EUR/USD Forecast: Euro closes in on key resistance area

- EUR/USD has regained its traction following Monday's drop.

- Euro could extend its rebound if it manages to clear 1.0900/1.0910 area.

- The US Dollar could have a hard time holding its ground in case risk mood improves.

EUR/USD has gathered recovery momentum and advanced to the 1.0900 area early Tuesday after having registered daily losses on Monday. The positive shift seen in risk sentiment could help the pair continue to stretch higher and buyers could show interest once 1.0900/1.0910 resistance area turns into support.

The negative opening in Wall Street's main indexes and rising US Treasury bond yields helped the US Dollar (USD) outperform its rivals on Monday. The market positioning suggests that investors are leaning toward another 25 basis points Federal Reserve rate hike in May with the CME Group's FedWatch Tool pointing to a nearly 70% probability.

Following the four-day Easter holiday, the Euro Stoxx 50 opened 0.5% higher, reflecting an improving market mood. Meanwhile, US stock index futures post small gains in the European trading hours. In case there is a risk rally in US stocks in the American session, the USD is likely to stay on the back foot. It's also worth noting that the Sentix Investor Confidence edged higher to -8.7 in April from -11.1 in March, supporting the Euro.

Ahead of Wednesday's highly-anticipated Consumer Price Index (CPI) data for March, however, market participants could refrain from making large bets. In that scenario, the USD's losses could remain limited even if risk flows continue to drive the action.

In the second half of the day, Minneapolis Fed President Neel Kashkari, Philadelphia Fed President Patrick Harker and Chicago Fed President Austan Goolsbee will be delivering speeches. In case these policymakers voice their willingness to vote in favor of another rate increase, the USD is likely to regather its strength and weigh on EUR/USD.

EUR/USD Technical Analysis

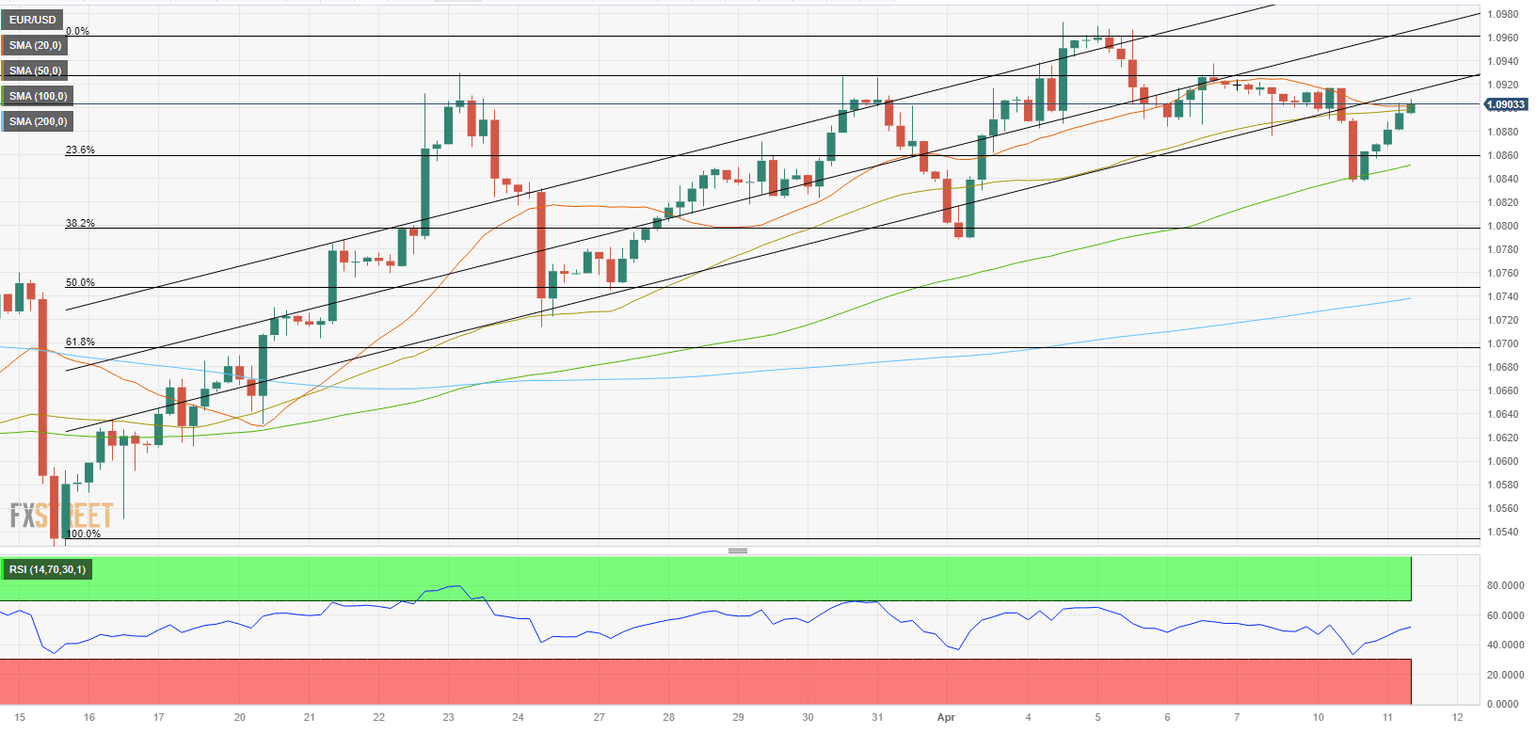

EUR/USD trades at around 1.0900, where the 20-period and the 50-period Simple Moving Averages (SMA) align. Slightly above that level, at 1.0910, the lower limit of the ascending regression channel acts as the next immediate resistance. Once the pair climbs above 1.0900/1.0910 area and starts using it as support, it could edge higher to 1.0930 (static level) and 1.0960 (static level, mid-point of the ascending channel).

On the downside, 1.0860/1.0850 (Fibonacci 23.6% retracement of the latest uptrend, 100-period SMA) form key support before 1.0800 (psychological level, Fibonacci 38.2% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.