- EUR/USD has been advancing after US Treasury Secretary nominee Yellen made the case for more stimulus.

- Biden's first steps as president are closely watched, with investors also eyeing the ECB.

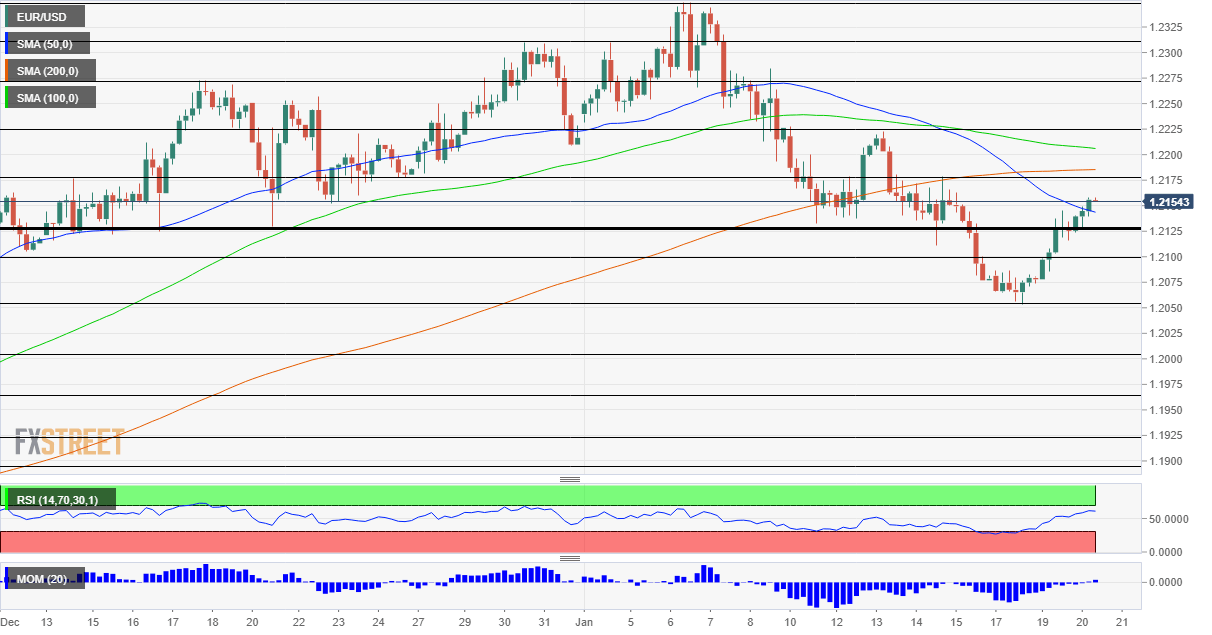

- Wednesday's four-hour chart is showing bulls are gaining ground.

The US money machine has been warming up – and global markets are heartened. Investors are awaiting President-elect Joe Biden's first moves in the White House with high hopes, pushing the safe-haven dollar down.

Janet Yellen, the nominee for Treasury Secretary, has made the case for going "big" on spending to stimulate the world's largest economy, still reeling from the coronavirus crisis. After America passed the grim milestone of 400,000 COVID-19 deaths, the former Federal Reserve Chair has urged Congress not only to approve her candidacy but also back the big $1.9 trillion spending bill. In a wide-ranging hearing,

Yellen also said that markets should determine the value of the dollar – moving away from the strong dollar policy. While her main points were already published ahead of the Senate hearing, she made a convincing case – and also refrained from committing to imminent tax hikes that Wall Street dislikes.

Looking ahead at Inauguration Day, fears of violence from supporters of outgoing President Donald Trump may be somewhat hiding investors back. However, the focus is on what Biden does in his first hours and days at the White House. According to reports, he is set to rush in a flurry of Executive Orders.

Will some of them have an immediate economic impact? The No. 1 issue is the pandemic. A call to wear face masks and a boost to America's vaccination campaign would be welcomed while trying to force states to shutter would weigh on markets.

More US-China Relations and the Biden Administration: Trade war over but you can't go home again

On the other side of the pond, tensions are rising ahead of Thursday's European Central Bank decision. The Frankfurt-based institution is set to leave rates unchanged but may warn about the higher exchange rate of the euro. Without cutting rates, any attempt by the ECB to talk down the common currency will likely be futile.

However, Bloomberg reported that the ECB could launch a strategy of controlling yield spreads – leveling down borrowing costs between different economies. While lowering returns on European debt may weigh on the euro, it would lower borrowing costs for some governments, a positive development.

See ECB Preview: Lagarde may trigger a “buy the dip” opportunity by trying to talk down the euro

Also in the old continent, Germany extended its lockdown through February 14 while Italy's government survived its political crisis. The common currency is somewhat dragged down by the slow pace of vaccinations, especially as Biden intends to ramp up America's immunization scheme.

Overall, Biden's first moves are set to dominate trading, with ECB speculation playing second fiddle.

EUR/USD Technical Analysis

Momentum on the four-hour chart has turned positive, a bullish sign. Euro/dollar has also surpassed teh 50 Simple Moving Average. However, the currency pair remains below the 100 and 200 SMAs.

All in all, bears are in retreat, but have not given up yet.

Resistance awaits at 1.2180, which capped EUR/USD last week. It is followed by 1.2225, which the peak back then. Further above, 1.2275 and 1.2310 are eyed.

Support awaits at the former triple bottom of 1.2125, then by the round 1.21, and finally by 1.2050, the 2020 trough.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.