EUR/USD Forecast: Depressed below 1.0900

EUR/USD Current Price: 1.0884

- US Initial Jobless Claims printed at 5245K in the week ended April 10.

- Market’s sentiment improved modestly, investors waiting for more clues.

- EUR/USD is bearish in the short term, needs to break below the 1.0835 support.

The EUR/USD pair slid to 1.0852 this Thursday, then surging towards the 1.0900 price zone ahead of the release of critical US data. The market mood remains the main market motor, dependent on the like-hood of economic re-opens. Hence, the attention on the coronavirus pandemic curves. Signs of flattening in Europe are still present, although the situation keeps worsening in the US. The end of the economic stalemate is still unclear.

The US has just released Initial Jobless Claims for the week ended April 10, which were worse than anticipated at 5245K although better than the previous weekly figure, which was upwardly revised to 6615K. The Philadelphia Fed Manufacturing Survey came in at -56.6 for April vs. the expected -30. The sour numbers had a limited effect on currencies, with EUR/USD holding a few pips below the 1.0900 figure.

Wall Street futures, on the other hand, are marginally higher and poised to open with gains after falling on Wednesday. US Treasury yields ticked higher in pre-opening trading, but remain depressed.

EUR/USD short-term technical outlook

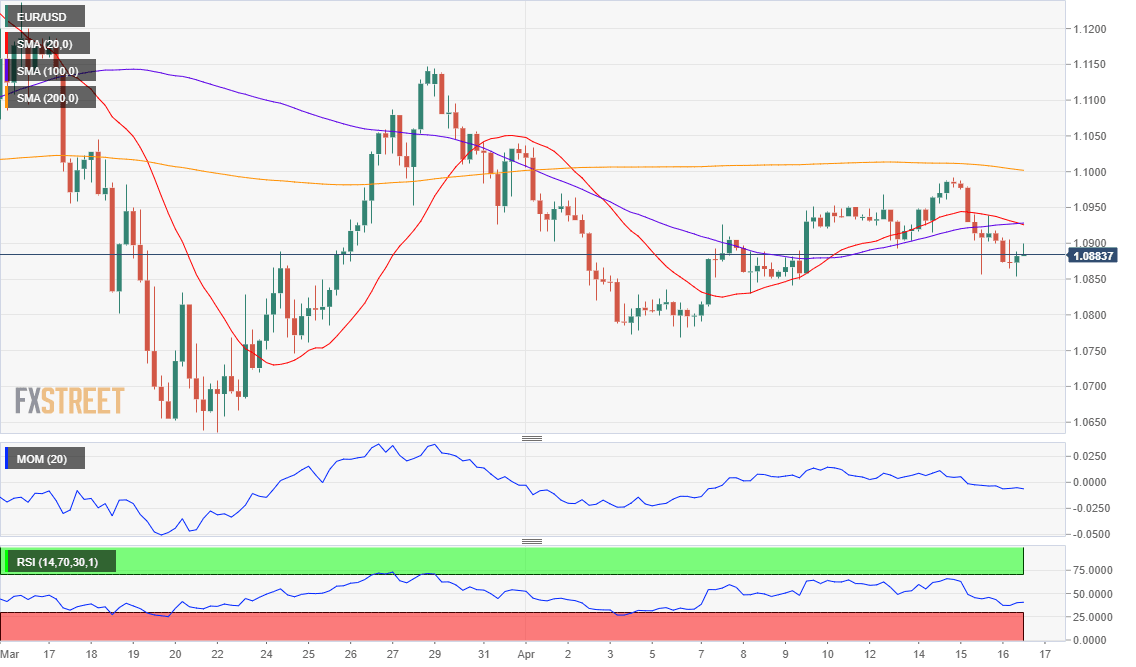

The EUR/USD pair is trading around 1.0890, the 50% retracement of its late March daily advance, unable to surpass the level. In the 4-hour chart, the risk remains skewed to the downside, as the pair is developing below all of its moving averages, while technical indicators remain within negative levels, with modest downward slopes. The main support is the 61.8% retracement of the same rally at 1.0835, with a steeper decline expected on a break below the level.

Support levels: 1.0835 1.0790 1.0750

Resistance levels: 1.0925 1.0960 1.1000

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.