EUR/USD Forecast: Euro could extend correction on a dovish ECB tone

- EUR/USD declines toward 1.1350 after posting gains on Wednesday.

- The ECB is widely anticipated to lower key rates by 25 basis points.

- The technical outlook points to a loss of bullish momentum in the near term.

EUR/USD gained traction and registered its highest daily close since February 2022 at 1.1400 on Wednesday. The pair corrects lower toward 1.1350 early Thursday as investors await the European Central Bank's (ECB) monetary policy announcements.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -1.15% | -0.81% | 0.06% | -1.03% | -1.63% | -0.01% | |

| EUR | 0.02% | -0.65% | -0.36% | 0.52% | -0.28% | -1.18% | 0.44% | |

| GBP | 1.15% | 0.65% | 0.70% | 1.17% | 0.37% | -0.53% | 1.10% | |

| JPY | 0.81% | 0.36% | -0.70% | 0.85% | -0.45% | -1.03% | 0.98% | |

| CAD | -0.06% | -0.52% | -1.17% | -0.85% | -1.04% | -1.68% | -0.14% | |

| AUD | 1.03% | 0.28% | -0.37% | 0.45% | 1.04% | -0.89% | 0.72% | |

| NZD | 1.63% | 1.18% | 0.53% | 1.03% | 1.68% | 0.89% | 1.66% | |

| CHF | 0.01% | -0.44% | -1.10% | -0.98% | 0.14% | -0.72% | -1.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The broad-based US Dollar (USD) weakness helped EUR/USD push higher on Wednesday as reports suggesting that the United States (US) President Donald Trump was planning to use ongoing tariff negotiations to pressure US trading partner to isolate China fed into fears over a deepening trade conflict.

The ECB is widely anticipated to lower key rates by 25 basis points (bps) following the April policy meeting. Since the ECB will not be releasing revised economic projections this time, investors will scrutinize the statement language and comments from President Christine Lagarde in the post-meeting press conference.

Earlier in the week, Bloomberg reported that the European Union (EU) was expecting a bulk of the tariffs imposed by the US to remain in place after little progress was made in talks on Monday. In case the ECB puts more emphasis on upside risks to inflation because of tariffs, rather than the growth outlook, markets could assess that as a hawkish tone. In this scenario, the Euro is likely to preserve its strength.

On the flip side, the Euro could struggle to find demand if the ECB, or President Lagarde, reaffirms confidence in the ongoing disinflation process and hints at a continuation of policy-easing.

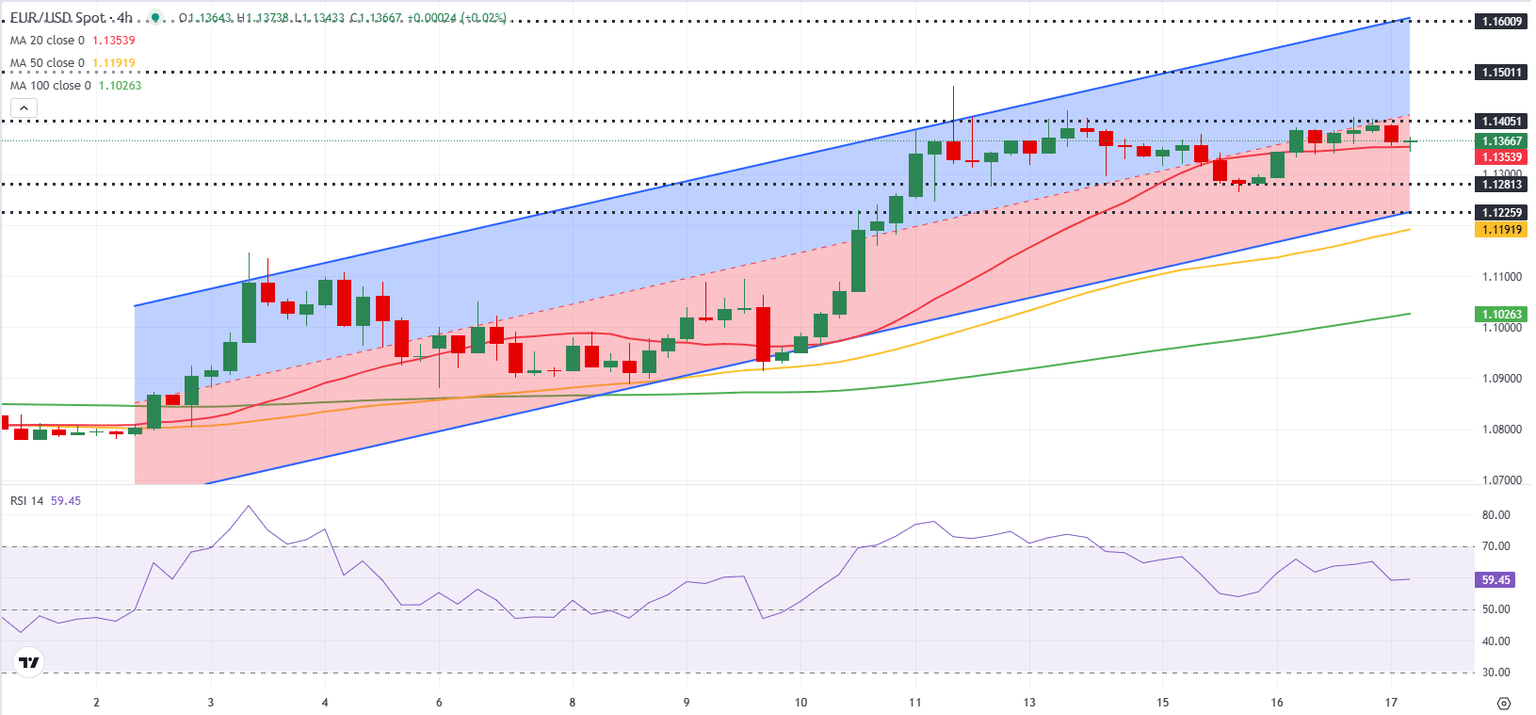

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart retreated slightly below 60 and EUR/USD declined to test the 20-period Simple Moving Average, reflecting a loss of bullish momentum.

On the downside, 1.1280 (static level) aligns as first support level below 1.1230 (lower limit of the ascending channel) and 1.1200-1.1190 (static level, 50-period SMA). Looking north, resistances could be spotted at 1.1400 (static level, mid-point of the ascending channel), 1.1470 (static level) and 1.1500 (round level).

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.