- EUR/USD has advanced after Moderna reported progress in developing a coronavirus vaccine.

- Uncertainty about the EU Fund, US COVID-19 cases, and other factors may limit gains.

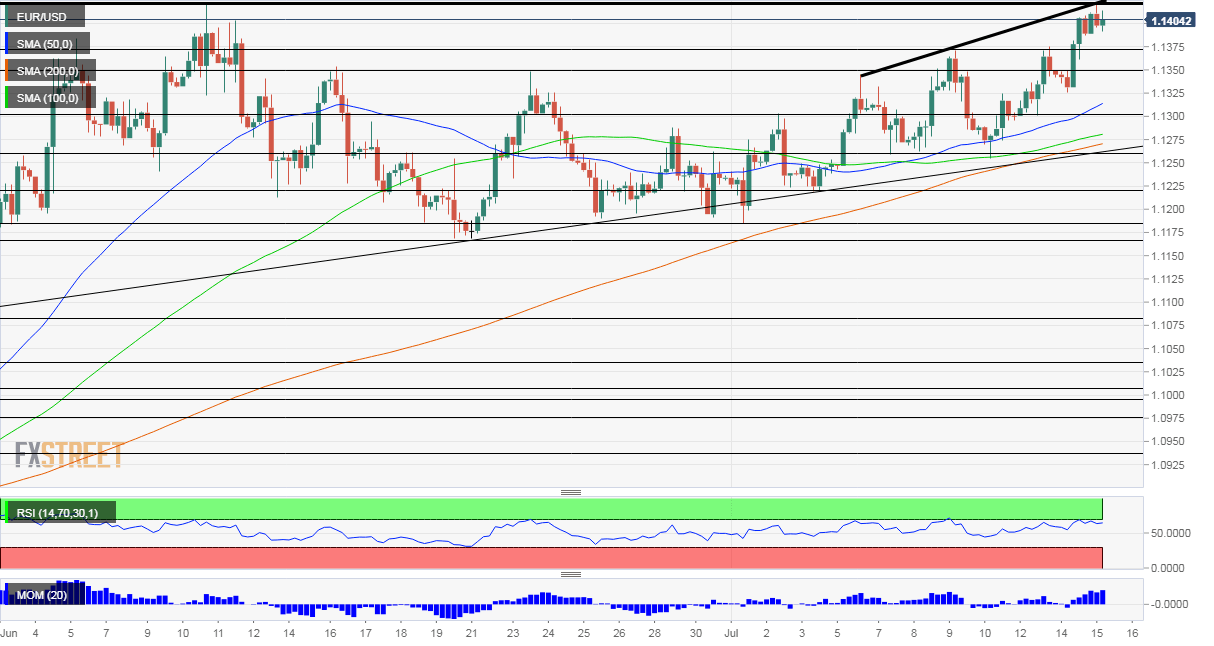

- Wednesday's four-hour chart is showing the pair is at a critical juncture.

"Robust immune response" – these words used by Moderna to describes its progress on developing a coronavirus vaccine lifted stocks and weighed on the safe-haven dollar. For EUR/USD, it means a challenge of high resistance.

Massachusets-based Moderna is moving markets up, and not for the first time. The highly-regarded New England Journal of Medicine reported that the pharma company's test produced neutralizing antibodies – four times more than in recovered patients – among the 45 human subjects and with little side effects.

Equities are torn between such promises for a rapid solution to COVID-19 and reality – which remains grim in several US states. California, which imposed a sweeping lockdown, hit a record number of cases, and so did Texas, which took only minor steps.

