EUR/USD Forecast: EUR unable to take advantage of dollar’s weakness

EUR/USD Current Price: 1.0804

- US employment data disappointed once again ahead of the April Nonfarm Payroll report.

- German dismal industrial production data limited the bullish potential of the common currency.

- EUR/USD bounced from a fresh multi-week low, retains its bearish stance.

The shared currency retained the doubtful honour of being the weakest dollar’s rival this Thursday. The EUR/USD pair fell to 1.0766, a fresh multi-week low, but bounced back toward the 1.0800 price zone, where it holds stable ahead of the Asian opening. German data weighed on the pair, as Industrial Production plummeted in March, down by 9.2% in the month and declining 11.6% when compared to a year earlier.

The pair remained under pressure despite US data was also disappointing. According to the Challenger Jobs Cut report, the number of layoffs reported for US companies in April jumped to 671.129K from 222.288K in March. Initial Jobless Claims for the week ended May 1 resulted in 3.17 million, worse than the 3 million expected. However, the preliminary estimate of Q1 Nonfarm Productivity fell by 2.5% from 1.2% in the previous quarter, while the Unit Labour Costs in the same quarter soared to 4.8%, both beating expectations. Falling US Treasury yields and resurgent gold were behind the dollar’s latest decline.

This Friday, the US will publish the April Nonfarm Payroll report. The country is expected to have lost 22 million jobs throughout the month, while the unemployment rate is seen jumping to 14% from 4.4%. Nevertheless, there is speculation that such a rate could be closer to 20%. Average Hourly Earnings are seen up by 0.3% in the month, and by 3.3% when compared to a year earlier.

EUR/USD short-term technical outlook

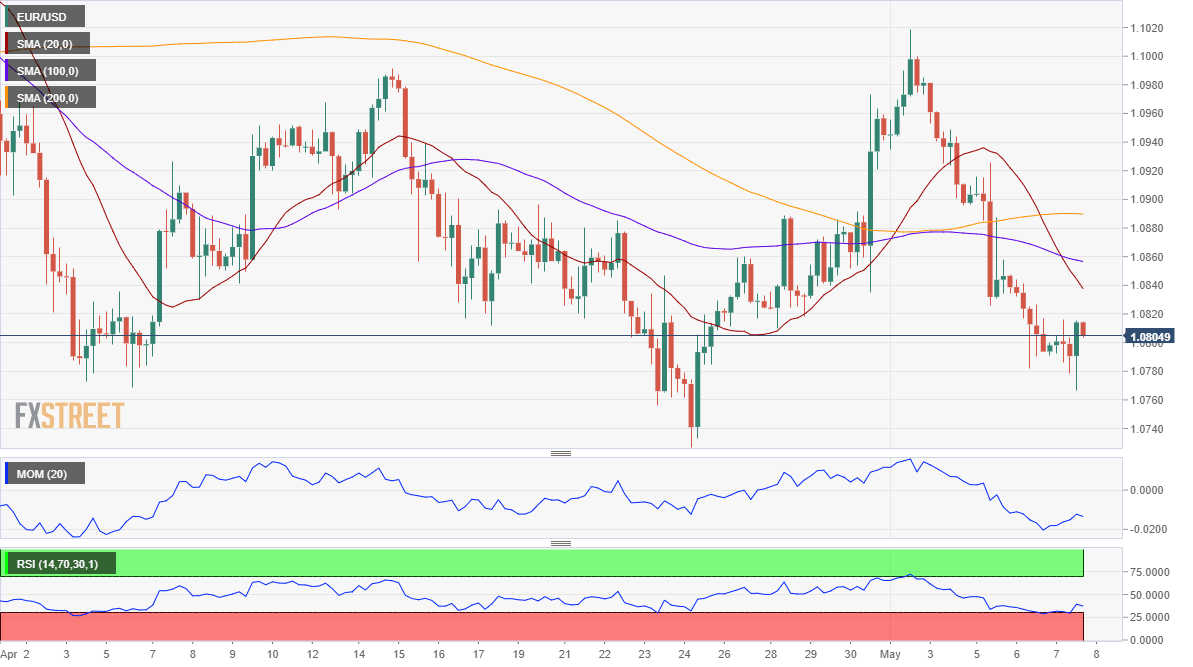

The EUR/USD trimmed daily losses and posted a modest intraday gain, although it holds within familiar levels around the 1.0800 figure. The bullish potential remains well limited, as, in the 4-hour chart, the pair is developing below all of its moving averages, with the 20 SMA heading south below the larger ones. Technical indicators in the meantime, have corrected oversold conditions, but detained their recoveries below their midlines and turned flat.

Support levels: 1.0790 1.0755 1.0710

Resistance levels: 1.0865 1.0900 1.0940

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.