EUR/USD Forecast: Daily close below 1.1200 could attract sellers

- EUR/USD trades in a tight channel near 1.1200 on Thursday.

- US Dollar could gather strength in case safe-haven flows dominate the markets in the American session.

- Investors will keep a close eye on weekly Initial Jobless claims data.

Following Wednesday's slide, EUR/USD stabilized slightly above 1.1200 in the European session on Thursday. The pair's technical outlook doesn't point to a buildup of bearish momentum but a daily close below 1.1200 could attract sellers.

The renewed US Dollar (USD) strength caused EUR/USD to stay under bearish pressure midweek. Meanwhile, European Central (ECB) Bank Governing Council member Yannis Stournaras said that the ECB could stop hiking rates after 25 basis points (bps) increase in July, putting additional weight on the Euro's shoulders.

Early Thursday, US stock index futures trade in negative territory as investors stay away from risk-sensitive assets after uninspiring earnings figures from big US tech firms. In case markets remain risk-averse in the second half of the day, the USD could continue to find demand and make it difficult for EUR/USD to gain traction.

The US economic docket will feature the weekly Initial Jobless Claims data, which is forecast to rise to 242,000 from 237,000 last week. A sharp increase in the number of first-time applications for unemployment benefits could cause the USD to weaken against its rivals.

EUR/USD Technical Analysis

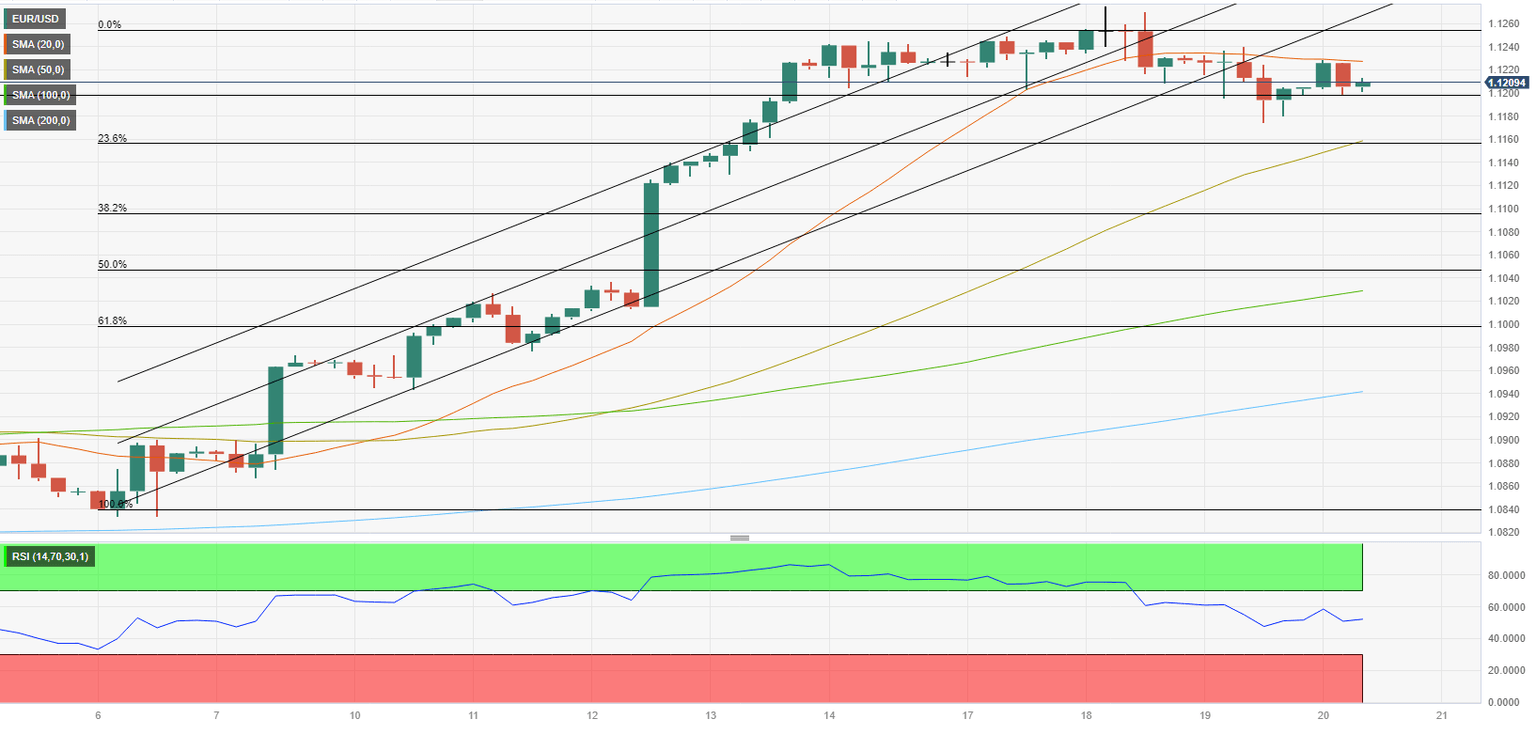

EUR/USD continues to trade below the lower limit of the ascending regression channel and the 20-period Simple Moving Average (SMA) on the 4-hour chart. The Relative Strength Index (RSI) indicator, however, moves sideways near 50, suggesting that the pair is yet to gather bearish momentum.

In case EUR/USD closes the day below 1.1200 (psychological level, static level) and confirms that level as resistance, additional losses toward 1.1160 (Fibonacci 23.6% retracement level of the latest uptrend, 50-period SMA) and 1.1100 (Fibonacci 38.2% retracement) could be seen.

On the upside, 1.1230 (20-period SMA) aligns as interim resistance before 1.1270 (static level from March 2022, multi-month high set on Tuesday, lower limit of the ascending channel) and 1.1300 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.