EUR/USD Forecast: Bears looking to test the 1.0700 region

EUR/USD Current price: 1.0740

- European Central Bank officials delivered hawkish comments on Sunday.

- The United States ISM Manufacturing PMI surged to 50.3 in March.

- EUR/USD approaches February low at 1.0694, aiming to break below it.

The EUR/USD pair fell on Monday to 1.0730, its lowest since mid-February. The US Dollar surged after Wall Street’s opening, as stocks dipped while solid United States (US) data reflected the strength of the local economy. Last Friday, Federal Reserve (Fed) Chairman Jerome Powell repeated that the central bank is in no rush to trim interest rates as inflation remains high while the economy is resilient.

Hawkish comments from European Central Bank (ECB) officials did not help the Euro. Austrian Central Bank Governor Robert Holzmann said on Sunday that the ECB could cut interest rates before the US Fed. When the ECB would pull the trigger “will depend largely on what wage and price developments look like by June,” Holzmann added.

Data-wise, the US S&P Global Manufacturing PMI was 51.9 in March, below the 52.5 expected. However, the ISM Manufacturing PMI unexpectedly surged to 50.3 in the same month after contracting for 16 consecutive months.

Germany will release on Tuesday the preliminary estimate of the March Harmonized Index of Consumer Prices (HICP), expected at 2.4% YoY, while the US will release February Factory Orders and JOLTS Job Openings for the same month. Additionally, several Fed officials will be on the wires during the American afternoon.

EUR/USD short-term technical outlook

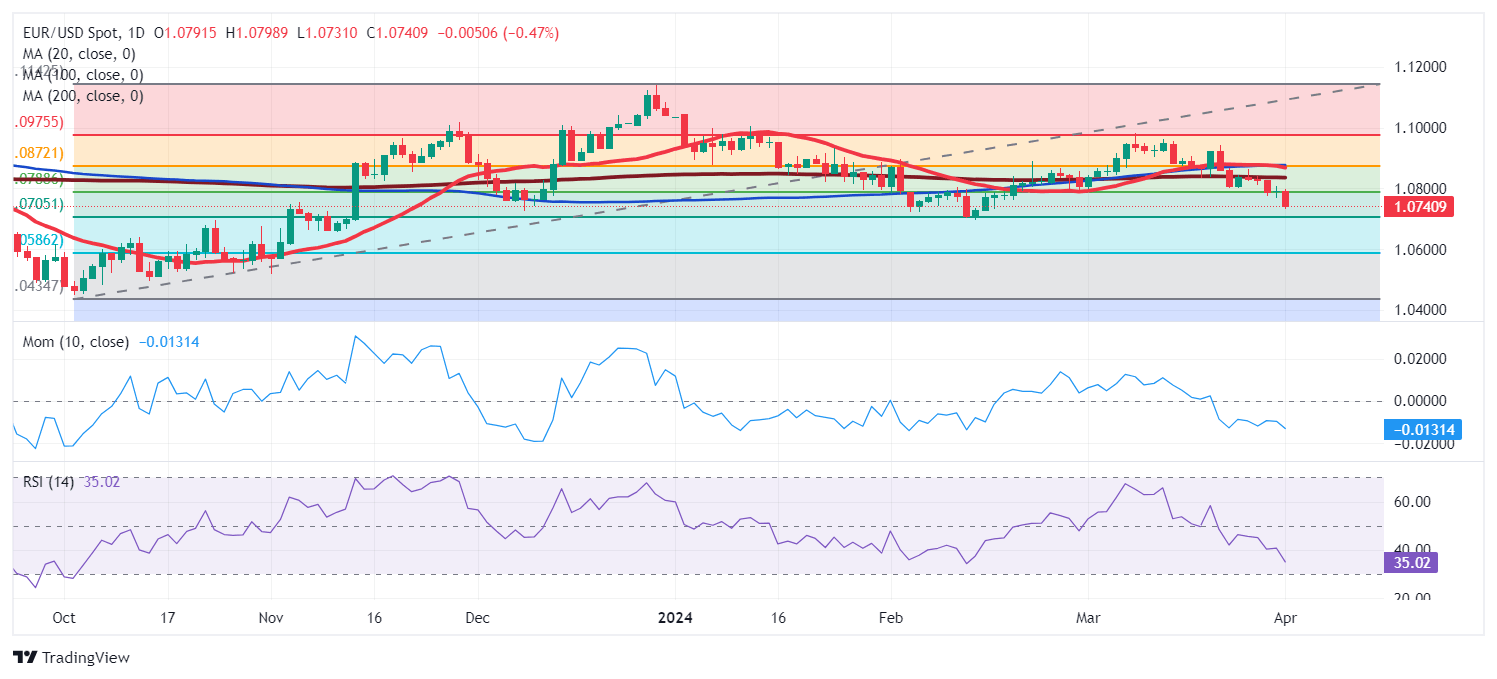

The EUR/USD pair bounced from the mentioned intraday low but looks poised to extend its slump. In the daily chart, moving averages are gaining downward traction well above the current level, with the 200 SMA currently around 1.0840, the 50% Fibonacci retracement of the 1.0694/1.0981 rally. At the same time, technical indicators head firmly lower, approaching oversold readings. A critical support level is now the base of the aforementioned range at 1.0694, also February´s monthly low.

The 4-hour chart supports another leg south, as the Momentum indicator heads lower vertically, while the Relative Strength Index (RSI) indicator consolidates at around 31. At the same time, a sharply bearish 20 Simple Moving Average (SMA) extended its slide below the longer ones, capping advances just ahead of the 1.0800 mark.

Support levels: 1.0730 1.0695 1.0660

Resistance levels: 1.0770 1.0805 1.0840

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.