EUR/USD Forecast: A soft German inflation reading could limit Euro's correction

- EUR/USD dropped below 1.0500, came within a few pips of the 2023-low.

- September inflation data from Germany will be watched closely by market participants.

- US bond sell-off pauses as markets eye US politics.

EUR/USD dropped below 1.0500 on Wednesday and came within a touching distance of the 2023-low of 1.0483. Early Thursday, the pair seems to have stabilized above 1.0500, with investors gearing up for key macroeconomic data releases.

The US Treasury bond sell-off continued mid-week as the lack of progress in US budget negotiations caused investors to position themselves for the potential negative impact of a government shutdown on the US credit rating. "I don't see the support in the House" for the funding bill presented by the Senate, Republican House Speaker Kevin McCarthy said Wednesday. The next procedural vote on the bill is expected to take place on Thursday.

As a result, US T-bond yields continued to push higher and the US Dollar shined as the go-to safe-haven asset, forcing EUR/USD to stay on the back foot.

Euro price this week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.25% | 0.79% | 0.12% | 0.97% | 0.55% | 0.19% | 1.35% | |

| EUR | -1.26% | -0.47% | -1.12% | -0.26% | -0.70% | -1.08% | 0.10% | |

| GBP | -0.79% | 0.47% | -0.65% | 0.22% | -0.23% | -0.61% | 0.56% | |

| CAD | -0.13% | 1.11% | 0.66% | 0.87% | 0.42% | 0.06% | 1.20% | |

| AUD | -0.98% | 0.26% | -0.21% | -0.86% | -0.46% | -0.82% | 0.35% | |

| JPY | -0.56% | 0.68% | 0.22% | -0.42% | 0.42% | -0.37% | 0.79% | |

| NZD | -0.20% | 1.07% | 0.61% | -0.04% | 0.82% | 0.37% | 1.16% | |

| CHF | -1.37% | -0.10% | -0.56% | -1.22% | -0.35% | -0.79% | -1.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Inflation in Germany, as measured by the change in the Consumer Price Index (CPI), is forecast to decline to 4.6% on a yearly basis in September from 6.1% in August. Earlier in the day, regional data from Germany confirmed softening price pressures. Annual CPI inflation in Brandenburg fell to 5.6% from 7.1%, while the same figure dropped to 4.7% from 6% in Hesse.

A softer-than-forecast CPI print in Germany could make it difficult for the Euro to stay resilient against its rivals. On the other hand, a stronger-than-expected reading, which is not very likely, could help EUR/USD edge higher.

The US economic docket will feature the final revision to the second-quarter Gross Domestic Product (GDP) growth and the weekly Initial Jobless Claims data. Market participant, however, could ignore these data and stay focused on political developments. In case Republicans and Democrats come to terms to avoid a government shutdown ahead of the October 1 deadline, risk flows could dominate financial markets and cause the USD to weaken sharply.

EUR/USD Technical Analysis

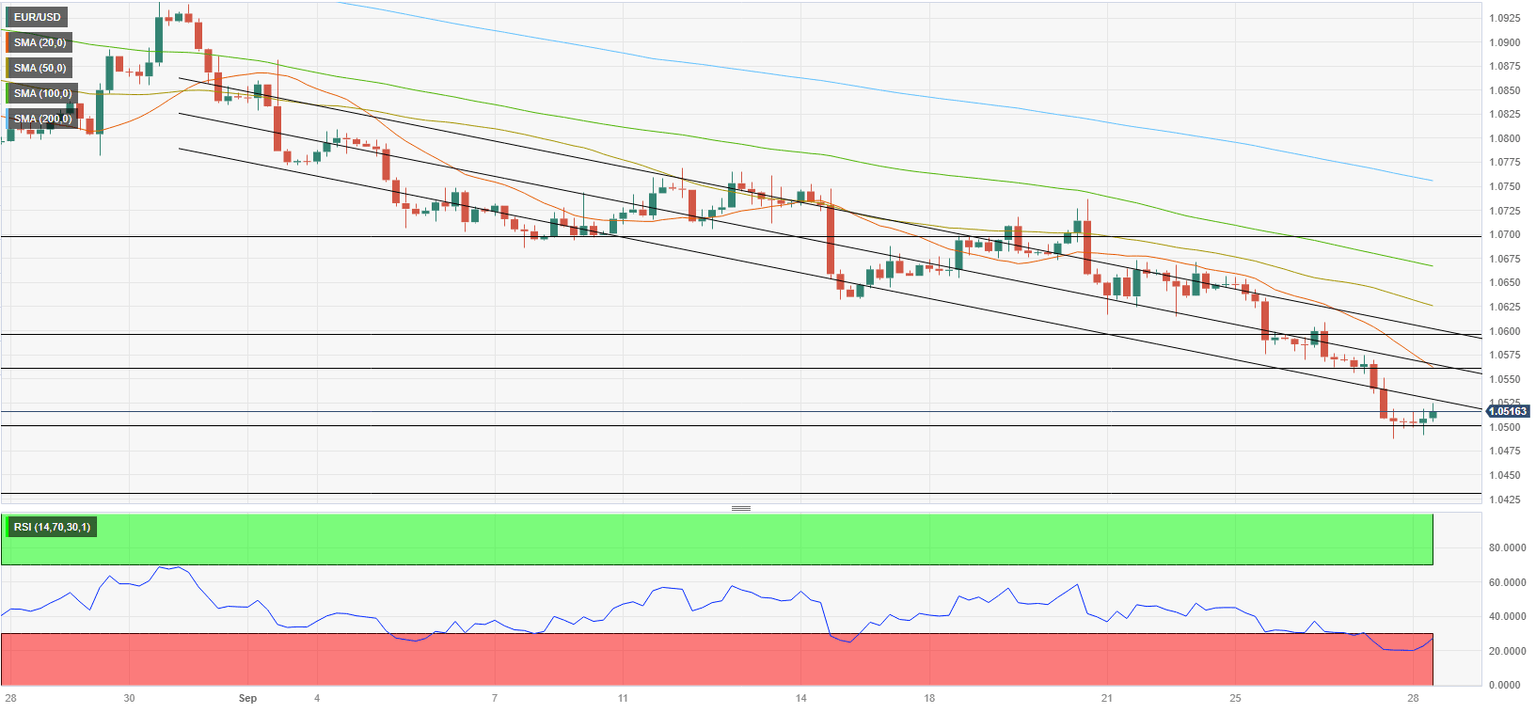

EUR/USD remains technically oversold as the pair trades below the lower limit of the descending regression channel. Additionally, the Relative Strength Index (RSI) indicator on the 4-hour chart stays below 30.

In case EUR/USD rises above 1.0530 and stabilizes within the channel, it could correct toward 1.0560 (20-period Simple Moving Average (SMA), mid-point of the descending channel) and 1.0600 (upper limit of the descending channel).

On the downside, 1.0500 (psychological level, static level) aligns as immediate support. A four-hour close below that level could open the door for an extended decline toward 1.0430 (static level from November 2022) and 1.0400 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.