EUR/USD Forecast: Buyers hesitate despite tepid US employment figures

EUR/USD Current price: 1.1094

- Mixed European macroeconomic figures failed to boost the Euro.

- Tepid United States employment-related data put the US Dollar under selling pressure.

- EUR/USD battles to extend gains beyond the 1.1100 mark, upward momentum limited.

The EUR/USD pair regained the 1.1100 threshold during European trading hours but struggled to extend gains beyond the level ahead of United States (US) employment-related figures. The pair peaked at 1.1118 after data came in worse-than-anticipated, as the ADP report showed the private sector added 99,000 new job positions in August, well below the 145,000 anticipated.

At the same time, the Challenger Job Cuts report showed that layoffs in August soared to 75,891, the highest monthly reading in fifteen years, while year-to-date hiring reached a historic low. Finally, Initial Jobless Claims in the week ended August 30 hit 227K, below the 230K expected and the previous 232K.

The figures further supported the case of a Federal Reserve (Fed) interest rate cut in the upcoming meeting, as it confirms the labor market has cooled enough to loosen the monetary policy.

European data released earlier in the day was mixed, as German factory Orders rose by 2.9% in July, better than the -1.5% anticipated. On a yearly basis, orders increased by 3.7%, following the -11.2% posted in June. However, the Eurozone reported that Retail Sales were up by just 0.1% MoM in July, and that also fell by 0.1% compared to a year earlier.

Data will remain under the spotlight, as the US will publish the August ISM Purchasing Managers Index (PMI) after Wall Street’s opening. The index is expected at 51.1, below the 51.4 posted in July.

EUR/USD short-term technical outlook

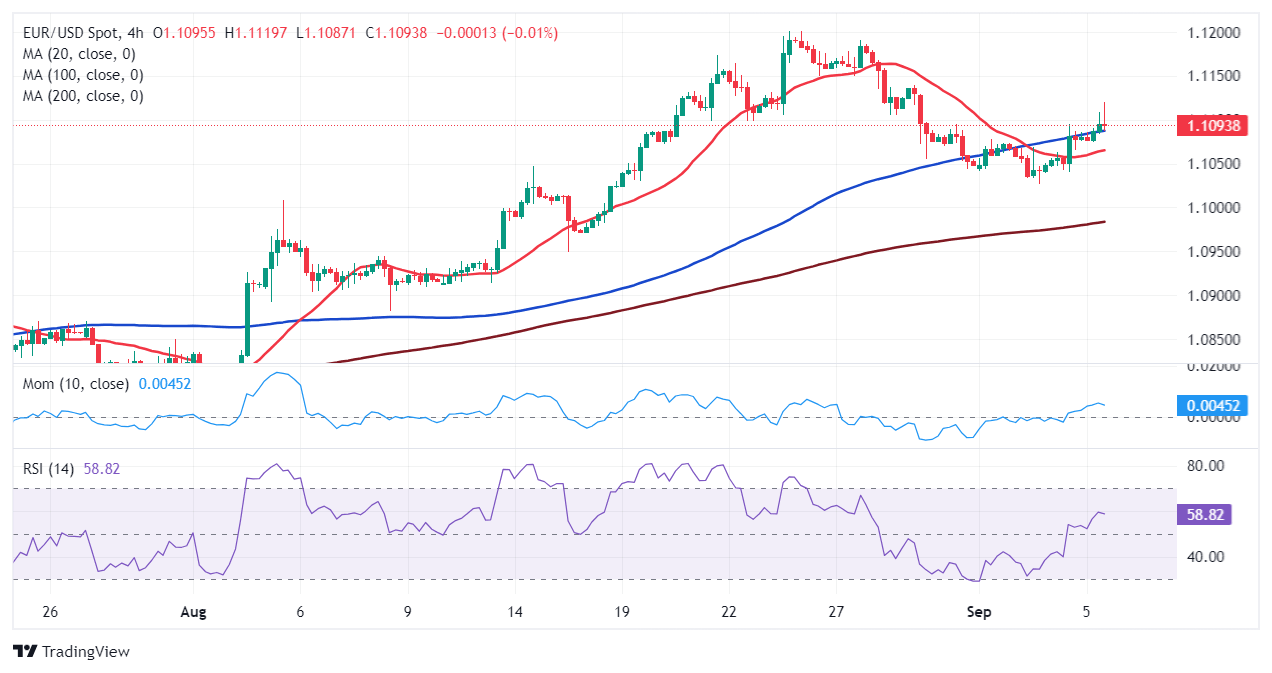

The EUR/USD pair currently trades at around 1.1090, and the daily chart shows it holds to modest intraday gains. The bullish potential, however, seems limited as technical indicators are neutral-to-bearish within positive levels. At the same time, the 20 Simple Moving Average (SMA) regained its bullish stance just below the current level, providing near-term support at around 1.1070. Finally, the 100 and 200 SMAs converge at around 1.0850 with modest upward slopes.

In the near term, and according to the 4-hour chart, the pair is neutral-to-bullish. EUR/USD is currently developing above all its moving averages, with a modestly bullish 100 SMA acting as near-term support. Technical indicators, however, have lost their upward strength and flipped lower, although are still holding within positive levels, limiting the bearish scope.

Support levels: 1.1065 1.1020 1.0975

Resistance levels: 1.1115 1.1150 1.1185

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.