EUR/USD Forecast: Bulls move to the sidelines ahead of US CPI

EUR/USD Current Price: 1.0946

- Concerns about a potential global recession undermine the market mood at the beginning of the week.

- Market players await the United States Consumer Price Index for clues on future monetary policy.

- EUR/USD loses its bullish strength but trades at the upper end of last week's range.

The EUR/USD pair consolidates last week's gains, trading at around 1.0950 after peaking at 1.0972 on Friday. The US Dollar gains uneven traction across the FX board as investors turned cautious ahead of first-tier events later this week. The main focus is the United States (US) Consumer Price Index (CPI). Inflation is expected to have eased to 3.1% YoY in June from 4% in May. The monthly increase, however, is foreseen up by 0.3%, following 0.1% in the previous month. Finally, the core annual reading is forecast at 5%, also decreasing compared with the previous month.

The market sentiment soured at the beginning of the day following tepid Chinese data and mounting concerns over Beijing's decision to limit exports of metals. China reported that the annual CPI stood unchanged in June, while the Producer Price Index (PPI) declined 5.4% YoY in the same month. Also, persistent monetary tightening from major central banks fueled fears of a global recession. US CPI figures may bring some relief this week, particularly if the numbers come below expectations.

Meanwhile, the Euro lost momentum following the release of the Eurozone Sentix Investors Confidence indicator, which contracted to -22.5 in July from -17 in June. The US will release May Wholesale Inventories, while a few Federal Reserve (Fed) speakers will hit the wires.

EUR/USD short-term technical outlook

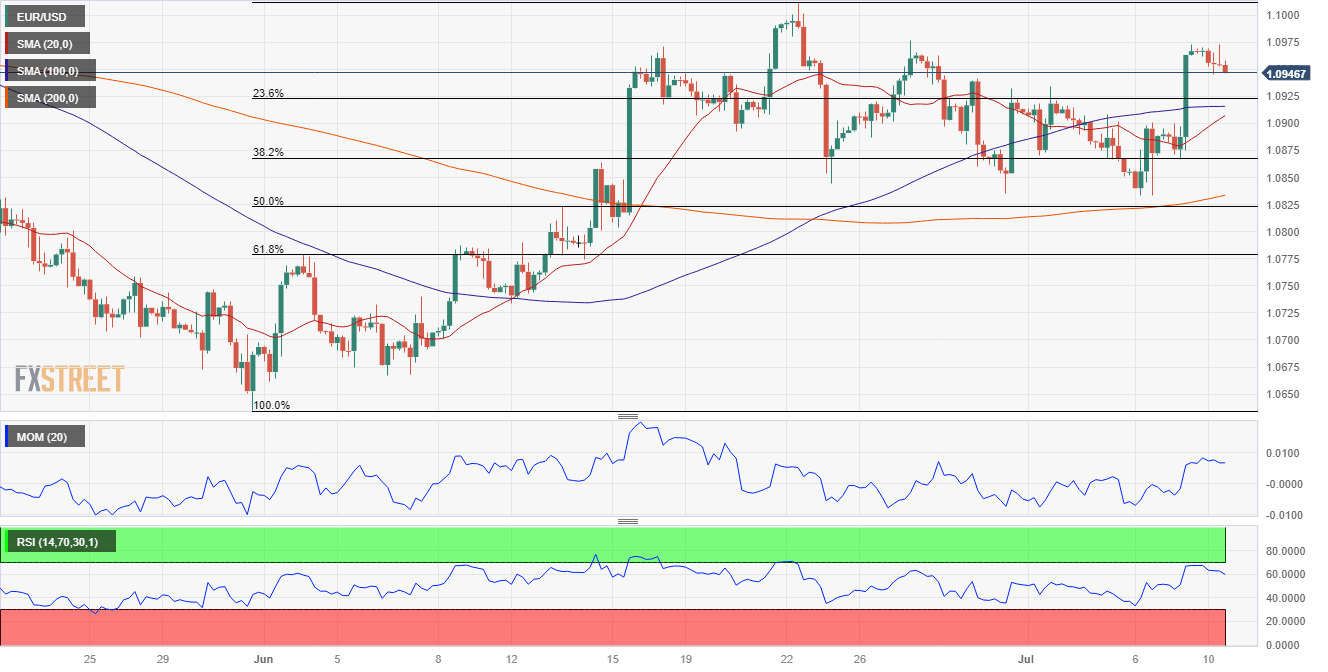

The daily chart for the EUR/USD pair offers a neutral-to-bullish stance. The pair trades above its moving averages, with the 20-day Simple Moving Average (SMA) gaining bullish traction above the longer ones while below the current level. Technical indicators, in the meantime, have lost their upward strength and consolidate just above their midlines. On a positive note, the pair develops above the 23.6% Fibonacci retracement of its latest bullish run at 1.0920, an immediate support level.

In the near term, and according to the 4-hour chart, bulls retain control. Technical indicators are barely retreating from overbought readings but remain well above their midlines. At the same time, moving averages remain well below the current level, with the 20-period SMA gaining upward strength below a flat 100-period SMA. Renewed buying interest above 1.0970 should give buyers enough confidence to push the pair beyond the 1.1000 threshold.

Support levels: 1.0920 1.0870 1.0820

Resistance levels: 1.0970 1.1015 1.1050

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.