EUR/USD Forecast: Euro breaks out of range ahead of US inflation data

- EUR/USD climbed to its highest level since early January above 1.1000.

- The technical outlook points to overbought confitions for the pair.

- July inflation data from the US could trigger the next big action.

EUR/USD gathered bullish momentum after breaking out of its one-week-old range and reached its highest level since early January above 1.1000. The pair's near-term technical outlook points to overbought conditions as market focus shifts to the US inflation data.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.96% | -0.62% | 0.31% | -0.21% | -0.86% | -0.16% | -0.31% | |

| EUR | 0.96% | 0.36% | 1.25% | 0.75% | -0.03% | 0.80% | 0.67% | |

| GBP | 0.62% | -0.36% | 1.15% | 0.39% | -0.39% | 0.43% | 0.31% | |

| JPY | -0.31% | -1.25% | -1.15% | -0.49% | -1.23% | -0.46% | -0.63% | |

| CAD | 0.21% | -0.75% | -0.39% | 0.49% | -0.71% | 0.05% | -0.07% | |

| AUD | 0.86% | 0.03% | 0.39% | 1.23% | 0.71% | 0.82% | 0.70% | |

| NZD | 0.16% | -0.80% | -0.43% | 0.46% | -0.05% | -0.82% | -0.12% | |

| CHF | 0.31% | -0.67% | -0.31% | 0.63% | 0.07% | -0.70% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

In the American session on Tuesday, the US Dollar (USD) came under renewed selling pressure and opened the door for a leg higher in EUR/USD. The improving risk mood, as reflected by rallying equity indexes in the US, and an extended decline in the US Treasury bond yields made it difficult for the USD to find demand.

In the second half of the day, the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for July. On a yearly basis, the CPI is forecast to rise 2.9%, down from the 3% increase recorded in June, while the core CPI is seen rising 3.2% in the same period. On a monthly basis, the CPI and the core CPI are both expected to increase 0.2%.

In case the monthlyl core CPI, which excludes prices of volatile items and doesn't get distorted by base effects, rises at a sronger pace than expected, the immediate reaction could trigger a USD recovery and weigh on EUR/USD. On the other hand, the pair could look to stretch higher if the monthly core CPI comes in below the market estimate.

EUR/USD Technical Analysis

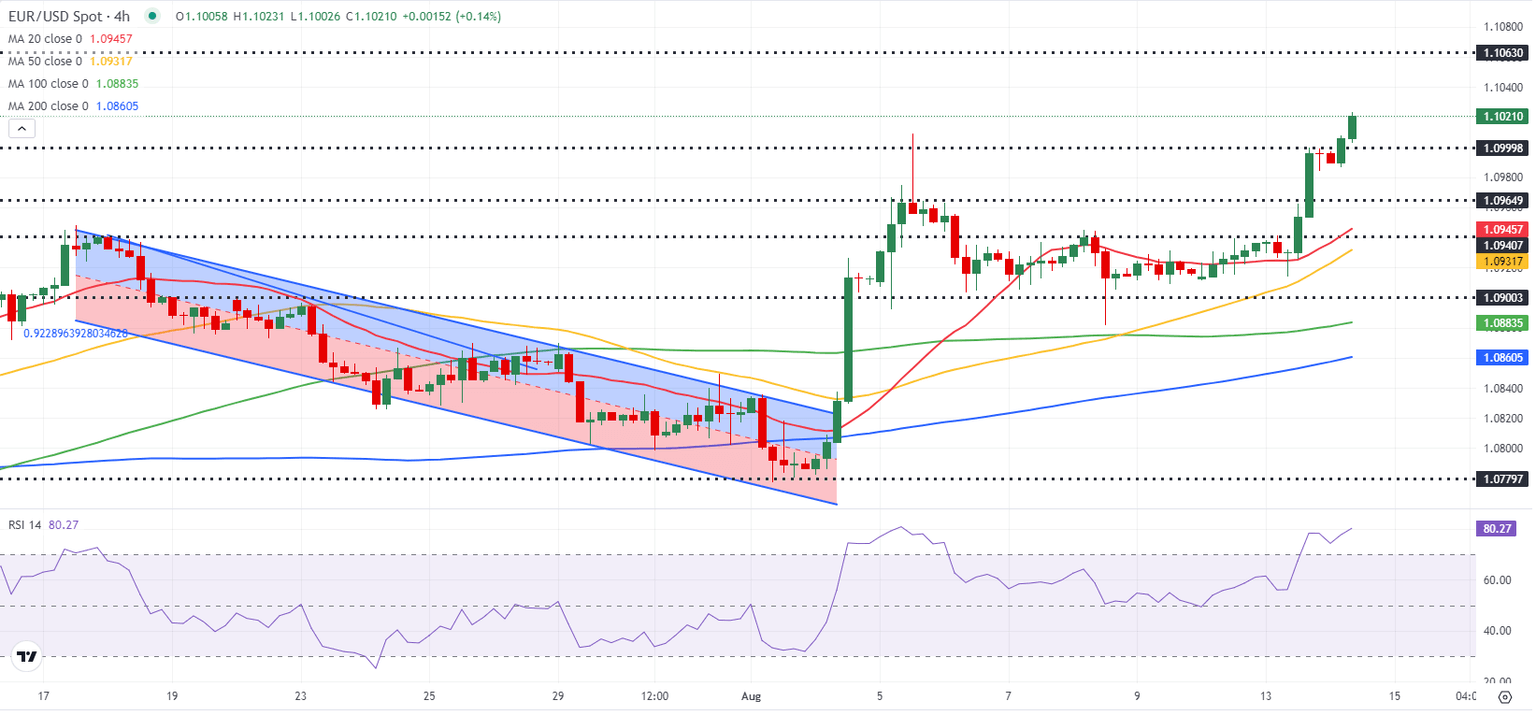

The Relative Strength Index (RSI) indicator on the 4-hour chart climbed to 80 early Wednesday, reflecting overbought conditions. On the upside, 1.1060 (static level) could be seen as next resistance before 1.1100 (psychological level, static level).

In case EUR/USD stages a technical correction and flips 1.1000 back into resistance, supports align at 1.0960 (static level), 1.0940 (static level) and 1.0900 (psychological level, static level).

Economic Indicator

Consumer Price Index ex Food & Energy (MoM)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The MoM print compares the prices of goods in the reference month to the previous month.The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Aug 14, 2024 12:30

Frequency: Monthly

Consensus: 0.2%

Previous: 0.1%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.