EUR/USD Forecast: At the lower end of the range

EUR/USD Current Price: 1.0794

- The EU Sentix Investor Confidence index plummeted to -42.9 in April, down from -17.1 in March.

- Mildly optimistic news about the coronavirus pandemic boosted the market’s mood.

- EUR/USD maintains its bearish stance despite decreased demand for safety.

Financial markets were in a better mood this Monday, amid some encouraging news related to the coronavirus pandemic. According to the latest data available the contagion curve and the death toll seem to be flattening in Italy, Spain and New York, the three places where coronavirus has hit the hardest. Nothing is yet done and things can worsen again. Furthermore, most major economies continue in lockdown, and governments have not yet figure out how to get out of it, as the most likely scenario is that the spread of the virus will take a turn to the worse. Equities rallied worldwide while high-yielding currencies recovered with uneven results.

In the case of EUR/USD, the pair spent the day hovering around the 1.0800 threshold, as the shared currency got undermined by the EU Sentix Investor Confidence index plummeted to -42.9 in April, down from -17.1 in March and worse than the -30.3 expected. This Tuesday, the macroeconomic calendar will remain quite light, as Germany will release February Industrial Production, while the US will only publish minor reports that have no chances of affecting the price.

EUR/USD short-term technical outlook

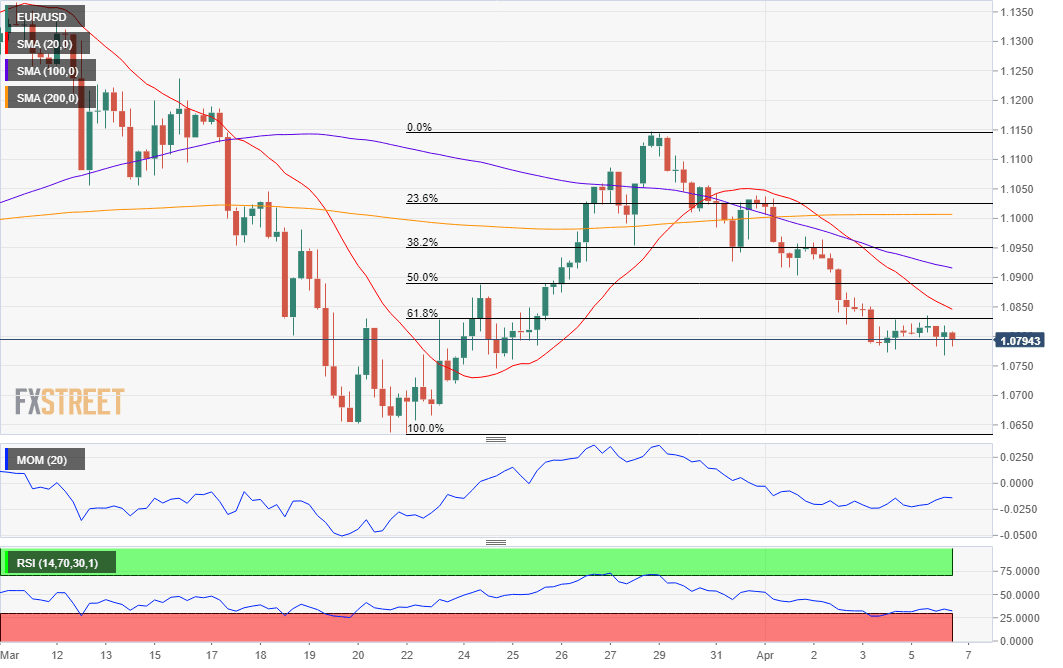

The EUR/USD pair has fallen to a daily low of 1.0767, while the upside remained capped by sellers aligned around 1.0830, the 61.8% retracement of the latest bullish run. The short-term picture is bearish, as, in the 4-hour chart, the pair is developing below bearish moving averages, wit the 20 SMA accelerating south below the larger ones and nearing the current level. Technical indicators, however, had spent the day directionless within negative levels, maintaining the risk skewed to the downside without confirming further declines ahead.

Support levels: 1.0770 1.0725 1.0680

Resistance levels: 1.0830 1.0890 1.0940

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.