EUR/USD Forecast: Bulls defend the downside, refrain from pushing it higher

EUR/USD Current price: 1.0849

- Economic growth in the Eurozone picked up in May, according to HBOC.

- Stock markets shrugged of the negative mood after NVIDIA results.

- EUR/USD trimmed FOMC-inspired losses and trades neutral around 1.0850.

The EUR/USD pair fell to 1.0811 early on Thursday as the US Dollar gained momentum following the release of the Federal Open Market Committee (FOMC) Meeting Minutes. The document showed that Federal Reserve (Fed) officials still believed price pressures would ease but expressed concerns about the lack of progress towards their goal of 2%. Furthermore, “various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.” On a positive note, officials considered growth remains solid, allowing them to keep interest rates in restrictive territory.

As a result, markets turned risk-averse. Stocks fell, with Wall Street closing in the red. The release of NVIDIA Q1 results partially offset the dismal mood, as the AI company reported upbeat sales and earnings that topped outrageously optimistic estimates. Asian shares traded mixed, while most European indexes trade in the green ahead of the American opening.

European figures helped EUR/USD recover from such a low following the release of the May flash Hamburg Commercial Bank (HCOB) Purchasing Managers Indexes (PMIs). German business activity rose for a second consecutive month and at a faster rate, according to the official report. The Eurozone economic recovery also gathered momentum in May, while rates of inflation of both input costs and output prices softened from April. The EU Composite PMI hit 52.3, its highest in twelve months, while the German index printed at 52.2, which was also a one-year peak.

The United States (US) published Initial Jobless Claims for the week ended May 17. which declined to 215K from the previous 223K, better than the 220K anticipated by market participants. S&P Global will release the preliminary estimates of the US PMIs after Wall Street’s opening, while the EU will unveil May Consumer Confidence.

EUR/USD short-term technical outlook

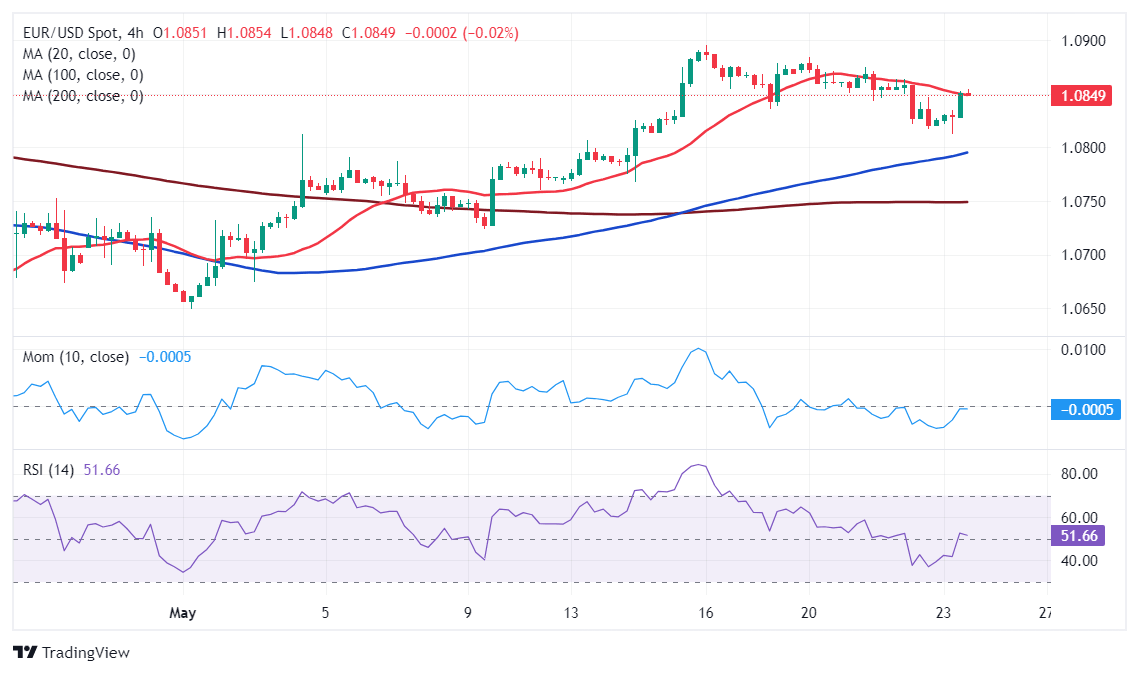

The EUR/USD pair returned to its comfort zone around 1.0850, and technical readings in the daily chart suggest sellers have no power around the pair. It bounced for a second consecutive day from around a mildly bearish 100 SMA, providing dynamic support at 1.0815. At the same time, the 20 SMA is aiming to cross above the 200 SMA, both converging around 1.0780. Meanwhile, technical indicators pared their corrective slides within positive levels and are trying to resume their advances, in line with dominant buying interest.

In the near term, according to the 4-hour chart, EUR/USD is battling to overcome a bearish 20 SMA but holding well above bullish longer ones. Finally, technical indicators advance, but within negative levels, not enough to confirm a bullish continuation in the upcoming hours.

Support levels: 1.0815 1.0780 1.0720

Resistance levels: 1.0880 1.0920 1.0960

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.