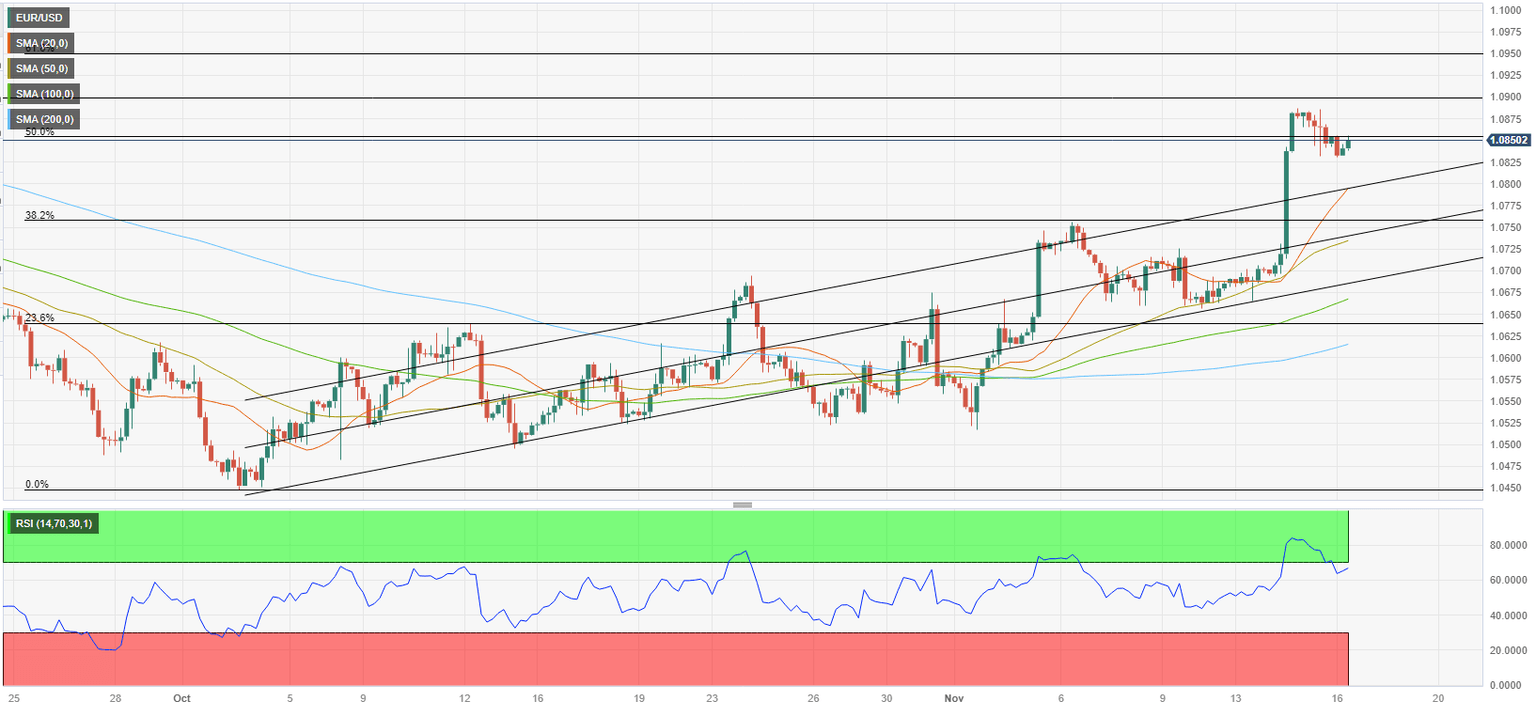

The Relative Strength Index (RSI) indicator on the four-hour chart declined below 70, suggesting that the bullish bias stays intact following the technical correction. 1.0850 (Fibonacci 50% retracement of the July-October downtrend) aligns as a key pivot level for the pair. Once this level is confirmed as support, bulls could target 1.0900 (psychological level, static level) and 1.0950 (Fibonacci 61.8% retracement).

On the downside, supports are located 1.0800 (psychological level, static level) and 1.0750 (Fibonacci 38.2% retracement) if 1.0850 fails.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.