EUR/USD Forecast: EUR corrects higher ahead of critical ECB decision

EUR/USD Current Price: 1.0154

- The European Central Bank will likely refrain from innovating with an unexpected announcement.

- A better market mood weighed on the American currency at the beginning of the week.

- EUR/USD has room to extend its corrective recovery in the upcoming days.

The EUR/USD pair holds on to substantial gains and trades in the 1.0160 price zone after hitting a daily high of 1.0200. The American dollar remained on the backfoot on Monday amid a better performance of stock markets. Investors remain concerned about looming recessions and overheated inflation, but at this point, it seems that policymakers would not do much more than what they have long ago anticipated.

This week, the European Central Bank will announce its monetary policy decision, already priced in as President Christine Lagarde has anticipated a 25 bps rate hike. The ECB is among the most conservative central banks, one of the reasons why EUR/USD pierced through parity last week.

On the data front, the week started in slow motion. The US published the July NAHB Housing Market Index, which contracted to 55 from 67 in June, while it will release May TIC Flows with Wall Street’s closing bell. On Tuesday, the EU will release the final June inflation figures, expected to be confirmed at 8.6% YoY. On the other hand, the US will release June Building Permits and Housing Starts.

EUR/USD short-term technical outlook

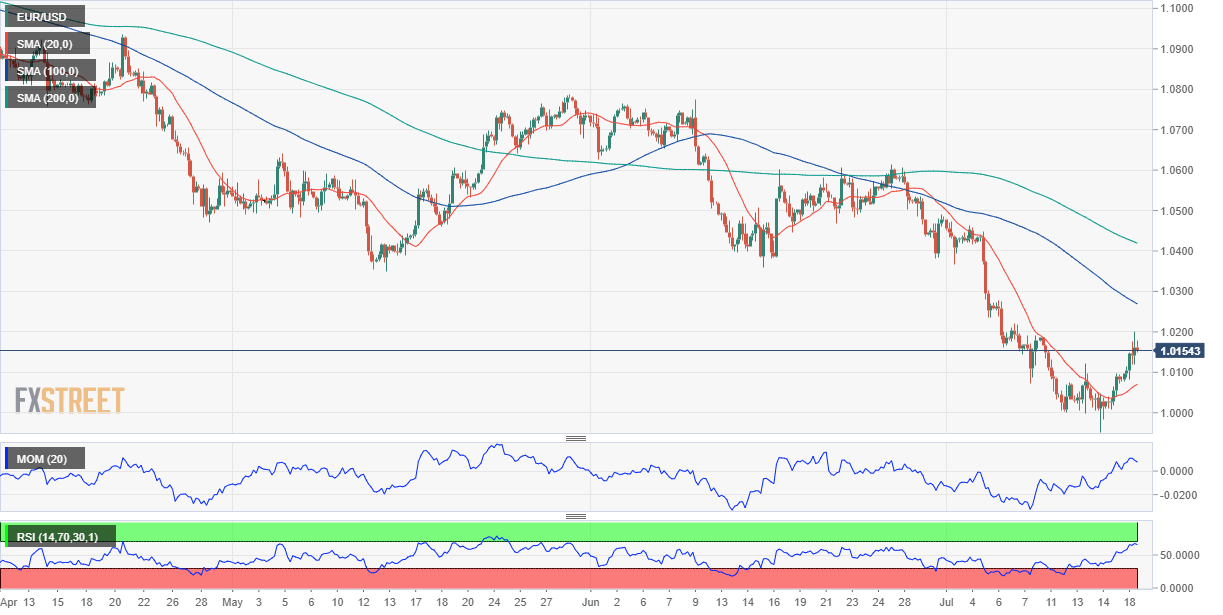

From a technical point of view, the daily chart shows that the pair is in a corrective advance that could continue in the upcoming sessions. Technical indicators maintain bullish slopes within negative levels but far below their recent lows in extreme oversold territory. However, the pair remains below bearish moving averages, with the 20 SMA heading firmly lower and providing dynamic resistance at around 1.0310.

The 4-hour chart shows that technical indicators reached overbought levels, with the Momentum consolidating nearby and the RSI retreating modestly. Meanwhile, the 20 SMA advances below the current level while the longer moving averages maintain their downward slopes well above the price.

Support levels: 1.0120 1.0070 1.0025

Resistance levels: 1.0185 1.0220 1.0265

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.