EUR/USD Forecast: Bulls fighting to conquer the 1.0800 threshold

EUR/USD Current price: 1.0803

- German upbeat data fell short of boosting the Euro.

- Hotter than anticipated, US inflation figures hit the Greenback.

- EUR/USD gains upward traction and could finally exhibit directional strength.

The EUR/USD pair keeps trading lifeless, although it has managed to marginally uplift the range. The pair hovered around 1.0800 throughout the first half of the day, with sellers rejecting advances around 1.0810 with limited conviction. Inflation takes centre stage this week, as Germany confirmed the Harmonized Index of Consumer Prices (HICP) at 2.4% YoY in April, as previously estimated.

The country also released the May ZEW Survey, which showed Economic Sentiment improved more than anticipated, to 47.1 from 42.9. Sentiment in the Eurozone also resulted upbeat, with the index hitting 47. Finally, the assessment of the Current Situation improved to -72.3, beating the 75 anticipated. None of such news, however, were enough to boost the Euro.

On the contrary, the US Dollar eases ahead of the American session following the United States (US) Producer Price Index (PPI) data. The figures indicated inflationary pressures persist, as the monthly PPI rose 0.5%, up from -0.1% in March and above the 0.3% expected. The yearly figure matched the anticipated 2.2%, while the core annual reading printed at 2.4%, unchanged from March EUR/USD dipped to 1.0766 but quickly trimmed losses and is once again battling with the 1.0800 threshold.

Right after Wall Street's opening, Federal Reserve (Fed) Chairman Jerome Powell will speak at the Netherlands Foreign Bankers' Association in Amsterdam. Powell will hardly deliver a surprise message that can affect the USD direction.

EUR/USD short-term technical outlook

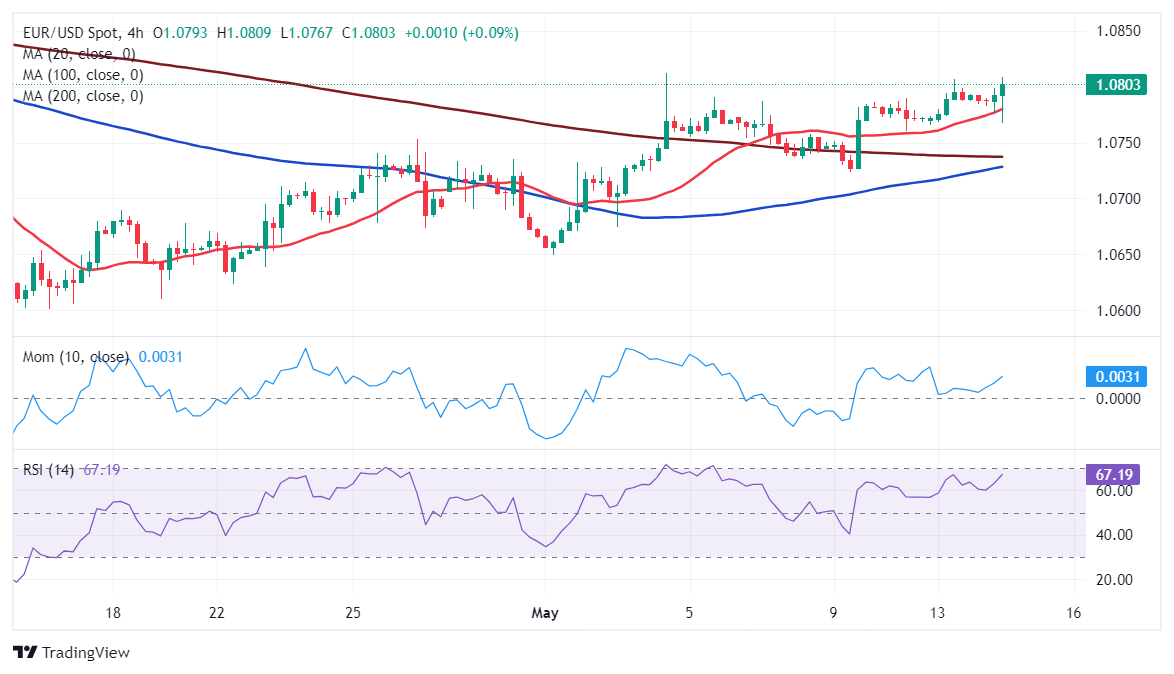

The daily chart for the EUR/USD pair shows it's slowly gaining upward momentum, up for a second consecutive day. Technical indicators grind higher within positive levels, supporting another leg north. At the same time, EUR/USD extends gains above a directionless 200 Simple Moving Average (SMA), while the 20 SMA gains bullish strength below the current level. Finally, the next hurdle is 1.0840, where a bearish 100 SMA provides resistance.

The optimistic tone is also clear in the 4-hour chart. The Momentum indicator bounced from its 100 level, offering a firmly bullish slope, while the Relative Strength Index (RSI) indicator also picked up and approaches overbought territory. At the same time, EUR/USD runs above all its moving averages, with the 20 SMA gaining upward traction above the longer ones, in line with increased buying interest.

Support levels: 1.0750 1.0695 1.0660

Resistance levels: 1.0810 1.0840 1.0885

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.