EUR/USD Forecast: Coronavirus comeback may end abruptly in chaotic week, two critical caps

- EUR/USD has surged as coronavirus fears sent the dollar tumbling down.

- Strong economic indicators related to the disease are eyed.

- Early March's daily chart shows where this rally may end.

- The FX Poll is pointing to rises on all timeframes.

The coronavirus' spread around Europe sparked a major stock sell-off – that eventually benefited the euro. While it has a good reason behind it, this paradoxical move may find its limits.

This week in EUR/USD: Coronavirus carnage

When Northern Italy became the center of attention for coronavirus news – that is when stock markets began noticing. The eurozone's third-largest economy has reported hundreds of infections, over a dozen deaths – and locked down a zone in which 50,000 live, in the country's industrial heartland.

The disease quickly spread from Italy to other countries in Europe including Switzerland, Austria, and mainland Spain. Later on, the first confirmed case in Nigeria and the rising death toll in Iran triggered greater worries, as these countries' health systems are less capable of containing the disease. Apart from health headlines, downgraded economic forecasts also weighed on the mood.

Stock markets, led by the US, began tumbling down. Investors began repricing growth forecasts and fearing a recession. Money flowed from equities to bonds, pushing yields lower. The benchmark ten-year Treasury yield collapsed to record lows under 1.20% the short end of the curve moved from signaling a rate cut in September to an imminent reduction of borrowing costs in the upcoming meeting in March.

Federal Reserve officials conveyed a message that they are monitoring the situation but have refrained from offering new stimulus measures. Nevertheless, the dollar tumbled down in response to these moves.

EUR/USD advanced from below 1.09 to above 1.10, driven by the greenback's weakness but was unable to hold its ground.

On the other side of the pond, the European Central Bank is no rush – and probably unable – to act. ECB President Christine Lagarde seemed reluctant to act. The ECB's deposit rate is at -0.50% and it already buys €20 billion per month. Compared to the Fed, the Frankfurt-based institution's ability to act is limited. Vitas Vasiliauskas suggested that the Governing Council may convene in an extraordinary manner, but added that there is little score for action.

The common currency was also temporarily supported by hopes of German economic stimulus. Olaf Scholz, the center-left finance minister, suggested suspending debt-rules for local governments – allowing them to open their purse strings. However, the official position of the government has not changed and Chancellor Angela Merkel's CDU party opposes any deficit expenditure.

Economic figures were mixed. The German IFO Business Climate beat expectations with 96.1 points in February, not fully reflecting the virus impact. Germany confirmed zero growth in the fourth quarter of 2019.

In the US, the economy's Q4 expansion of 2.1% annualized was also confirmed, while statistics fro January mostly beat expectations. New Home Sales beat with 764,000 annualized and Durable Goods Orders beat expectations, indicating a pick up in strength.

Overall, the US economy was better positioned than the eurozone one before the coronavirus crisis became dominant.

Eurozone events: Stimulus talk, Final PMIs, and more

The ongoing health crisis is set to dominate headlines day and night. The internal debate within the German government – and external pressure – about spending its reserves will likely rage. Moreover, the ECB may issue extraordinary statements given the exceptional situation.

It is hard to see how long politicians in the old continent will refrain from taking significant economic steps – and not only health measures. Any aid program has room to boost the euro, while ongoing reluctance to do so may weigh on the common currency.

The economic calendar features the final Purchasing Manager's Indexes for Germany and the eurozone for February. While Markit's figures tend to have a more substantial impact on their preliminary release, the updated statistics may consist of downgrades. The market mood severely deteriorated toward the end of February.

Later in the week, retail sales figures are set to show increases in Germany and the whole eurozone. Consumption has been preventing an outright contraction so far, and data for January – before the outbreak – is likely positive.

Last but not least, Friday's German Industrial Production and Factory Orders figures will probably rock the euro. The statistics for January follow devastating drops in December – releases that sent the euro plunging. Has the German manufacturing sector recovered in early 2020, before the virus infected the headlines? If another downfall is reported, the common currency could come under pressure.

Here are the events lined up in the eurozone on the forex calendar:

US events: Coronavirus indicators, NFP, Super Tuesday

Will America begin reporting a massive increase in cases? The CDC's ramping up of tests – and cases of unknown origin – suggest confirmed infections may surge. Markets are set to respond not only to health headlines but also to the cancelation of events and profit warnings from firms.

Apple's warning in mid-February – which came before the market rout – was probably only the firing shot. Further downgrades and gloomy statements may trigger harsher responses.

The first week of the month is always busy. In this case, it is an exceptionally significant one as Purchasing Managers' Indexes will shed light on business sentiment in the wake of the crisis. Chinese PMIs for February – both official and independent, will provide updated information investor confidence in the world's second-largest economy – and the epicenter of the disease.

The figures are published over the weekend and early on Monday. Economists expect significant falls with the manufacturing sector to drop to the contractionary territory.

