- EUR/USD has drawn a very bearish chart pattern, looks to the downside.

- A lighter economic calendar in the upcoming days should favor an extension of the recent slide.

- ECB's monetary policy stance is out-dovishing the Fed's one, which keeps driving the pair.

EUR/USD has built a double-top formation which opens up another bearish scenario. The consecutive upbeat releases from the US jobs report and both the ISM Manufacturing and Non-Manufacturing PMIs have finally propelled some US dollar buying, stopping the greenback's route from October. The month of November has started on the downward path and a lighter economic calendar for the upcoming days indicates that bears could ride their trend back for some time, as they keep profiting from the monetary policy and macroeconomic differential between the US and the Eurozone.

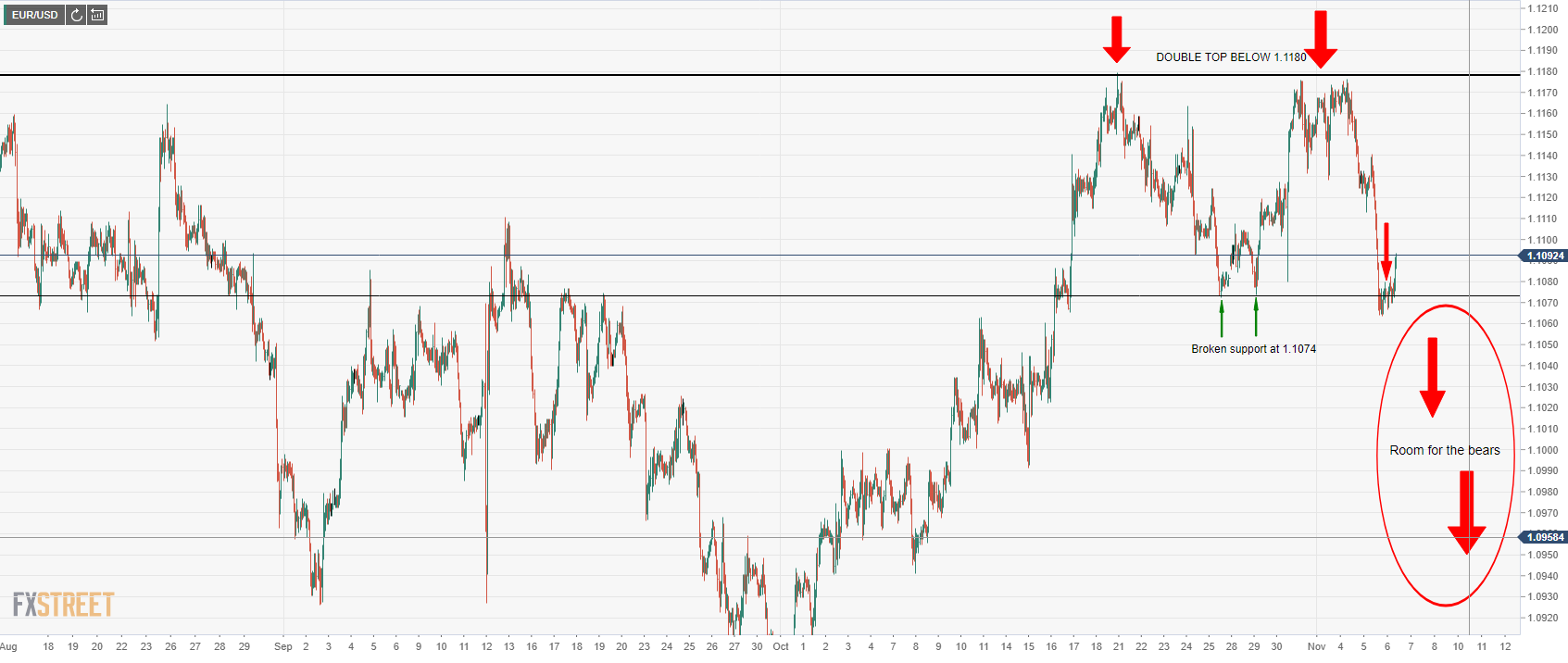

EUR/USD 1H chart: Double top puts bears back in the driving seat

The euro dollar 1-hour chart comes in handy to picture the current double-top formation. It is showing the textbook chart pattern, confirmed by looking at the Investopedia definition of what a double top means: "extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. It is confirmed once the asset's price falls below a support level equal to the low between the two prior highs".

A meaningful high was set at 1.1180, where EUR/USD bulls were rejected on Friday after better-than-expected Non-Farm Payrolls figures. From then on, sellers have taken over, breaking below the support level located at the lows set between October 25th and October 29th around 1.1075. A weak recovery after some positive data from Germany and the Eurozone seen in the last hours confirms that the bias is clearly bearish.

This double-top formation has some acute EUR/USD bearish potential, particularly taking into account that the economic calendar will take a step back from the exhilarating sequence of high-impact events that we have seen for the last week. Germany is set to release Industrial Production figures on Thursday and we will get from the US the preliminary results from November's University of Michigan Consumer Sentiment survey, but those are events a tier below from the high-top ones we have got in the last seven days. That should help the market set a stable trend favoring more downside momentum, as the bullish steam gathered in October is reversed.

