- Eurozone PMIs crashed to record low levels amid the coronavirus crisis.

- The EU Summit carries elevated hopes which may be shattered.

- US economic figures may dampen the mood and strengthen the dollar.

- Thursday's four-hour chart is pointing to the downside.

Coronavirus carnage is becoming more evident – and that has sent EUR/USD below 1.08, the lowest in two weeks.

Here are three reasons for the fall and why it may continue.

1) Horrifying economic figures

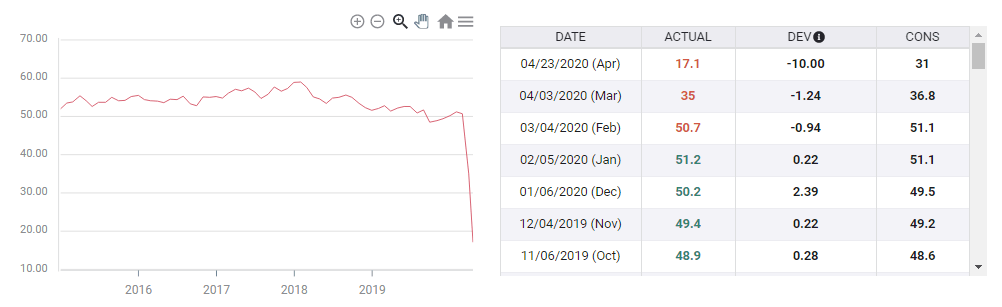

How hard is coronavirus hitting the economy? Markit's preliminary Purchasing Managers' Indexes were expected to fall to record levels but the figures are more devastating than expected. The German Composite PMI fell to 17.1 points against 31 expected while any score below 50 represents contraction.

The services sector is leading the collapse with numbers in the teens, yet manufacturing PMIs in both France and Germany have also disappointed, falling to the lowest since the 2008-2009 crisis. The surveys were taken during early April when lockdowns were firmly in place.

The figures are set to continue echoing and weighing on the euro. They are compounded by German Chancellor Angela Merkel's statement to parliament, where she said that the virus is here to stay for a longer period.

2) False hopes for the EU Summit?

Spain, France, and the European Commission have been working hard to mediate between the northern and southern camps, finding a solution that would provide a considerable fiscal boost as Italy and others want but refrains from sharing debt, as the Netherlands and Germany object. Sums of between €1.5 to €2 trillion have been thrown in the air.

However, some of the money may be leveraged, it may reach the economies late, and has yet to be agreed upon. Hopes for a robust "bazooka" have been supporting the common currency but a potential "euro-fudge" – a diluted agreement may send it down.

See Yes, the future of the union is at risk, three scenarios for EUR/USD, including parity

3) US data may dampen the mood

Weekly Unemployment Claims are due out and may show that the world's largest economy lost over 4 million jobs in the week ending April 17. While that would be the third consecutive drop, the US labor market is suffering badly.

See Jobless Claims Preview: Progress or exhaustion in the US labor market

Shortly after, Markit's US PMIs will likely follow Europe's path and also paint a grim picture. ISM PMIs normally have more influence, but substantial falls may also weigh on the mood.

See US PMIs Preview: Looking into the abyss

It is essential to note that the safe-haven dollar has been gaining ground in response to downbeat figures – even if they are for the American economy.

The figures could send stocks lower, reversing gains partially attributed to encouraging coronavirus statistics in the US, especially in New York. Governor Andrew Cuomo also noted a "very productive" meeting with President Donald Trump. From this relatively high point, things may go downhill.

Overall, economic figures and the EU Summit will likely outweigh COVID-19 statistics on a busy day.

EUR/USD Technical Analysis

Euro/dollar is trading below the 50, 100, and 200 Simple Moving Averages, and momentum remains to the downside. Bears remain in the lead.

Significant support awaits at 1.0770, which is April's low. It is followed by 1.0720, which was a stepping stone on the way up in March, and then by the 2020 low of 1.0640.

Some resistance is at last week's low of 1.0810, followed by 1.0835, the daily high. Wednesday's high of 1.0885 is a stronger resistance line and it is followed by 1.0930 and 1.0995.

More: Coronavirus: Lack of leadership may lead to L-shaped economy, markets may suffer badly

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.

-637232281845176752.png)