See Chinese PMIs preview: Coronavirus-related plunge must be deep to push markets lower

Data from the US – the world's largest economy – are due out already on Monday. The Manufacturing PMI is of interest due to complicated supply chains and also as the first hint towards the Non-Farm Payrolls.

On Tuesday, politics steal the spotlight for a short time as Democrats vote in "Super Tuesday" 0 14 state contests, which may shape the nomination of their candidate. Left-leaning Senator Bernie Sanders is in the lead, and if he consolidates it, investors may worry. On the moderate side, Vice President Joe Biden and Micahel Bloomberg, a businessman, would better suit financial markets.

See US Super Tuesday Presidential Primaries March 3: It's all about the delegates

ADP\s private-sector jobs report will help shape expectations for Friday's official labor market report, and a moderate increase is expected after a robust increase beforehand. The ISM Non-Manufacturing PMI will be closely watched for three reasons: another hint toward the jobs report, the impact of coronavirus on investors, and after Markit's figure showed contraction.

ISM tends to outweigh Markit when it comes to American PMIs, but the latter's score of 49.4 – reflecting contraction in the sector that drove the economy forward – adds to concerns.

Friday's Non-Farm Payrolls report is forecast to show a healthy increase of nearly 200,000 positions after a robust rise of 225,000 in January. Economists expect annual wage growth to hold above 3%. If the market mood remains sour, an unimpressive NFP could convince the Federal Reserve to cut rates on March 18.

For a full guide to the tumultuous first week of March, see March Madness: 5 critical (mostly) coronavirus-linked events to rock markets in the first week of March

Here are the scheduled events in the US:

EUR/USD Technical Analysis – Two confluences

Euro/dollar has made an impressive recovery bounce from the lows of 1.0777, where the Relative Strength Index on the daily chart was below 30 – indicating oversold conditions. The recent rise has lifted momentum – yet it still leans to the downside. EUR/USD temporarily topped the 50-day Simple Moving Average but was rejected at the 100-day SMA.

All in all bears still have an advantage despite the recovery.

Support awaits at 1.0985, a low point in December. The former double-bottom from September, at 1.0940, is more significant. The 2019 low of 1.0879 is next, and it is followed by 1.0820, which temporarily held the currency pair down in February. Finally, 1.0777 is the 2020 low.

Resistance awaits at 1.1050, the late February high which also converges with the 100-day SMA. The round level of 1.11 also held the pair down in January and converges with the 200-day SMA.

The next cap at 1.1175 is also a confluence line – of the long-term downtrend support running from early 2019 and a stubborn resistance line in October last year and January 2020. The next levels to watch are 1.1250 and 1.1285.

EUR/USD Sentiment

The world's most popular currency pair may have reached the limits of its recovery as its underlying economic weakness, dependence on China and reluctance to act all weigh on it. The virus-related dollar weakness may be substituted for safe-haven flows. All in all, EUR/USD has more room to the downside than to the upside.

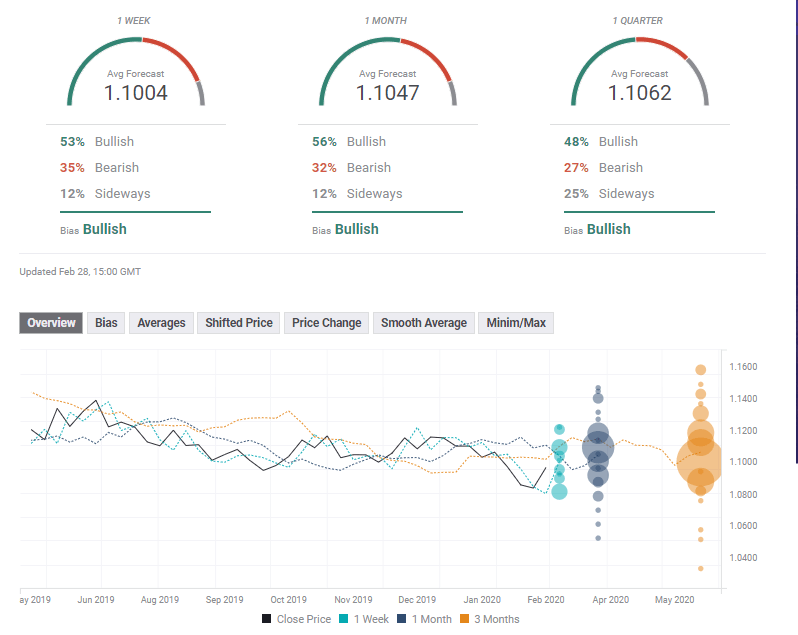

The FXStreet Poll is pointing to a bounce back to above 1.10 in all time frames. On average, experts have upgraded their targets and foresee Friday's dip as temporary.

Related Forecasts

- GBP/USD Forecast: Potential upside from Brexit talks competes with coronavirus concerns

- Gold Price Forecast: Panic leads to speculation of a US Fed rate cut

- EUR/USD Price Forecast 2020: Lean times soon to turn into flush times for euro dollar

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.