EUR/USD Forecast: Bulls maintain the pressure as the mood improves

EUR/USD Current price: 1.0840

- The surprise outcome of the French elections brought relief to financial markets.

- The United States will publish the June Consumer Price Index this week.

- EUR/USD pressures July high, faces strong resistance at around 1.0850.

A better market mood weighs on safe-haven assets at the beginning of the week, resulting in the US Dollar shedding ground against its European rivals. The EUR/USD pair reached a fresh July high of 1.0842, holding nearby ahead of Wall Street’s opening. Market participants recovered their optimism following the United States (US) Nonfarm Payrolls (NFP) report published last Friday, which showed the country added 206K new jobs in June, but also that the Unemployment Rate ticked higher to 4.1%, while wage-related inflation eased.

Speculative interest breathed after French elections showed no conclusive result but kept the far right away from the leadership. A left-wing alliance won the second round of the snap election, while Marine Le Pen’s far-right party came in third.

European data kept the EUR/USD in check, as the Eurozone Sentix Investor Confidence Index unexpectedly fell to -7.3 in July from 0.3 in June. On a positive note, Germany reported a Trade Balance superavit of €24.9 billion in May, better than anticipated. The American session will bring short-term bill auctions and May Consumer Credit Change. Later in the week, the country will publish the June Consumer Price Index (CPI).

EUR/USD short-term technical outlook

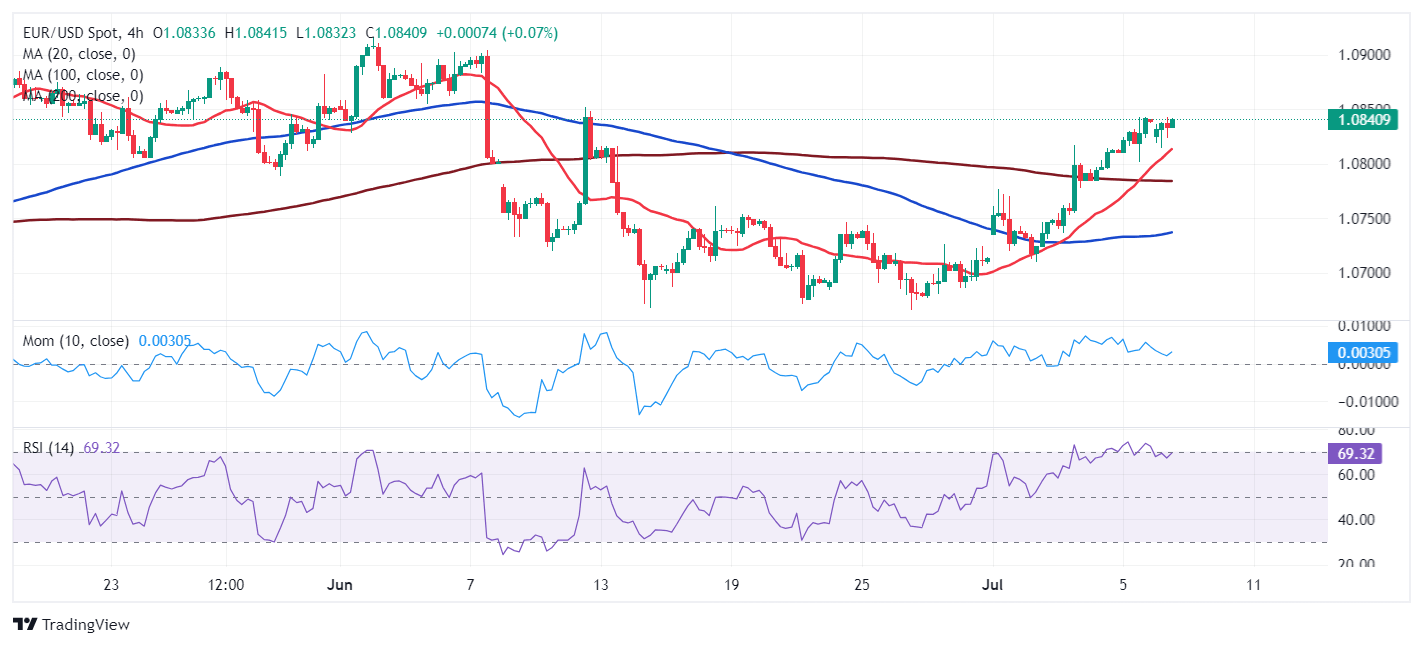

The daily chart for the EUR/USD pair shows it found intraday support above the converging 100 and 200 Simple Moving Averages (SMAs), providing support at around 1.0790. The 20 SMA, in the meantime, lost its directional strength and turned flat below the longer ones. Finally, technical indicators have turned flat within positive levels but show no signs of giving up.

In the near term, and according to the 4-hour chart, a bullish 20 SMA attracted buyers during Asian trading hours while it extends its bullish slope above the longer ones. Technical indicators, in the meantime, resume their advance within positive levels and following a corrective slide, in line with persistent buying interest.

Support levels: 1.0790 1.0740 1.0700

Resistance levels: 1.0850 1.0880 1.0930

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.