EUR/USD Forecast: Buyers take control, aim to conquer 1.0900

EUR/USD Current price: 1.0875

- The ECB Consumer Expectations Survey showed consumers expect inflation to ease modestly.

- Federal Reserve speakers flood the news wires, inflation concerns weigh on the USD.

- EUR/USD bullish potential increased, but 1.0900 still in the way.

The EUR/USD pair trades at the upper end of its latest range, still lacking directional momentum but afloat amid broad disinterest in the US Dollar. The pair hovers around 1.0880 ahead of Wall Street's opening despite the sour tone of Asian and European indexes, usually a sign of a tepid market mood.

The European macroeconomic calendar included the European Central Bank’s (ECB) monthly Consumer Expectations Survey, which showed inflation expectations among consumers for the next twelve months declined to 2.9% from 3.0% in March. The figure is the lowest since September 2021, although consumers expect inflation to remain above the central bank's 2% goal in the next three years. The news did not impact the Euro, as market players had long ago priced in a rate cut for next June. Also, Germany released the April Wholesale Price Index, which rose by 0.4% MoM, higher than the 0.1% expected.

The American session will bring the United States (US) the Housing Price Index for March and the Conference Board's Consumer Confidence Index, foreseen at 96.0 in May after posting 97.0 in April. Finally, the country will publish May's Dallas Fed Manufacturing Business Index.

Meanwhile, Federal Reserve (Fed) officials keep commenting on monetary policy. During Asian trading hours, Governor Michelle Bownan said she would have supported either waiting to slow the quantitative tightening pace or a more tapered slowing in balance sheet run-off. Mid-European session, Minneapolis Fed's President Neel Kashkari said the US economy has remained remarkably resilient and that he does not see a need to hurry to cut rates. He added that policymakers should not rule anything out on the monetary policy path and that he would prefer to see more months of positive inflation data before a rate cut. Mary Daly and Lisa Cook will hit the wires later in the day.

EUR/USD short-term technical outlook

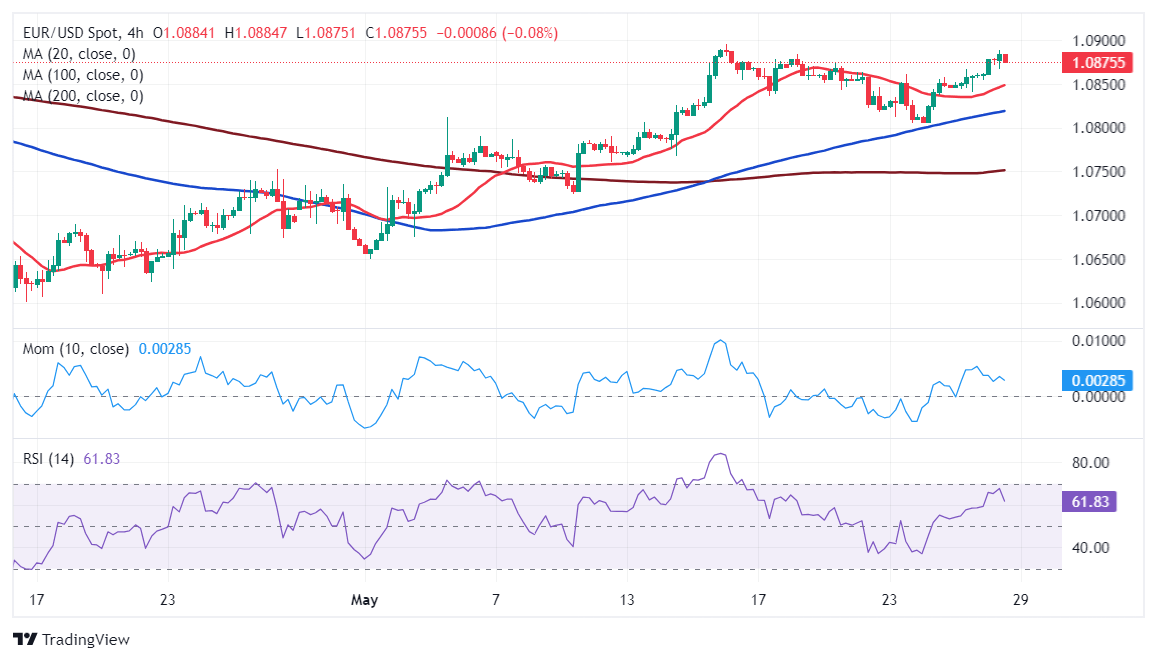

From a technical point of view, the EUR/USD pair is poised to extend its advance. The daily chart shows EUR/USD developing above all its moving averages. The 20 Simple Moving Average (SMA) heads firmly north above a flat 200 SMA and is about to cross above an also directionless 100 SMA. Technical indicators, in the meantime, extend their advances within positive levels, reflecting persistent buying pressure.

The 4-hour chart shows that technical indicators are approaching overbought readings, in line with the ongoing bullish momentum. The 20 SMA heads firmly north below the current level and above the longer ones, with the shorter one providing support at around 1.0850. Stronger positive momentum could come with the pair breaking through 1.0910, a strong static resistance level.

Support levels: 1.0850 1.0815 1.0780

Resistance levels: 1.0910 1.0960 1.1000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.