EUR/USD Forecast: Corrective advance before a new leg south

EUR/USD Current price: 1.0751

- German inflation eased from a year earlier in March, according to preliminary estimates.

- United States employment-related data and Fed speakers flooding the American session.

- EUR/USD bounced from 1.0724, a fresh one-month low, retains the bearish stance.

The EUR/USD pair bounced modestly from a fresh one-month low of 1.0724 posted in the European session, currently hovering around 1.0750 ahead of Wall Street’s opening. The US Dollar preserves its strength across the FX board but paused its rally ahead of United States (US) employment-related data and a batch of Federal Reserve (Fed) officials speakers.

The USD surged in thin trading on Monday as investors rushed to price in holiday news. On Friday, the US released the core Personal Consumption Expenditures (PCE) Price Index, which was confirmed at 2.8% YoY in February, matching January’s reading. Additionally, Fed Chairman Jerome Powell delivered some interesting comments on monetary policy, remarking that, with inflation still above target and the economy growing strongly, policymakers are in no rush to trim interest rates.

Demand for the USD escalated following the release of the ISM Manufacturing PMI, which unexpectedly surged to 50.3 in March after sixteen months in a row in contraction territory.

The European session has been quite busy in terms of data releases. The Hamburg Commercial Bank (HCOB) unveiled the final March Manufacturing PMIs for the Eurozone, which suffered modest upward revisions. The German index was confirmed at 41.9, while the EU final figure was 46.1. Despite the revisions, the index continued to indicate economic contraction.

Meanwhile, Germany published the preliminary estimate of the March Harmonized Index of Consumer Prices (HICP). Annualized inflation was 2.3% YoY, easing from 2.7% the previous month. The monthly gain was 0.6%, matching February’s reading.

The US will publish February Factory Orders and JOLTS Job Openings for the same month, while multiple Fed speakers will be on the wires.

EUR/USD short-term technical outlook

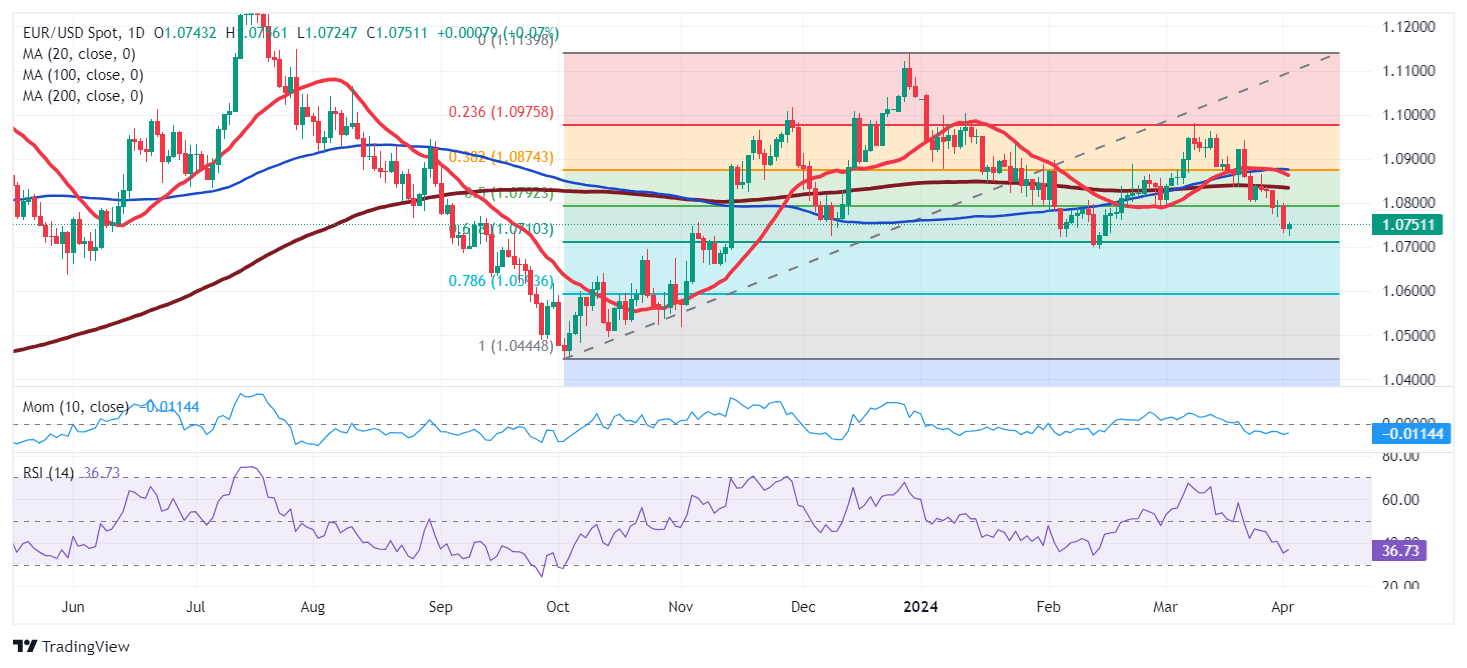

The EUR/USD pair is technically bearish according to the daily chart, as the pair posted a lower low and a lower high while trading around its opening level. The Momentum indicator maintains its sharply bearish slope well into negative territory, while the Relative Strength Index (RSI) indicator has lost its bearish momentum but consolidates at around 36. At the same time, EUR/USD extended its slide below all its moving averages, slowly gaining bearish strength. The main bearish target is 1.0694, February’s monthly low.

The near-term picture suggests that EUR/USD may correct higher before resuming its slide, although the risk skews to the downside. Technical indicators in the 4-hour chart have recovered from their recent lows and head firmly higher, although within negative levels. Finally, a sharply bearish 20 SMA caps the upside at around 1.0770 while developing well below the longer ones.

Support levels: 1.0725 1.0690 1.0645

Resistance levels: 1.0770 1.0805 1.0840

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.