EUR/USD Forecast: Bulls looking to conquer the 1.1100 mark

EUR/USD Current price: 1.1083

- The persistent upbeat mood maintains the US Dollar under strong selling pressure.

- Financial markets welcome stable macroeconomic data and an upcoming rate cut.

- EUR/USD is technically overbought but can reach higher highs in the near term.

The EUR/USD pair keeps reaching fresh 2024 highs, approaching the 1.1100 mark during European trading hours. An upbeat mood and the market’s conviction that the Federal Reserve (Fed) will pull the trigger in September put pressure on the US Dollar. As the date looms, global equities accelerate its momentum, with Asian and European indexes posting substantial gains, reflecting the optimistic sentiment.

Meanwhile, Germany released the July Producer Price Index (PPI), which rose 0.2% MoM while declining by 0.8% from a year earlier, in line with the market’s expectations. Additionally, the Eurozone confirmed that the Harmonized Index of Consumer Prices (HICP) rose 2.9% YoY in July. Finally, the EU reported that the June Current Account posted a seasonally adjusted surplus of €51 billion. The figures had no impact on the Euro.

The American session will bring no United States (US) data, although some Fed members will be on the wires. Should they pave the way for a September interest rate cut, the most likely outcome is additional USD weakness.

EUR/USD short-term technical outlook

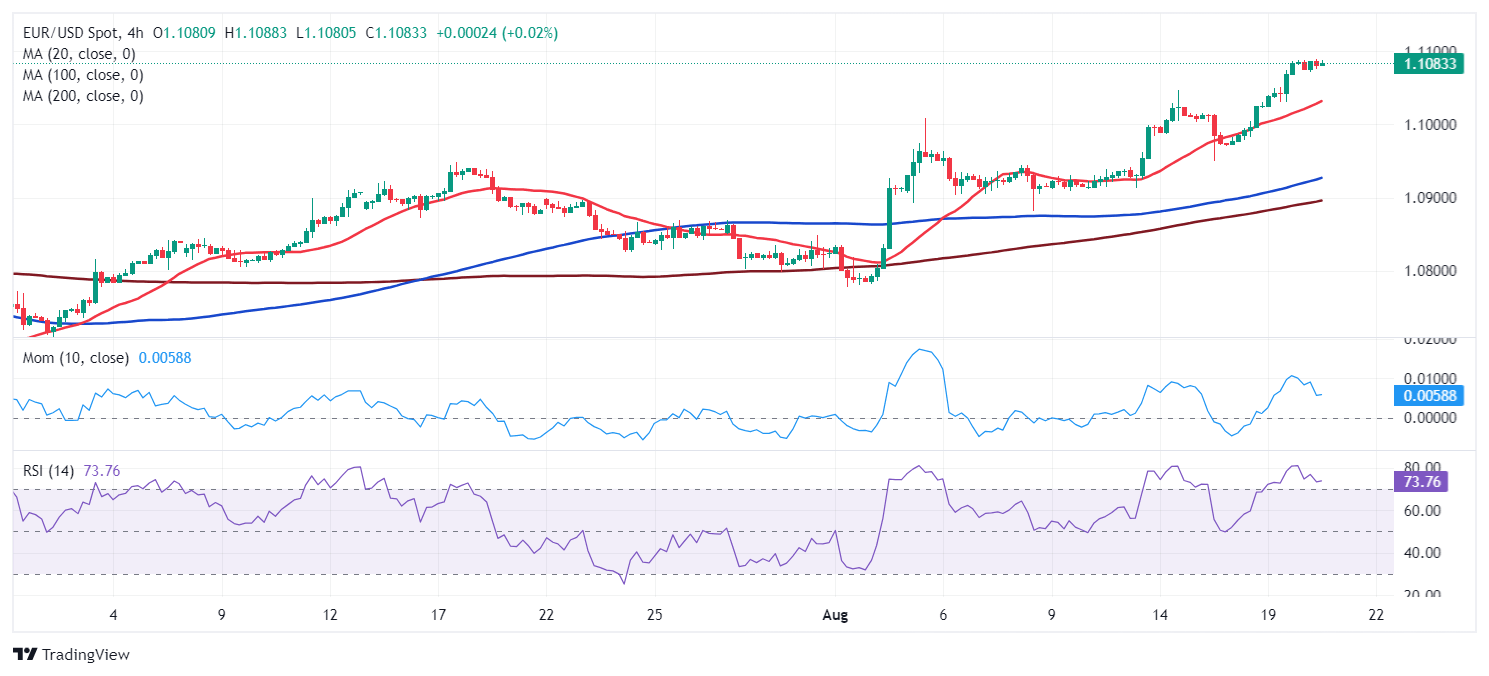

From a technical point of view, EUR/USD bullish route seems poise to continue. The daily chart shows that the pair extends its advance beyond all its moving averages, with the 20 Simple Moving Average (SMA) heading north almost vertically far below the current level while above the longer ones. Technical indicators, in the meantime, have lost their directional momentum and consolidate within overbought levels, not giving any other sign of upward exhaustion.

The 4-hour chart shows bulls maintain the pressure in the near term. The Relative Strength Index (RSI) indicator aims marginally higher at around 75, while the Momentum indicator consolidates as the pair hovers below its intraday high. Still, moving averages are clearly bullish, well below the current level, in line with buyers' continued pressure.

Support levels: 1.1050 1.1020 1.0985

Resistance levels: 1.1090 1.1120 1.1160

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.