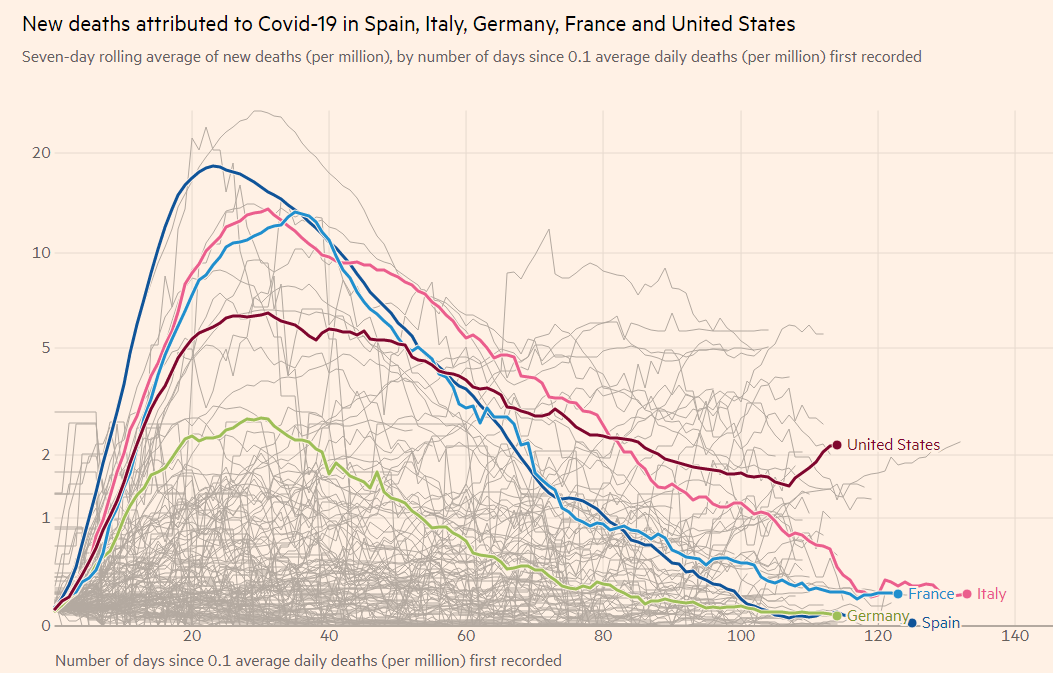

Total US infections have surpassed 3.6 million, and deaths topped 136,000. Mortalities are on the rise. The seven-day rolling average of new deaths million is here:

Source: FT

Updated coronavirus statistics will be of interest later in the day.

Recent US data has been satisfactory, with the Core Consumer Price Index (Core PCI) rising holding up at 1.2% in June, beating expectations. Wednesday's calendar includes the Empire State Manufacturing Index for July and Industrial Production for June.

The most significant publication is on Thursday – Retail Sales for June. Last month kicked off with rising expenditure amid reopenings, but then suffered a downturn as COVID-19 cases soared.

In the old continent, the disease remains under control despite several local flareups. The focus is on deliberations between EU members on the proposed recovery fund. German Chancellor Angela Merkel hosted Spanish Prime Minister Pedro Sánchez on Tuesday and said she is willing to compromise to get the deal over the line.

Spain and Italy are staunch proponents of the ambitious program – which includes €500 billion in mutually funded grants. Opposition comes from the "Frugal Four" – a group of rich nations led by the Netherlands. Investors still expect a compromise that will be good enough to help the eurozone recover.

The European Central Bank meets on Thursday and will likely leave its policy unchanged while pressing leaders to approve the fund.

See ECB Preview: EUR/USD depends on Lagarde's fearless nudging of the Frugal Four

Markets have brushed aside Sino-American tensions. President Donald Trump has ended Hong Kong's special status in response to China's tighter grip on the city-state. Nevertheless, the world's largest economies continue to uphold the trade deal.

Overall, coronavirus hopes and fears are prominent factors moving EUR/USD.

EUR/USD Technical Analysis

Euro/dollar is trading below and uptrend resistance line that has been accompanying it since early July. That line now converges with 1.1425 – the currency pair's peak in early June. Breaking above this critical resistance line would open the door to the highest levels since March.

Momentum on the four-hour chart is to the upside and EUR/USD is trading above the 50, 100, and 200 Simple Moving Averages. The Relative Strength Index is below 70 – thus outside overbought conditions.

All in all, bulls are in control.

Resistance above 1.1425 is at 1.1495, March's peak, and then 1.1560. Support awaits at 1.1375, a stepping stone on the way up, followed by 1.1350, a swing high from early in the month. The next levels at 1.13 and 1.1265.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD appreciates to near 1.0400 ahead of Eurozone HICP inflation

EUR/USD continues its winning streak for the third successive session, trading around 1.0400 during the Asian hours on Tuesday. The upside of the EUR/USD pair is attributed to the subdued US Dollar.

GBP/USD rises toward 1.2550 as US Dollar continues to correct downwards

GBP/USD continues to rise for the third consecutive day, trading near 1.2530 during Tuesday's Asian session. The pair's upward momentum is driven by a subdued US Dollar. Later in the day, the US ISM Services Purchasing Managers Index is set to be released.

Gold price sticks to modest gains; lacks bullish conviction amid Fed's hawkish shift

Gold price attracts some haven flows amid worries about Trump’s tariff plans. The Fed’s hawkish shift and elevated US bond yields cap gains for the XAU/USD. Traders seem reluctant ahead of FOMC minutes and US NFP releases later this week.

Solana Price Forecast: Open Interest reaches an all-time high of $6.48 billion

Solana price trades slightly down on Tuesday after rallying more than 12% the previous week. On-chain data hints for rallying continuation as SOL’s open interest reaches a new all-time high of $6.48 billion on Tuesday.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.