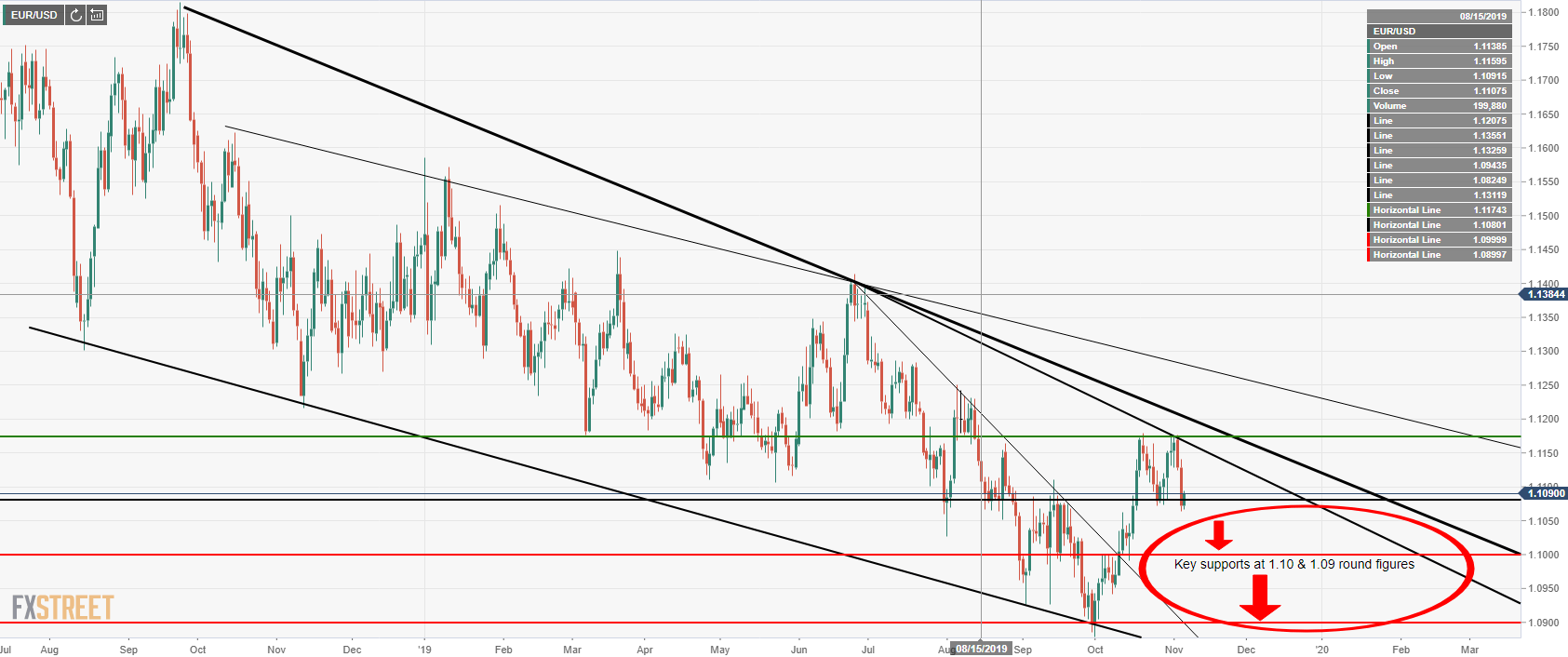

EUR/USD Daily chart: The downtrend is relentless

Euro dollar's daily chart shows that the recent double-top fits quite nice within the long-term bearish trend that the pair has been riding for the last year and a half. It is a slow but deliberate slide that has just provided another strong confirmation signal. Therefore, bears should be targeting a return to the psychological 1.10 figure before staring at the just-below 1.09 lows set at the end of September.

These targets should be reachable during November, as there's some cyclical demeanour going on that downward trend that relates well to the current picture. Let's take a look at the monthly data.

Fed expected to pause interest rates, good news for USD bulls

By gaining around 270 pips, October has been the most bullish month in the euro dollar since the start of 2018 – there have only been seven bullish months out of 22 in such period, with last June being the only one close to that gain, which was quickly reversed with a 310-pip slide in July, when the Fed started cutting its interest rates. That one could be a similar scenario to the one we are now facing, as the Fed has hinted a pause to its three consecutive rate cuts while the ECB, under Christine Lagarde's new leadership, is set to continue looking for unconventional (and unsuccessful) ways to stimulate the economy.

All in all, it's easy to see why the market keeps coming to the same point: the fact that the European Central Bank keeps out-dovishing the Federal Reserve, which was the case again in October, is the most relevant factor to keep pulling EUR/USD lower. There is not an end at sight for this monetary policy differential and while this lasts, the long-term forecast will always tend to favor the US dollar.

US-China trade and Brexit, the only risks for the upside

Risks to the upside could be located on the risk that the US-China trade negotiations – reportedly working more smoothly lately – were to be derailed, which could trigger some USD short-term selling. That could trigger some short-term USD sell-off, probably translating into some bad US consumer and business sentiment surveys, although in the mid- and long-term, the greenback is much better equipped to work as a safe-haven asset than the euro and its other counterparts.

On the euro side, an ordered Brexit finally happening could provide some relief to the common currency, so December 12th UK election has to be seen as a key date. Markets would look like a positive a stabilizing result – at this point, only a Boris Johnson comfortable win would probably do that – but even that effect would be limited until Brexit is confirmed. The UK is now expected to leave the European Union on January 31st. Any other outcome which triggers more uncertainty and likely further delays to the Brexit deadline should be looked as EUR-negative, so there's even more downside potential looming there.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold struggles to hold above $2,400

Gold loses its traction and trades in negative territory below $2,400 after suffering large losses in the second half of the previous week. The benchmark 10-year US Treasury bond yield holds above 4.2% and risk flows return to markets, not allowing XAU/USD to rebound.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.