EUR/USD Forecast: Bears lead, despite awful US employment data

EUR/USD Current Price: 1.0889

- Unemployment claims in the US jumped to a record of 6.64 million in the week ended March 27.

- The coronavirus pandemic and its effects on the economy continue to be the main market mover.

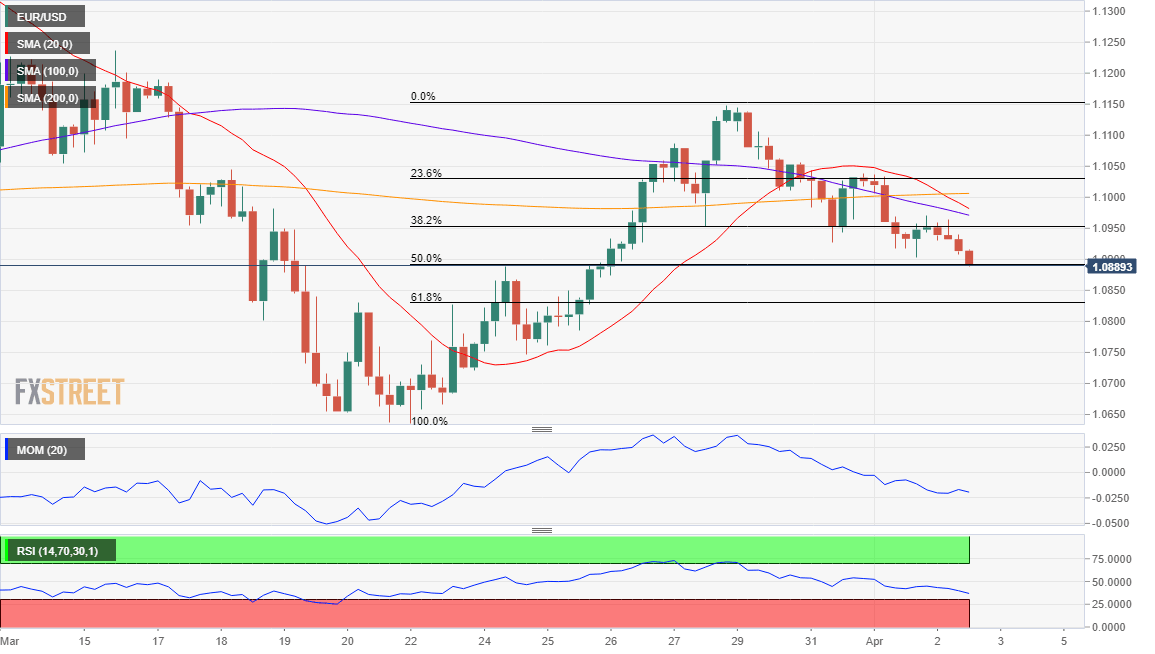

- EUR/USD about to fall below the 50% retracement of its latest daily advance.

Financial markets are in better shape this Thursday, although optimism is nowhere to be found. The American dollar trades marginally higher against most major rivals, except the Pound, which remains resilient to the dollar’s strength. The EUR/USD pair pierced the 1.0900 level ahead of the release of US weekly unemployment claims. Meanwhile, the world continues to gyrate about coronavirus-related news, as the pandemic escalates with no signs of reaching a peak

There EU didn’t release relevant macroeconomic data, but the US published earlier today March Challenger Job Cuts, which showed that US-based employers announced 222,288 cuts, a 292% surge from February. As for unemployment claims, they jumped to 6.64 million almost doubling the market’s forecast. The dollar’s reaction, however, was quite limited although Wall Street’s futures turned into the red.

EUR/USD short-term technical outlook

The EUR/USD pair is pressuring the 50% retracement of its latest bullish run, technically bearish in the short-term. The 4-hour chart shows that the price is below all of its moving averages, which remain confined to a tight range although gaining bearish traction. Technical indicators in the mentioned time-frame, turned south within negative levels, favoring additional declines, mainly on a break below 1.0890, the immediate support.

Support levels: 1.0890 1.0850 1.0810

Resistance levels: 1.0960 1.1000 1.1045

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.