EUR/USD Forecast: At risk of resuming its decline despite extremely oversold

EUR/USD Current Price: 1.0798

- Coronavirus-related concerns eased, but investors maintain a cautious stance.

- EU macroeconomic figures missed the market’s expectations, US data upbeat.

- EUR/USD hovering sub-1.0800, to gain bearish momentum below 1.0770.

The EUR/USD pair has spent Wednesday confined to a tight range around the 1.0800 level, extending its yearly decline by a few pips to 1.0781. Coronavirus-related concerns eased amid Chinese authorities reporting that the pace of contagion outside the Hubei province has slowed, although the dollar and gold, both considered safe-haven, retained their strength, suggesting investors are still cautious.

Macroeconomic data continued to highlight the imbalances between the two economies. The EU released December Current Account with the seasonally adjusted figure at €32.6 B, missing the market’s expectations. The Union also released December Construction output, which also came in below expected, down by 3.1% MoM and by 3.7% YoY. The US published the January Producer Price Index, which was up by 2.1% YoY, beating the market’s expectations. Housing Starts in the same month were down by 3.6% while Building Permits were up by 9.2%, both much better than anticipated.

This Thursday, Germany will release the GFK Consumer Confidence Survey, seen in March at 9.8, down from 9.9 previously, and January PPI, foreseen down by 0.4% YoY. The EU will publish the preliminary estimate of February Consumer Confidence, seen at -8.2 from -8.1. The US will release the usual weekly unemployment data and the Philadelphia Fed Manufacturing Survey, seen in February at 12 after printing 17 in January. The US Federal Reserve released the Minutes of its latest meeting, but it was a non-event.

EUR/USD short-term technical outlook

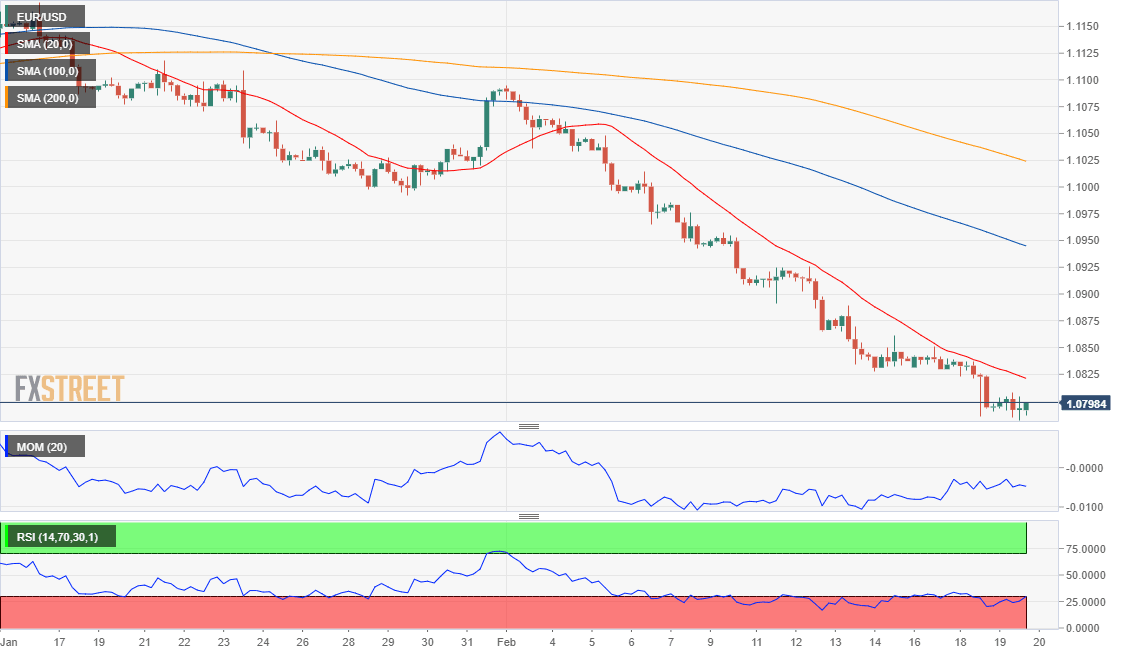

The EUR/USD pair hovers around 1.0790 ahead of the Asian opening, holding on to its bearish stance according to the 4-hour chart. The pair continues to develop below a bearish 20 SMA, while the Momentum indicator eases within negative levels and the RSI consolidates in oversold levels. The pair is extremely oversold but with no signs of changing course. A bullish corrective advance is not out of the cards, although a break below 1.0770 should open doors for another leg south.

Support levels: 1.0770 1.0725 1.0690

Resistance levels: 1.0840 1.0885 1.0910

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.