EUR/USD Forecast: Downside pressure mitigated above the 200-day SMA

- EUR/USD manages well to keep business above 1.1900 so far.

- German IFO survey showed morale remains high in June.

- Markets’ focus will be on the US calendar later on Thursday.

EUR/USD navigates in a choppy fashion so far this week, always in the upper bound of the recent range and above the 1.1900 mark following Monday’s sharp bounce off the mid-1.1800s.

The main driver of the pair’s price action has come from investors’ appetite for riskier assets as of late, as the effects of the Fed’s message from the latest meeting have been dying off.

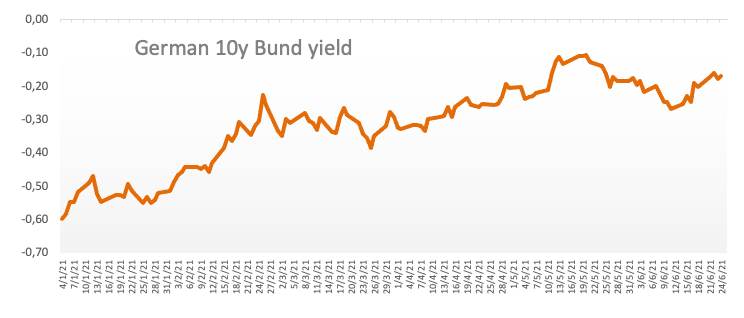

In addition, yields of the German 10-year benchmark keep the upside pressure intact, adding to the upbeat mood around the European currency vs. the steady performance of the US bonds market.

Fundamentals in the region also sustain the bid bias in the pair. This time, the German IFO survey showed the Business Climate improved further in June, surpassing expectations at the same time and showing morale remains high and supporting the ongoing economic recovery.

Regarding technicals, and although the pair left the oversold territory, it remains close to it as per the daily RSI levels. On it way up, EUR/USD expects to meet a minor resistance at a Fibo retracement at 1.1976 ahead of the more significant barrier at the critical 200-day SMA, today at 1.1993. Further north comes in the psychological yardstick at 1.20 the figure. Above the 200-day SMA, the selling pressure is expected to alleviate somewhat.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.