EUR/USD Forecast: Bears are not willing to give up

EUR/USD Current price: 1.0754

- Contraction in business activity and new orders softened in the EU at the beginning of the year.

- The United States ISM Services PMI is foreseen to improve further in January.

- EUR/USD bearish case gains momentum as Treasury yields run higher.

The EUR/USD pair extends its 2024 slump to fresh lows sub-1.0750 amid broad US Dollar demand. Treasury bond yields lead the way in an otherwise quiet week, and as market participants digest the latest central banks' decisions and the United States (US) employment situation. At the end of the previous week, the USD surged on the back risk aversion, triggered by robust employment figures that followed Federal Reserve (Fed) Chairman Jerome Powell's words cooling down expectations for a March rate cut.

The US Dollar found extra legs on Monday on resurgent yields. Ahead of Wall Street's opening, the 10-year Treasury note offered as much as 4.10%, holding nearby, while the 2-year note peaked at 4.46%, now offering 4.44%. Meanwhile, stock markets trade with a positive tone, with most Asian and European indexes holding on to modest gains.

Data-wise, the Hamburg Commercial Bank (HCOB) published the final Services Producer Manager Index (PMI) surveys for the Eurozone, with most figures suffering upward revisions but still indicating contraction in the sector. The German Services PMI fell for a fourth consecutive month, printing at 47.7, while the Composite PMI contracted to 47.0 from 47.4 in December. The EU report was a bit more encouraging, as it says: "Contractions in business activity and new orders softened, while growth expectations strengthened to a nine-month high." The EU Composite PMI surged to 47.9, a six-month high. Finally, the EU December Producer Price Index (PPI) contracted by 10.6% YoY and 0.8% MoM, indicating price pressures eased further.

S&P Global will later publish the US Services PMI and the Composite PMI for January, while the country will release the official ISM Services PMI, the latter foreseen at 52, up from 50.6 in December.

EUR/USD short-term technical outlook

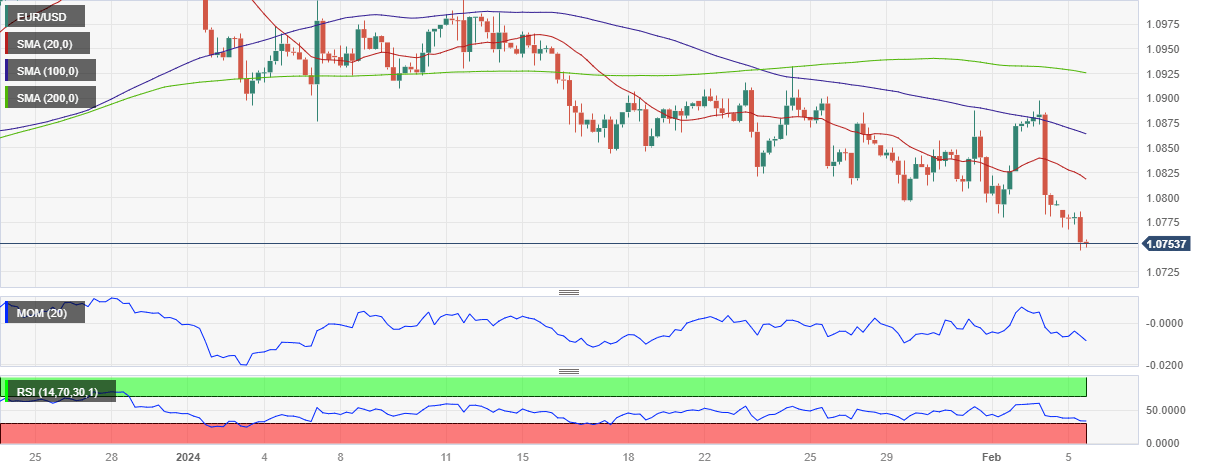

The EUR/USD pair trades near its slows, and technical readings in the daily chart show the risk remains skewed to the downside. The pair started the day at around a flat 100 Simple Moving Average (SMA) and could not recover above it. In the meantime, the 20 SMA keeps gaining downward traction above the longer ones. Finally, technical indicators hold within negative levels, with the Relative Strength Index (RSI) indicator at 35 and anticipating another leg lower.

The 4-hour chart shows bears are not willing to give up. EUR/USD is developing below all its moving averages with firmly bearish slopes. Furthermore, technical indicators remain within negative levels, with the Momentum indicator stable but the RSI indicator nearing oversold readings. A continued decline is expected on a break through 1.0745, the immediate support level.

Support levels: 1.0745 1.0710 1.0680

Resistance levels: 1.0790 1.0845 1.0890

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.