EUR/USD Forecast: Bulls give it another try

EUR/USD Current price: 1.0719

- Upbeat United States data fueled market’s optimism and pushed the USD lower.

- European Economic Sentiment contracted in June to 95.9, also missing expectations.

- EUR/USD en route to extend its recovery, critical resistance at 1.0750.

The EUR/USD pair recovered the 1.0700 mark and trimmed its Wednesday losses when it bottomed at 1.0665. Demand for the US Dollar lost steam throughout the first half of the day despite the market mood remaining sour. Asian and European indexes edged lower following Wall Street's poor performance, unable to take advantage of the tech sector recovery and limiting USD intraday weakness. The Greenback, however, accelerated its slump after the release of generally encouraging United States (US) figures.

Earlier in the day, the Eurozone published the June Economic Sentiment Indicator, which contracted to 95.9 from 96 in May, missing expectations of 96.2, which failed to trigger an EUR/USD reaction.

US data, on the contrary, spurred optimism. On the one hand, Durable Goods Orders were up 0.1% MoM, better than the -0.1% expected. On the other hand, the US confirmed the Gross Domestic Product (GDP) to be at 1.4% as expected, slightly above the previous estimate of 1.3%. At the same time, the country reported that Initial Jobless Claims for the week ended June 21 at 233K, better than the 236K expected. The US will later release May Pending Home Sales and the June Kansas Fed Manufacturing Activity Index.

EUR/USD short-term technical outlook

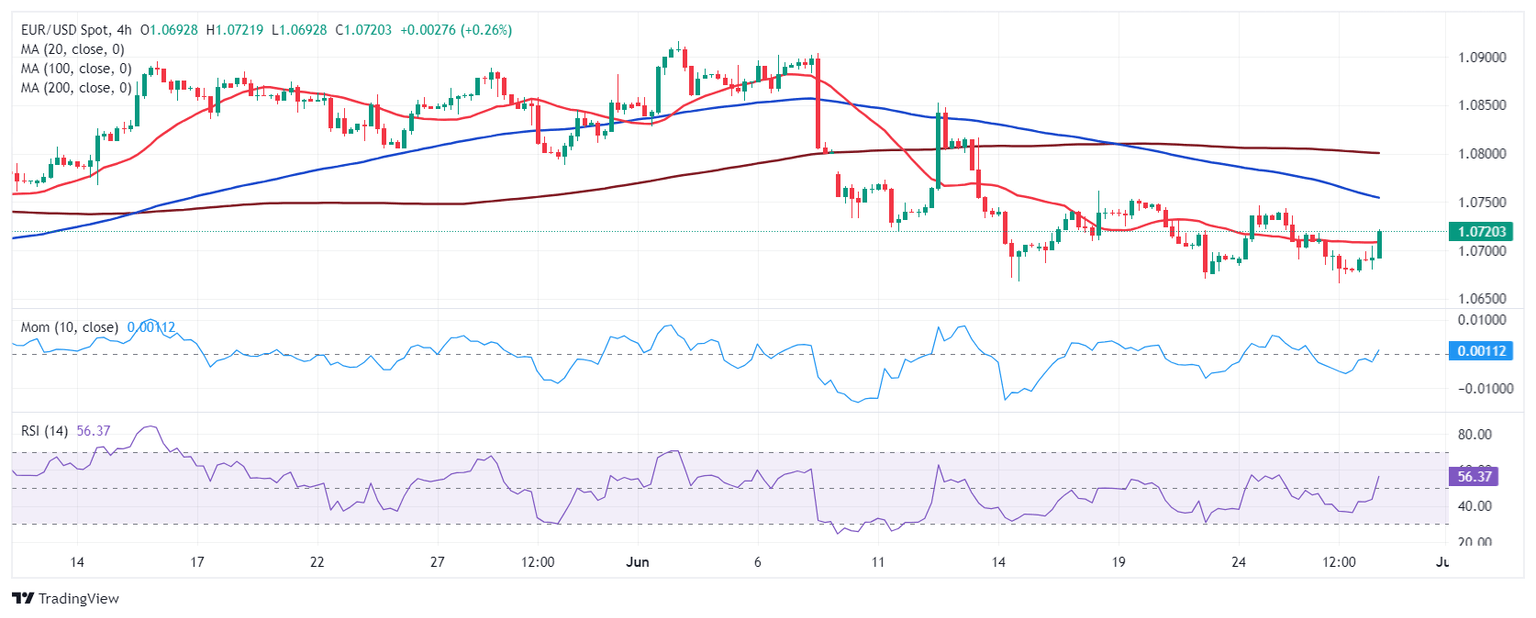

The EUR/USD pair hovers around 1.0720, and although the bearish momentum has receded, it is still at risk of falling. In the daily chart, the pair keeps trading below all its moving averages, with the 20 Simple Moving Average (SMA) heading firmly south below directionless 100 and 200 SMAs. Technical indicators, however, aim higher but remain within negative levels, somehow limiting the bullish scope.

The 4-hour chart offers a similar picture. Technical indicators head firmly higher, although the Momentum indicator remains below its 100 line. The Relative Strength Index (RSI) indicator, on the contrary, stands at 55, suggesting the pair may extend its near-term gains. At the same time, the current candle reflects strong buying interest, pushing EUR/USD above a flat 20 SMA, also supporting additional gains. Finally, a bearish 100 SMA provides dynamic resistance in the 1.0750 price zone. A clear break above the latter should support steady gains in the upcoming sessions.

Support levels: 1.0665 1.0620 1.0580

Resistance levels: 1.0750 1.0800 1.0845

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.