EUR/USD Forecast: EUR/USD gaining ground ahead of Federal Reserve’s decision

EUR/USD Current price: 1.1120

- Looming Federal Reserve’s announcement undermines demand for the US Dollar.

- Eurozone and United States data came in better than anticipated.

- EUR/USD is technically bullish and could reach the 1.1150 region in the near term.

The EUR/USD pair surged to 1.1132 on Monday, its highest in over a week. The pair trades nearby amid the broad US Dollar’s weakness, fueled by speculation the Federal Reserve (Fed) will trim interest rates when it meets this week. The Fed is scheduled to announce its decision on monetary policy next Wednesday, and market participants have long ago priced in a reduction of at least 25 basis points (bps). There is still a minor chance that the central bank will go for a more aggressive 50 bps cut, a decision that could further undermine demand for the USD.

Meanwhile, a firmer Japanese Yen (JPY) weighed on the Greenback at the beginning of the day. Central banks’ imbalances drove the USD/JPY to 139.54, a fresh multi-month low, as the Bank of Japan (BoJ), which also meets this week, is expected to move in the opposite direction of the Fed and hike interest rates.

Data-wise, the Eurozone released the July Trade Balance, which posted a seasonally adjusted surplus of €15.5 billion, below the June one at €17.0 billion. As for the United States (US), the country released the NY Empire State Manufacturing Index, which drastically improved to 11.5 in September from -4.7 in the previous month. As a result, the USD remained under selling pressure. There are no other relevant figures scheduled for the rest of the day.

EUR/USD short-term technical outlook

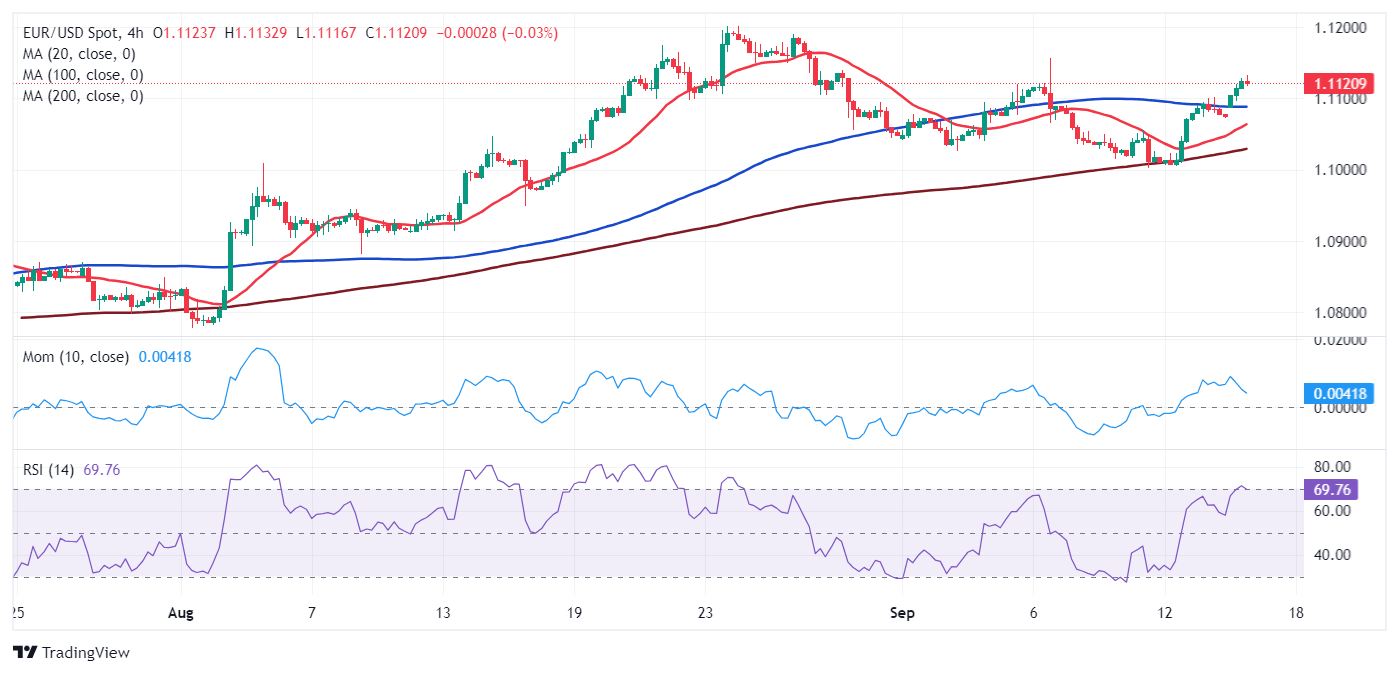

Technically, the EUR/USD pair is bullish. The daily chart shows it hovers near the intraday high after recovering above a bullish 20 Simple Moving Average (SMA). The latter provides near-term support in the 1.0990 price zone. At the same time, technical indicators aim north, although with uneven strength and the Momentum indicator still below its 100 line, somehow limiting the upward potential. Finally, the 100 SMA grinds higher above a flat 200 SMA, suggesting persistent buying interest.

In the near term, and according to the 4-hour chart, the bullish momentum eased, although the risk remains skewed to the upside. EUR/USD is developing above all its moving averages, with only the 20 SMA heading north, trapped between flat 100 and 200 SMAs. Technical indicators, in the meantime, have lost their upward strength after reaching overbought readings, now hovering directionless near their intraday peaks.

Support levels: 1.0990 1.0950 1.0910

Resistance levels: 1.1050 1.1090 1.1140

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.