EUR/USD Forecast: Bears seize control as the Fed decision looms

EUR/USD Current Price: 1.0554

- The United States Federal Reserve will unveil its monetary policy decision in the American afternoon.

- Market participants watch critical US employment-related figures ahead of Fed.

- EUR/USD trades in the red for a second consecutive day, support at 1.0520.

The EUR/USD pair extends its slide on Wednesday, trading near a daily low of 1.0540 ahead of Wall Street’s opening. The US Dollar benefits from a cautious stance as investors await the United States (US) Federal Reserve (Fed) monetary policy announcement in the American afternoon.

Stock markets are on the back foot ahead of the announcement, while Treasury yields gain as investors expect the Fed to remain on hold but doubt whether the central bank is done with rate hikes. Rather than the decision itself, speculative interest will pay close attention to Chairman Jerome Powell’s words and whatever guidance offered in his press conference.

A holiday in Europe kept the local macroeconomic calendar empty, although the US released some relevant employment-related figures. The ADP survey on job creation showed that the private sector added 113K new positions in the month, below the 150K expected but higher than the previous 89K. The country also unveiled MBA Mortgage Applications for the week ended October 27, which declined by 2.1% against the 1% slide in the previous week.

The US calendar has more to offer ahead of the Fed’s announcement, as the country will publish the October ISM Manufacturing PMI, foreseen steady at 49, and September JOLTS Job Openings. The latter is expected to indicate 9.25 million openings in the month, further easing from the 10.3 million peak posted last April. The report is an indication of the labor market tightness, a spot the Fed is watching closely to take monetary policy decisions.

EUR/USD short-term technical outlook

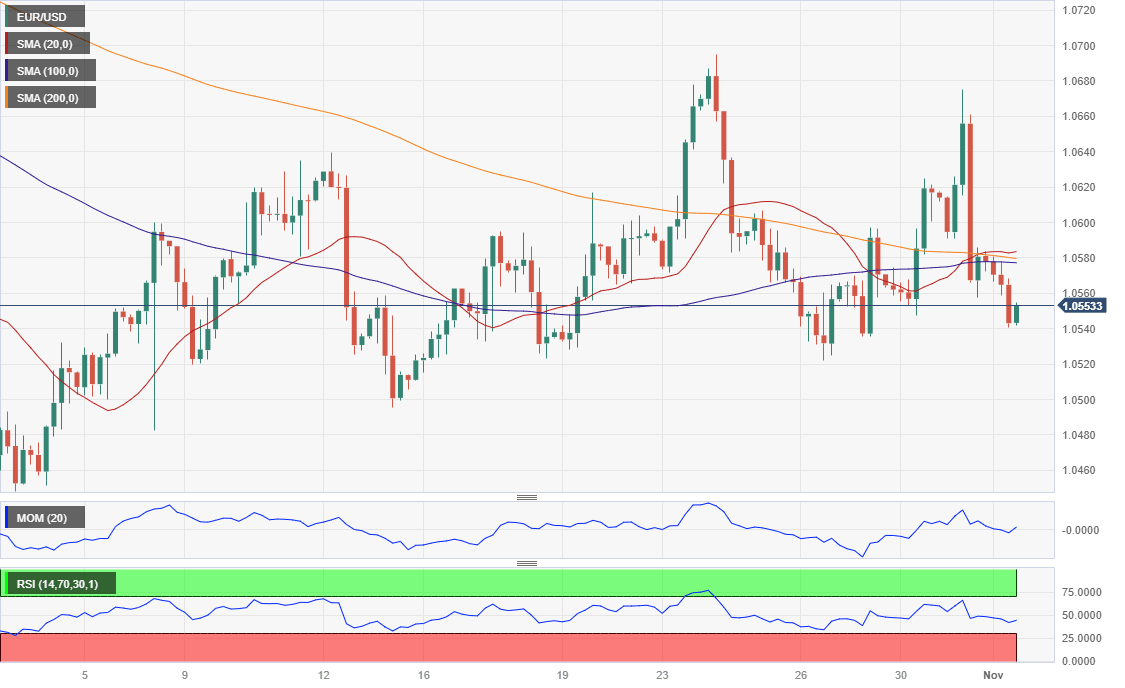

The daily chart for the EUR/USD pair shows bears seized control of the pair, although additional slides will depend on the Fed event’s outcome. The pair is developing below a now flat 20 Simple Moving Average, which provides intraday resistance at around 1.0575. At the same time, the 100 and 200 SMAs gain downward traction, converging in the 1.0810 price zone. Finally, the Momentum indicator seesaws around its 100 line, but the Relative Strength Index (RSI) indicator heads firmly south at around 44, in line with persistent selling interest.

In the near term, and according to the 4-hour chart, EUR/USD is bearish. The pair is developing below all its moving averages, confined to a tight range in the 1.0570/80 region. Meanwhile, technical indicators are gaining downward traction within negative levels, supporting another leg lower in the upcoming hours.

Support levels: 1.0520 1.0490 1.0445

Resistance levels: 1.0575 1.0620 1.0660

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.