EUR/USD Forecast: Door opens to parity

- EUR/USD has dropped below 1.0100 for the first time in nearly 20 years.

- Sellers could dominate the pair's action and book their profits around parity.

- Focus shifts to June Nonfarm Payrolls data from the US.

EUR/USD has extended its slide to its lowest level in nearly two decades below 1.0100 in the early European session on Friday. The pair shows no signs of a convincing recovery and it wouldn't be surprising to see the euro hit parity against the dollar at this point.

The risk-averse market environment helped the dollar regather its strength following a two-day consolidation phase. The US Dollar Index, which tracks the greenback's performance against a basket of six major rivals, advanced to its highest level since late 2002 above 107.00.

Meanwhile, European Central Bank (ECB) Governing Council member Ignazio Visco said on Friday that the bank could consider a bigger rate hike in September after raising rates by 25 basis points in July.

Despite the worsening inflation outlook in the euro area, ECB policymakers sound relatively cautious regarding the rate outlook as they also have to think about the possibility of the euro area economy tipping into recession.

In the second half of the day, the US Bureau of Labor Statistics will release the June jobs report. Investors expect Nonfarm Payrolls (NFP) to rise by 268,000 following May's stronger-than-forecast increase of 390,000 in May. In addition to the headline NFP print, market participants will also pay close attention to wage inflation. An upbeat NFP print coupled with strong wage inflation could provide a boost to the dollar as it would remind investors of the policy divergence between the ECB and the US Federal Reserve. On the other hand, disappointing figures could trigger a dollar selloff but the currency's weakness is likely to remain short-lived with investors seeking refuge in that scenario.

Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one.

EUR/USD Technical Analysis

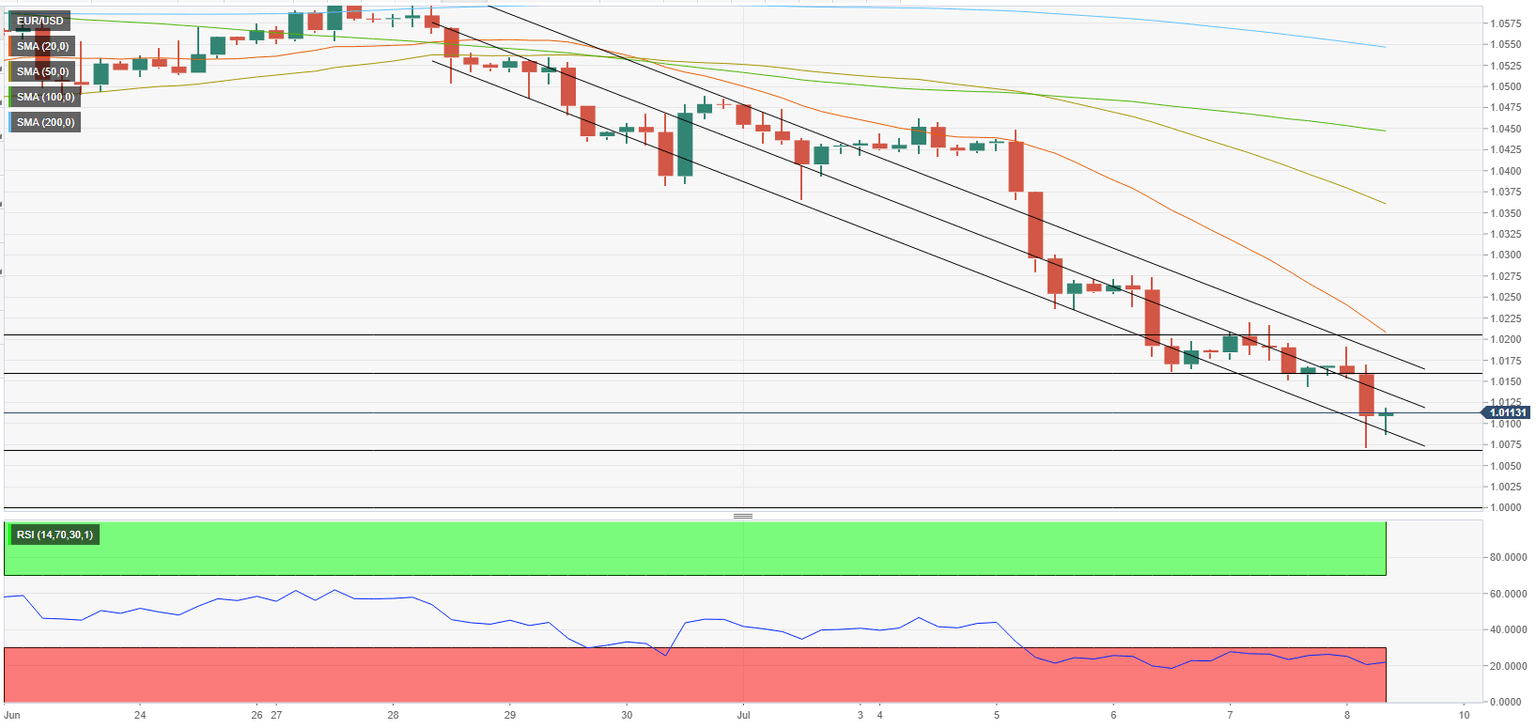

EUR/USD remains extremely oversold in the near term with the Relative Strength ındex (RSI) indicator on the four-hour chart staying well below 30. The descending regression channel coming from late-June stays intact and the pair's technical correction is likely to meet resistance at the upper limit of that channel at 1.0150. With a four-hour close above that level, the pair could extend its recovery toward 1.0200 (psychological level, static level, 20-period SMA).

On the downside, interim support seems to have formed at 1.0070 (static level) before the pair could target the all-important parity.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.