EUR/USD Forecast: Bulls on pause but still in control

EUR/USD Current Price: 1.0611

- An upbeat German IFO survey lifted the market mood and helped the EUR.

- US Treasury yields advance ahead of the opening, helping the US Dollar.

- EUR/USD holds above 1.0600 without clear directional strength in the near term.

The EUR/USD pair hovers around the 1.0600 level, barely up in a slow start to a slow week. Market players started the week with optimism, although this sentiment hardly reached the FX board. On the one hand, some private technology-related companies announced they would resume activity in China after strict covid-related measures forced closures earlier in the year.

Additionally, European data beat expectations while hinting at easing risks of a recession in the EU. The German IFO Survey on Business Climate improved to 88.6, while Expectations rose to 83.2. Finally, the assessment of the current situation improved to 94.4, beating the market expectations. The EUR/USD pair jumped to 1.0657 with the news but was unable to retain its gains.

The US Dollar advances ahead of the American opening, helped by raising Treasury yields. The 10-year note currently yields 3.52%, while the 2-year note offers 4.18%, barely up on the day. The US macroeconomic calendar has nothing relevant to offer today, with some interesting figures scheduled for the end of the week.

EUR/USD short-term technical outlook

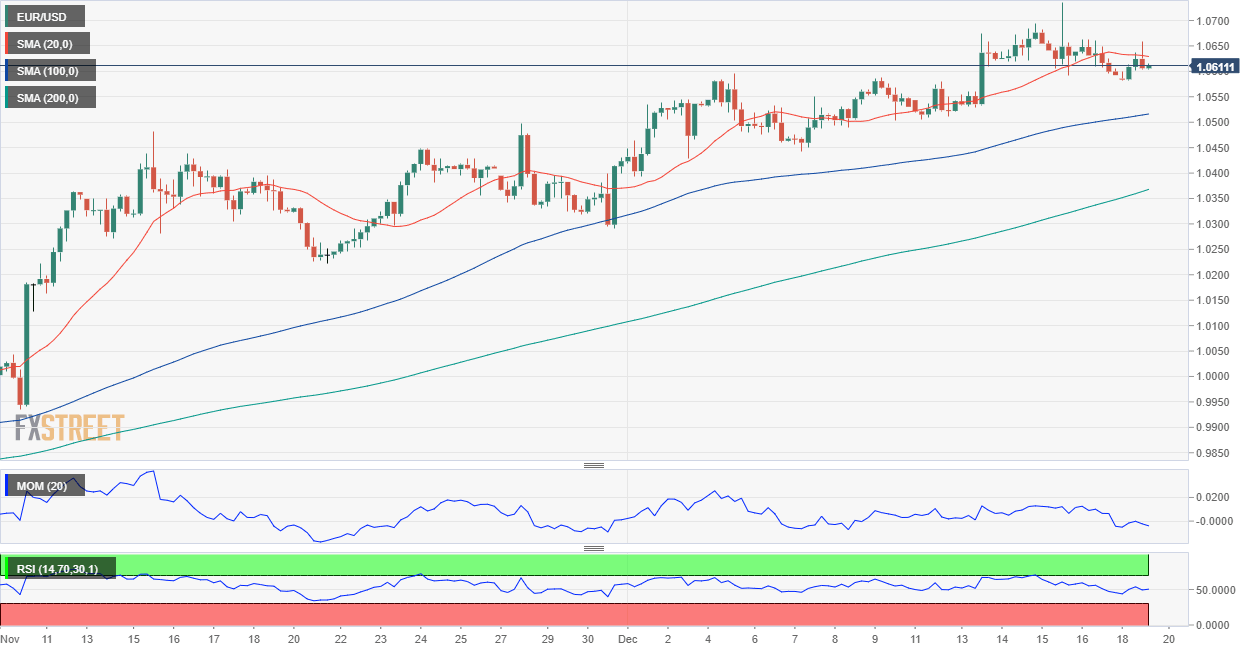

The daily chart for the EUR/USD pair shows that bulls retain control, despite currently being sidelined. The pair develops above all its moving averages, with the 20 SMA heading north at around 1.0495. Technical indicators, in the meantime, lack directional strength but remain well above their midlines without signs of upward exhaustion.

In the near term, and according to the 4-hour chart, EUR/USD offers a neutral stance. The pair is trading just below a flat 20 SMA, although the longer moving averages maintain their upward slopes below the current level. At the same time, technical indicators remain directionless at around their midlines. The pair could shed some ground on a break below 1.0580, the immediate support level, but a relevant slide is out of the picture for now.

Support levels: 1.0580 1.0535 1.0480

Resistance levels: 1.0650 1.0695 1.0740

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.