EUR/USD Forecast: Bulls hold the grip in a slow start to the week

EUR/USD Current Price: 1.0923

- European Central Bank policymakers signal additional interest-rate hikes.

- Markets in the United States will be closed Monday due to the Juneteenth holiday.

- EUR/USD corrects extreme overbought conditions, but remains on a bullish path.

The EUR/USD pair is under mild selling pressure on Monday, easing from the 1.0970 multi-week high posted on Friday, to trade near the 1.0900 level. The US Dollar entered a sell-off spiral following softer-than-anticipated United States (US) inflation-related figures and the Federal Reserve's (Fed) hawkish pause. Financial markets turned optimistic amid speculation the US will avoid a recession. Stocks rallied, while the safe-haven Greenback came out of investors' radar.

At the same time, the European Central Bank (ECB) hiked its benchmark interest rates while anticipating additional increases in the docket. The news was not a surprise but helped the Euro on its way up.

On Monday, ECB's Member of the Executive Board Philip R. Lane said another hike in July seems appropriate, while September's decision will depend on data. He sounded confident as he said inflation would come down fairly quickly to the central bank's 2% target. Meanwhile, another ECB Member of the Executive Board, Isabel Schnabel, expressed concerns about the central bank underestimating inflation, adding the path in raising interest rates should have been steeper.

The macroeconomic calendar has nothing relevant to offer for the rest of the day, while US markets will be closed amid the Juneteenth holiday, anticipating quiet consolidation across the FX board.

EUR/USD short-term technical outlook

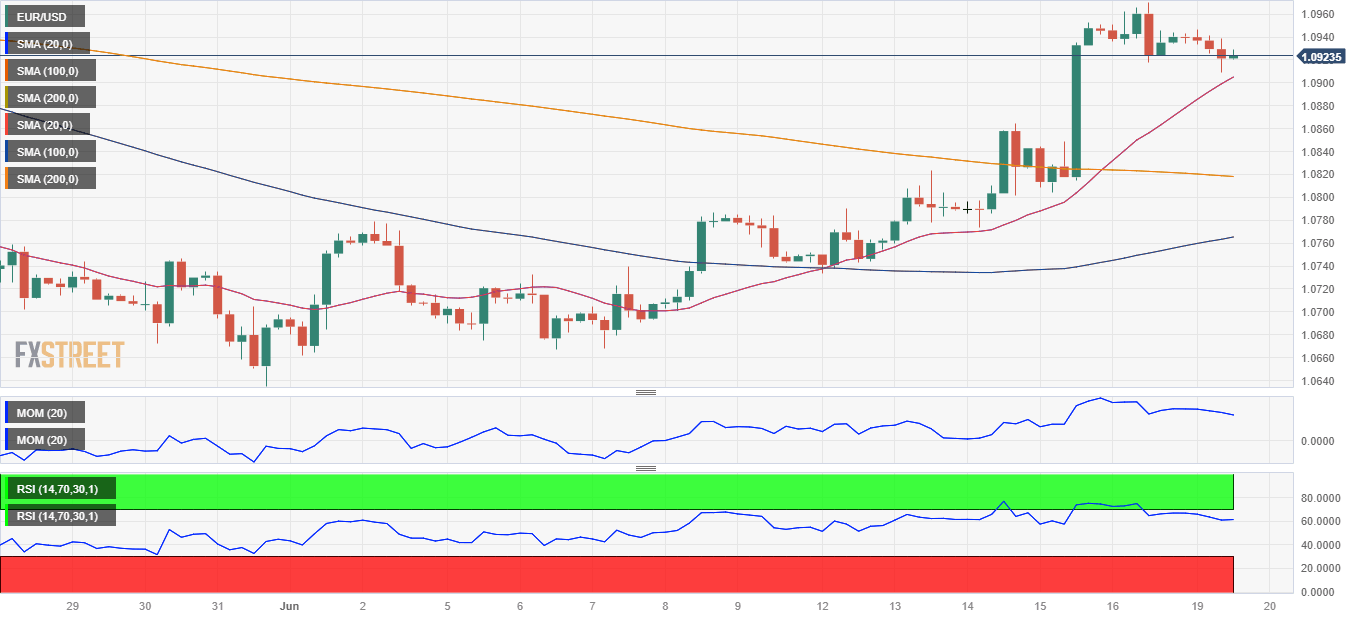

The EUR/USD pair consolidates last week's gains and retains its bullish potential. The daily chart shows it develops well above its moving averages, although the 20-day Simple Moving Average (SMA) is losing its upward strength below a flat 100-day SMA. At the same time, technical indicators have turned marginally lower but remain well above their midlines, reflecting the absence of solid selling interest.

In the near term, and according to the 4-hour chart, the risk is still skewed to the upside. The pair trades in the 1.0920 region, meeting buyers earlier in the day a handful of pips above a bullish 20-SMA, which heads firmly north above the longer ones. The Momentum indicator resumed its advance well into positive territory and after correcting extreme overbought conditions, while the Relative Strength Index (RSI) indicator corrects extreme readings, heading marginally lower at around 62.

Support levels: 1.0890 1.0850 1.0810

Resistance levels: 1.0945 1.0995 1.1040

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.