EUR/USD Forecast: Euro closes in on key support

- EUR/USD has started to push lower following Tuesday's wild swings.

- 1.0700 aligns as first key support for the pair in the short term.

- EUR/USD is likely to stay on the back foot in case safe-haven flows continue to dominate.

EUR/USD has lost its traction and declined toward 1.0700 mid-week after having spiked to its highest level in two weeks above 1.0800 with the knee-jerk reaction to US inflation data on Tuesday. The pair's near-term technical outlook points to a lack of buyer interest and additional losses could be witnessed in case the market mood fails to improve.

The US Bureau of Labor Statistics reported on Tuesday that the annual Consumer Price Index (CPI) edged lower to 6.4% in January from 6.5% in December. This reading came in slightly higher than the market expectation of 6.2%. On a monthly basis, the Core CPI, which excludes volatile food and energy prices, rose 0.4% as expected. More importantly, the underlying details of the report revealed that the core services' inflation, which the Fed pays close attention to, stood at 7.2% on a yearly basis.

These figures showed markets that the disinflation has not picked up any steam in January and reminded that the Federal Reserve is unlikely to entertain the idea of a policy pivot. According to the CME Group FedWatch Tool, the probability of the US central bank holding the policy rate steady in May following a 25 basis points rate hike in March declined to 16% from 20% ahead of the CPI data release.

Supported by hawkish Fed bets and rising US Treasury bond yields, the US Dollar Index stays in positive territory above 103.50. Meanwhile, US stock index futures are down between 0.4% and 0.7% on the day, reflecting a risk-averse market atmosphere that is beneficial for the US Dollar.

December Industrial Production data will be featured in the European economic docket. Unless this data offers a significant surprise, it is unlikely to trigger a noticeable reaction in the pair. In the second half of the day, January Retail Sales from the US will be looked upon for fresh impetus. Following December's 1.1% contraction, Retail Sales are forecast to rise by 1.8% in January. Although this data should have little to no impact on the Fed's policy outlook, a strong print could help the US Dollar preserve its strength and vice versa.

Market participants will also pay close attention to the performance of Wall Street's main indexes. In case US stocks open deep in negative territory and continue to push lower, EUR/USD could stay under bearish pressure in the second half of the day.

EUR/USD Technical Analysis

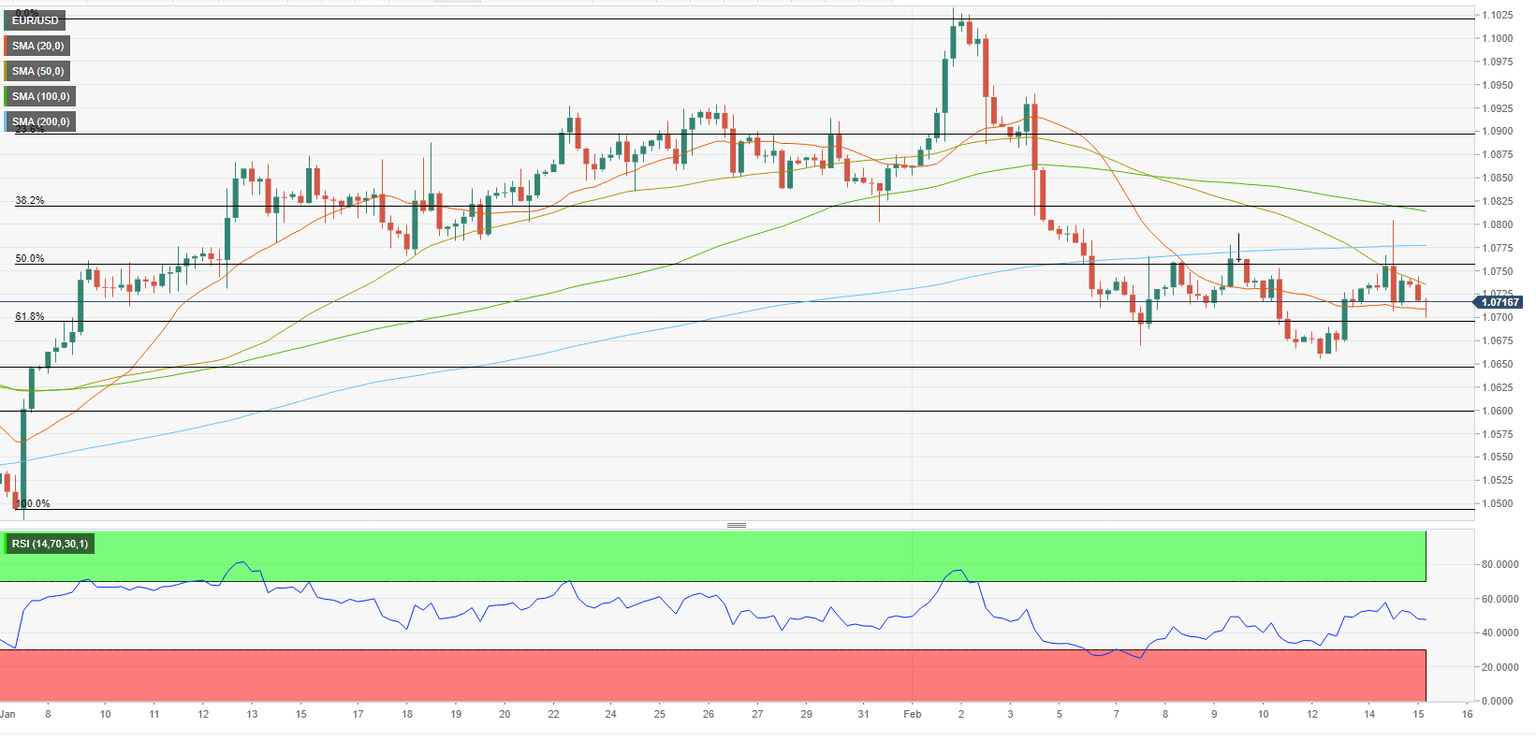

EUR/USD failed to hold above the 50-period Simple Moving Average (SMA) on the four-hour chart despite having tested this level several times on Tuesday. Additionally, the Relative Strength Index (RSI) indicator on the same chart retreated below 50, suggesting that buyers remain on the sidelines.

On the downside, 1.0700 (psychological level, Fibonacci 61.8% retracement of the latest uptrend) aligns as key support. A four-hour close below that level could trigger another leg lower toward 1.0645/50 (static level) and 1.0600 (psychological level).

Interim resistance for the pair is located at 1.0730 (50-period SMA) ahead of 1.0760 (Fibonacci 50% retracement). In case the pair rises above the latter resistance, it is likely to face another strong hurdle at 1.0775, where the 200-period SMA is located.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.