EUR/USD Forecast: A “buy the fact” opportunity? Why Non-Farm may trigger a correction

- EUR/US has dropped to the lowest since October.

- Upbeat US data is one of the reasons for pushing the dollar higher.

- A better than expected Non-Farm Payrolls may already be in the price.

Buy the rumor, sell the fact – the old pattern is repeating itself and may provide a buying opportunity on EUR/USD.

The US dollar has reasons to rise – ADP reported a leap of 291,000 private-sector positions in January, ISM Purchasing Managers' Indexes beat expectations, and higher yields are also pushing the dollar higher. The euro has its reasons to fall – a plunge in German factory orders has shown that the manufacturing slump in the eurozone is far from over.

Nevertheless, markets tend to exaggerate and front-run events – the Non-Farm Payrolls in this case. The economic calendar is pointing to an increase of 160,000 positions in January – but realistic expectations are probably considerably higher after the ADP and ISM figures.

See

- Nonfarm Payrolls Preview: Get ready for some action this time

- US Non-Farm Payrolls January Preview: Indications turn positive

What are markets expecting? It is safe to say that an increase of 200,000 positions or higher is on the cards. Moreover, the US dollar is stretched into the event and even a beat with 220,000 may be insufficient to send EUR/USD higher.

Ahead of the weekend, traders may want to book profits on short positions and squeeze to the upside cannot be ruled out.

Will we see a "buy the rumor, sell the fact? The world's most popular currency pair still has time to correct before the event, but ranges tend to be tight in the hours leading to the Non-Farm Payrolls release.

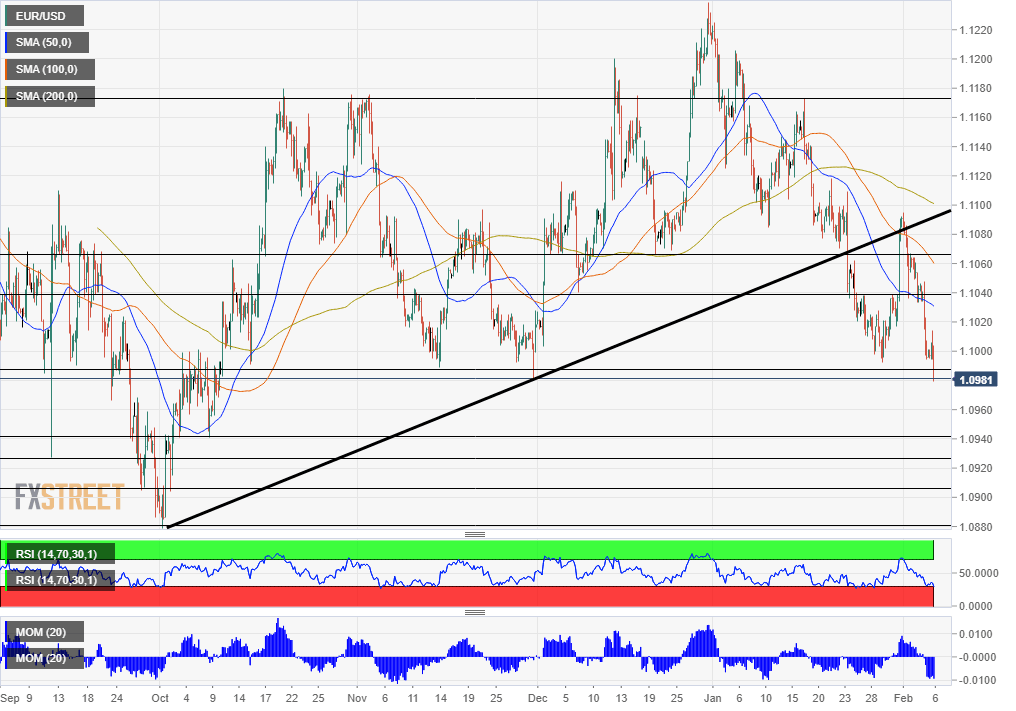

EUR/USD levels to watch

To the upside: 1.0991, 1.1040, 1.1065 – all levels seen in January

To the downside: 1.0940, 1.0925, 1.0905 – lines dating back to October and September.

It is essential to note that coronavirus headlines are coming at a rapid clip and may also shift market sentiment. The current upbeat tone may change upon new cases outside China, additional plant shutdowns, or other developments.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.